U.S.-listed Iris Energy and Bit Digital have reported growth in revenues from AI servicing contracts, as they expand revenue streams following the bitcoin halving event.

Bit Digital, which recorded $8.1 million in AI high-performance computing revenues during Q1, said on Friday that it earned an unaudited revenue of $4.1 million from its AI servicing contract in June. This brings the company’s unaudited AI revenue to $12.4 million for the second quarter.

In comparison, Bit Digital mined 244 BTC in the last quarter, worth approximately $16 million based on bitcoin’s average prices during the period. That was down 40% from the 410 BTC mined in Q1.

Additionally, Bit Digital appears to have shifted its BTC reserves to ETH in June. Its bitcoin holdings decreased from 1,038 BTC to 585.9 BTC last month, while its ethereum holdings increased from 20,583 ETH to 29,927 ETH.

Iris Energy, on the other hand, recorded AI cloud service revenue of $567,000 in Q1, likely beginning in March and accounting for about 1% of its total revenue for the quarter.

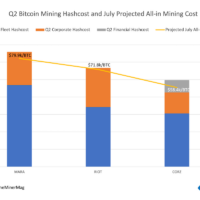

In its June production update released on Friday, Iris Energy reported that its AI segment generated $1.1 million in revenue, up from $892,000 in May and $581,000 in April. This totals $2.55 million, comprising about 4% of its unaudited Q2 revenue, based on its monthly updates. Iris Energy’s bitcoin production also declined from 1,004 BTC in Q1 to 821 BTC in Q2.

Both companies did not increase their realized bitcoin hashrate in June, while other pure-play mining operators continued to ramp up production and hashing power.

Iris Energy’s realized hashrate remained at around 9.33 EH/s while Bit Digital saw a decline in realized hashrate from 2.57 EH/s in May to 2.48 EH/s last month.

Share This Post: