U.S. bitcoin mining giant CleanSpark is set to acquire rival mining firm GRIID in a deal valued at $155 million in a bid to bolster its mining power capacities in the U.S.

CleanSpark confirmed the acquisition news on Thursday, following last week’s rumors that drove GRIID’s stock price to surge by up to 400% in recent days.

GRIID’s stock price (GRDI) declined by 10% during the pre-market trading on Thursday. However, the trading of GRDI was temporarily halted after the market opened at 9:30 a.m. due to increased volatility. The stock plunged by 50% after the trading resumed at 10:05 a.m.

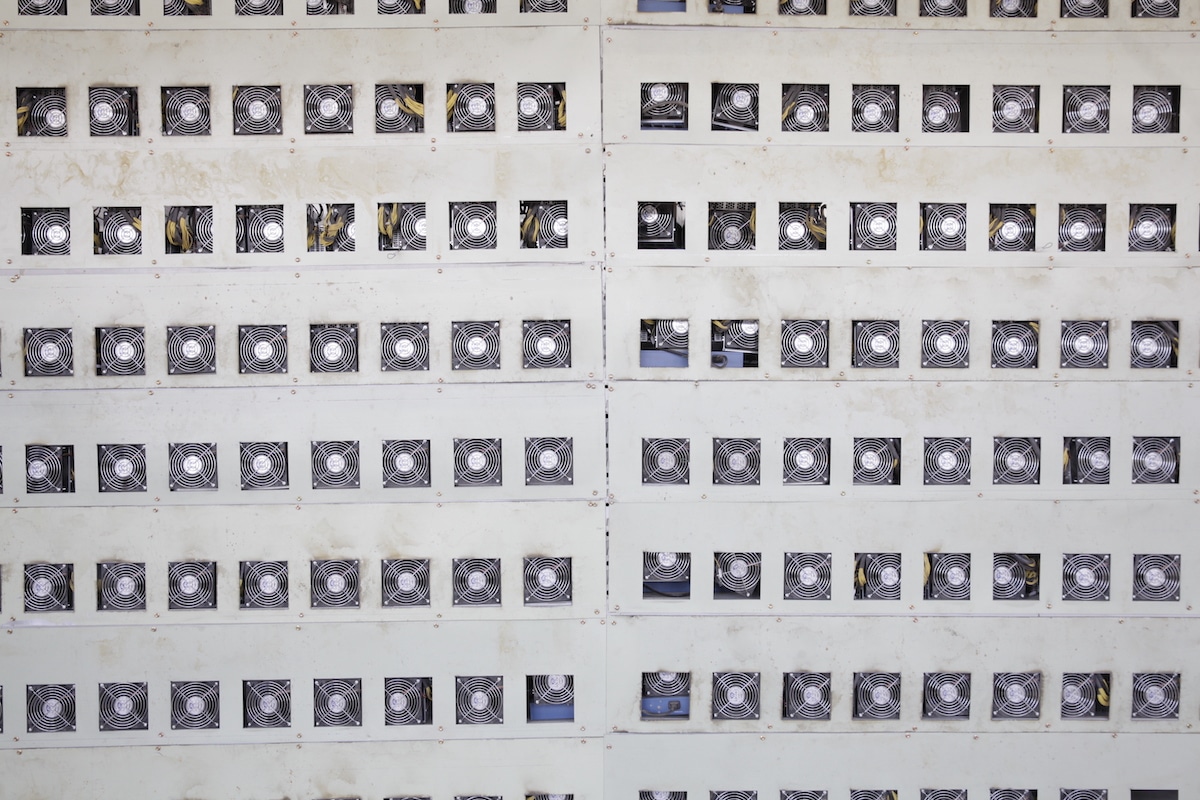

The deal marks the latest consolidation in the bitcoin mining space, responding to increased pressure on mining profitability post the fourth halving event.

According to the release, CleanSpark will acquire all the issued and outstanding shares of GRIID in an all-stock transaction.

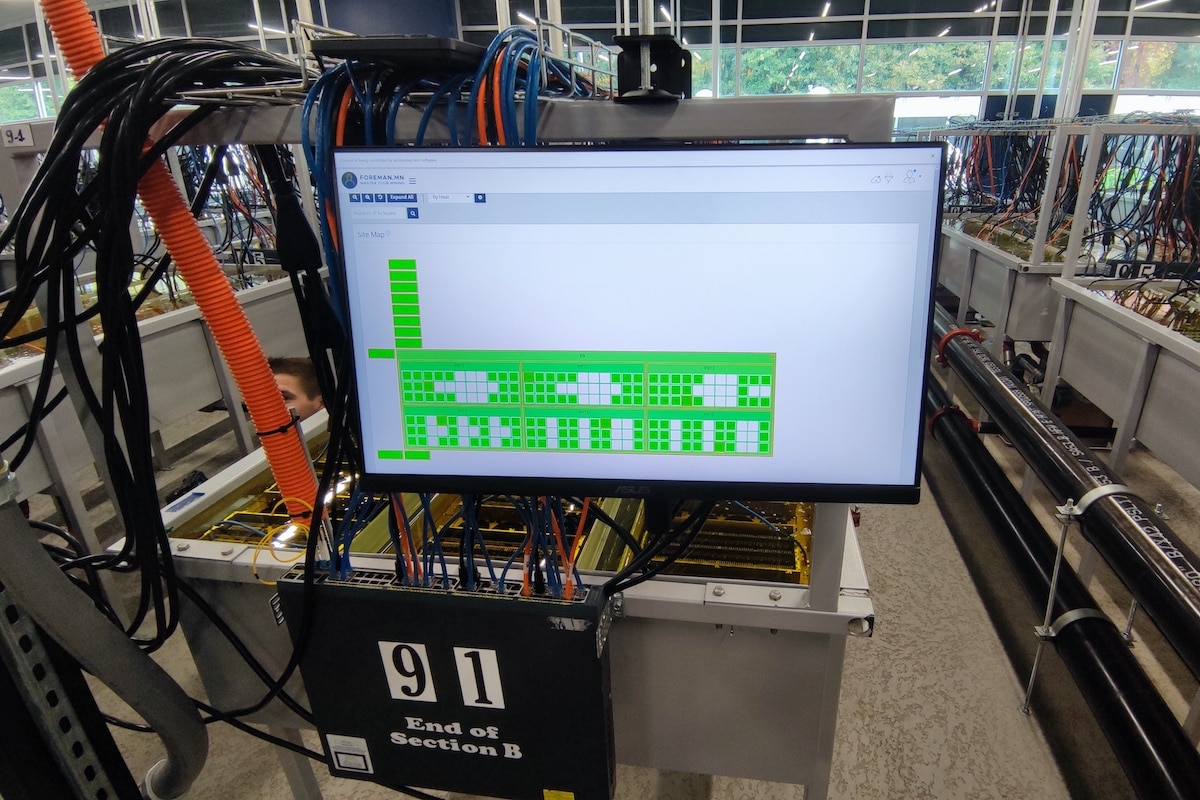

“The total enterprise value, including payment and assumption of debt, of the transaction is $155 million,” CleanSpark said in the release, adding that 20 megawatts (MW) of hosting capacity will be immediately available for CleanSpark after the merger agreement is signed.

CleanSpark’s CEO Zack Bradford expects the transaction to help CleanSpark to “exceed 100 MW in Tennessee by the end of this calendar year and eventually grow that to 200 megawatts in 2025 before exceeding 400 megawatts in 2026.”

Based on GRIID’s Q1 earnings report, it had total assets of $42.2 million and total liabilities of $102 million, indicating a shareholders deficit of over $60 million.

Share This Post: