Bitcoin mining giant Marathon Digital has announced plans to offer $250 million in aggregate principal amount of convertible senior notes due 2031.

In a release on Monday, the company stated that the notes will be unsecured and senior obligations, with interest payable semi-annually on Mar. 1 and Sep. 1, starting on Mar. 1, 2025. The notes will mature on Sep. 1, 2031. However, Marathon did not disclose the interest rate in the announcement.

Marathon said it intends to use the proceeds from the offering to acquire additional bitcoin and for general corporate purposes, including working capital, strategic acquisitions, and debt repayment.

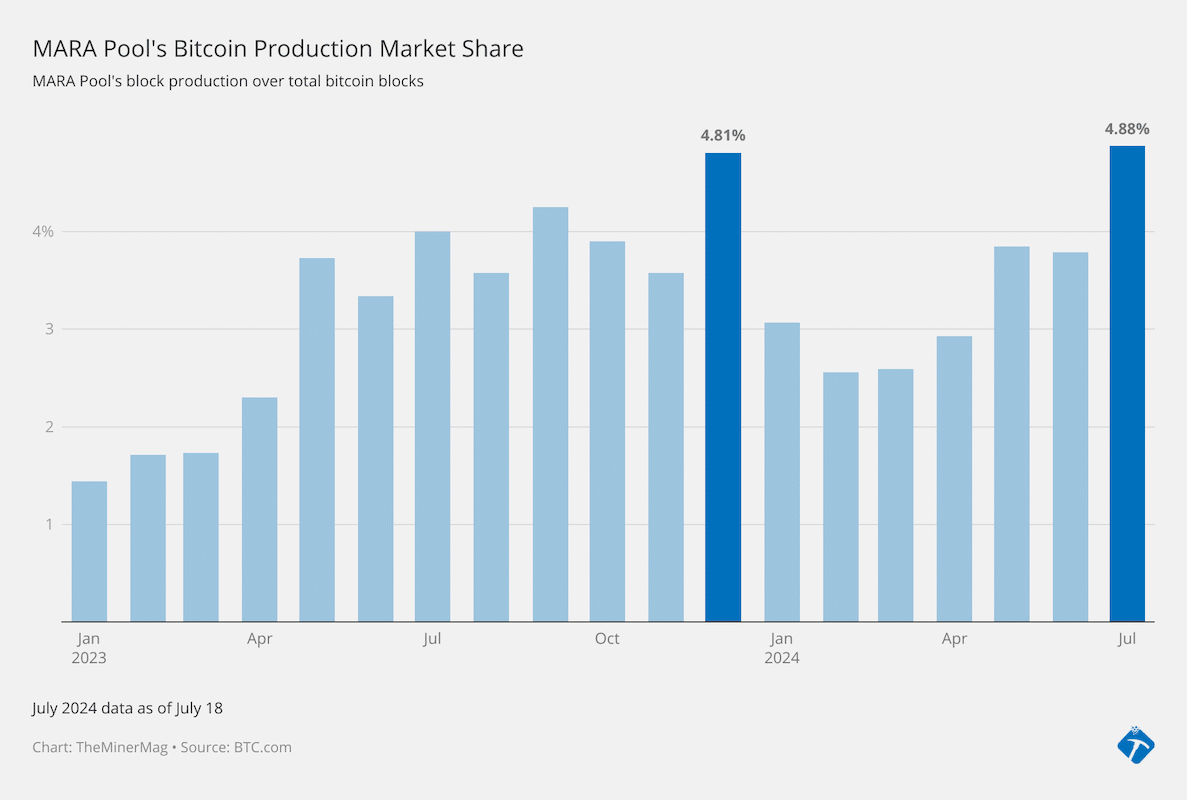

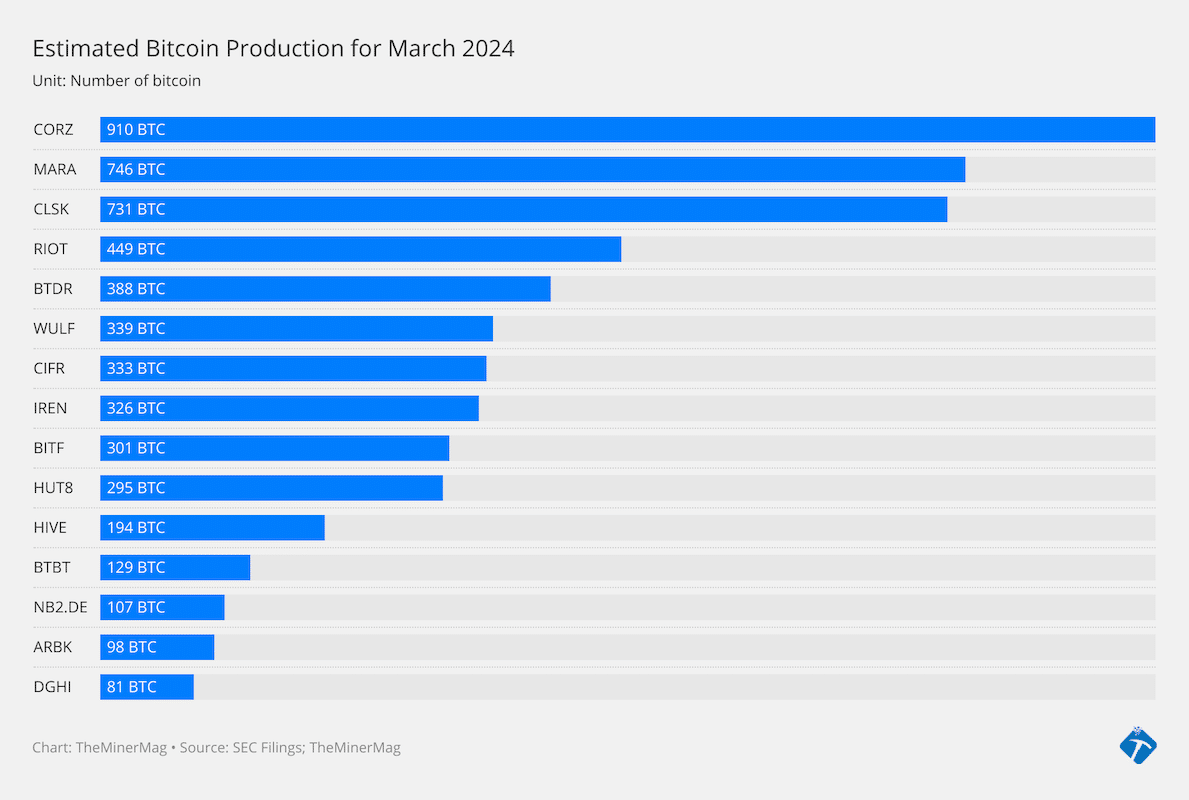

This plan follows Marathon’s recent shift in its treasury strategy, where the company returned to a full HODL mode, meaning it will not sell any of its monthly mined bitcoin. Instead, Marathon plans to rely on other cash flow-generating activities to fund operating and capital expenditures. According to Marathon’s Q2 filing, the company has raised nearly $1 billion through stock offerings year-to-date.

The company also plans to grant initial purchasers of the notes an option to buy an additional $37.5 million in principal amount of the notes within 13 days of the initial issuance.

Investors holding the notes will have the option to require Marathon Digital to repurchase the notes on March 1, 2029. The notes are convertible into cash, Marathon’s common stock, or a combination of both, at the company’s discretion.

With its full HODL strategy, Marathon is likely to hold over 21,000 BTC as of this publication. The firm held 20,818 BTC on its balance sheet as of July 31 after mining 692 BTC and purchasing about 1,500 BTC from the market last month.

Share This Post: