Bitcoin’s hashprice, the daily mining revenue per unit of hashing power, has jumped to $46.5/PH/s, approaching one-month highs after the network’s difficulty decreased by 4.6%.

Bitcoin’s mining difficulty adjusted to 88.40 trillion early Thursday UTC following two weeks of hashrate decline likely due to unprofitable mining operators disconnecting from the network. Bitcoin’s hashprice experienced a brief spike in late August before plummeting to as low as $38.2/PH/s on Sep. 7.

In the wake of the recent market rebound and reduced difficulty, the hashprice has recovered by approximately 20% since earlier this month and 24% since its all-time low recorded in early August, according to data from Hashrate Index.

This recovery offers bitcoin mining operators some respite, at least temporarily, before a potential surge in hashrate as public mining companies in the U.S. prepare to activate more machines in the upcoming quarter.

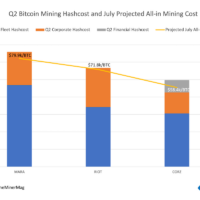

As previously reported, IREN has become the latest public mining firm to cross the 20 EH/s threshold. While MARA remains the only mining company operating over 30 EH/s of proprietary hashrate, both IREN and CleanSpark are positioned to surpass 30 EH/s by the end of the year.

Share This Post: