This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

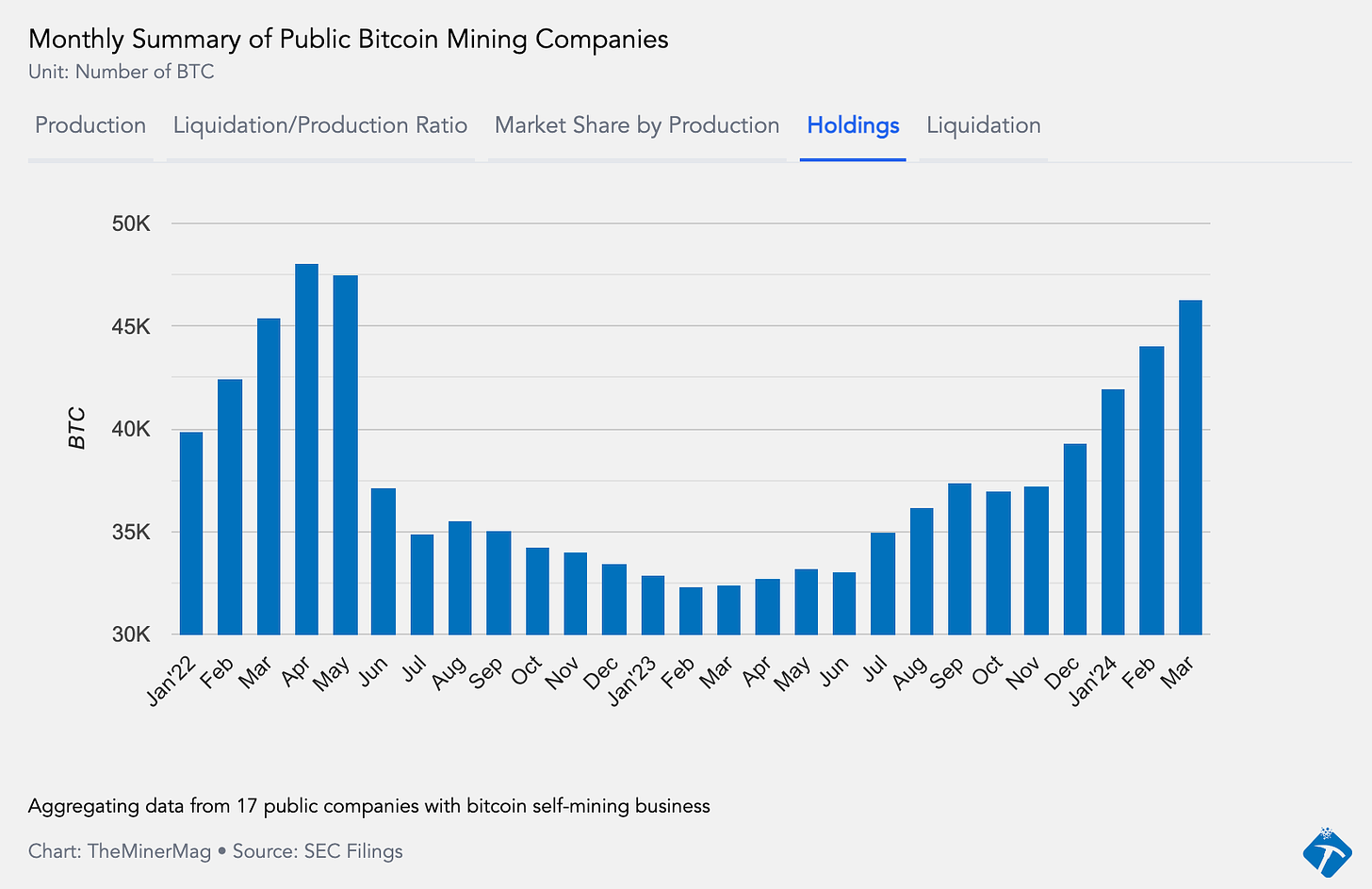

As most of the public mining companies have published their March production updates, it is interesting to see that their combined bitcoin reserves are finally back to the level before the June 2022 sell-off.

As of March 31, public mining companies collectively held more than 46.2k BTC. As the chart below shows, the all-time high for that metric was 48k BTC in April 2022 which was then sold off to 37k BTC in the next two months amid a broader market sell-off.

Their collective reserves then proceeded to decline, reaching the lowest point of 32k BTC in February 2023. However, in July 2023, a major reversal began, which was amplified in Q1 2024 as the market grew bullish.

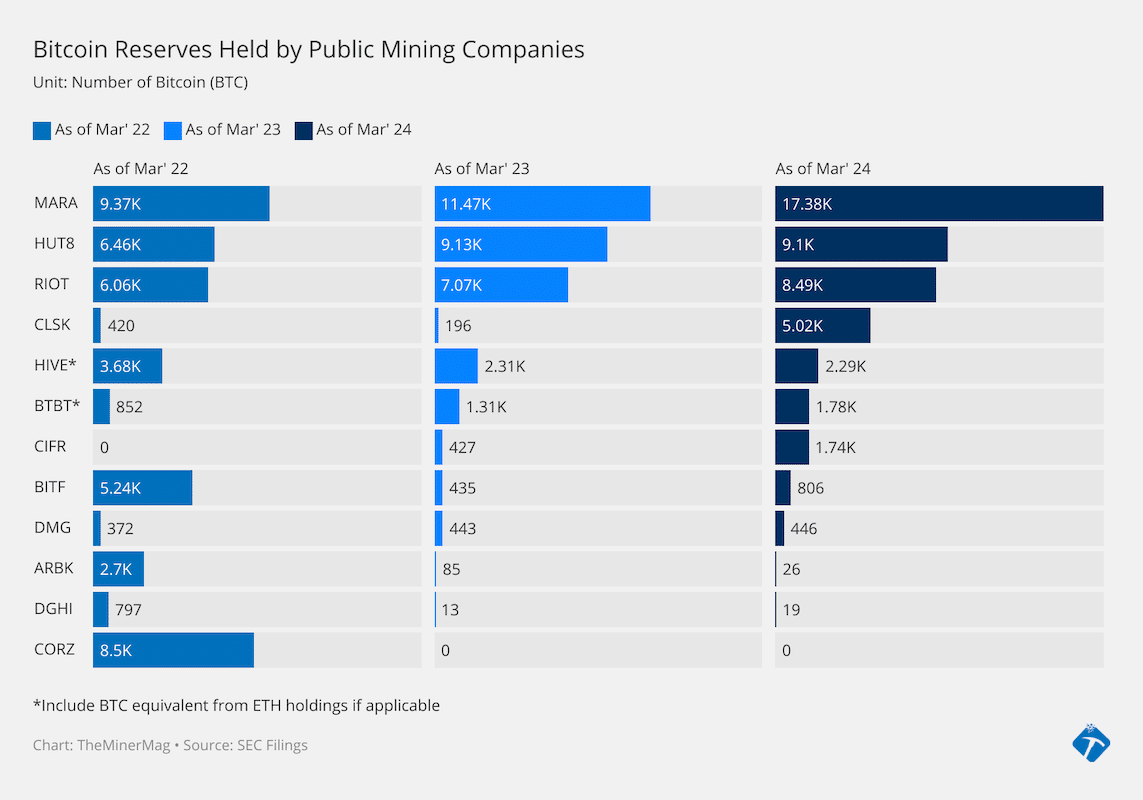

More granular data also shows a significant consolidation among the bitcoin mining hodlers over the past two years.

As per the table featured at the top, some companies used to hold thousands of bitcoin following the 2021 bull run. However, once the bear market trend prevailed, part of them were forced to liquidate a lot of their reserves due to the high financial leverage they had taken. Others managed to stockpile their bitcoin reserves throughout the bear market.

The top three mining hodlers in March 2022 were Marathon, Core Scientific, and Hut 8. They accounted for 55% of the total reserves among bitcoin miners. Bitfarms and Riot were also holding considerable amounts at the time.

Fast forward to March 2024, the top three hodlers – Marathon, Hut8, and Riot – now account for 74% of the total reserves held by mining companies. Marathon alone is holding over 17.3k BTC, which is close to Hut 8 and Riot’s current BTC reserves combined.

With the next halving just less than two weeks away, it will only become more difficult for companies to accumulate bitcoin from mining operations at a cheaper cost.

Regulation News

- Bitcoin Mining Ban Proposed in Paraguay Over Power Problems – Decrypt

- State Lawmakers File Several Bills Addressing Crypto Mining Concerns – Arkansas Democrat Gazette

Hardware and Infrastructure News

- Greenidge Secures Access to 60 MW Low-Cost Power in South Carolina – Link

- Bhutan to Upgrade Bitcoin Mining in Himalayas as ‘Halving’ Looms – Bloomberg

- Bitdeer Acquires Its Bitcoin Mining Landlords in Norway for $30M+ – TheMinerMag

- US Bitcoin Miner Maker Auradine Raises $80M in Series B – TheMinerMag

- Bitcoin Mining Difficulty Hits ATH in Last Adjustment Before Halving – TheMinerMag

Corporate News

- Marathon Rolls out ‘Phased Plan’ to Reduce Noise in Texas as Demand for BTC Soars – DLNews

- Bitdeer Leverages TSMC for $60M Proprietary Bitcoin Miners – TheMinerMag

- Tether’s $500m Bitcoin Mining Push is just About Ready as Halving Looms, CEO Paolo Ardoino Says – DLNews

- Poolside Upsizes and Extends AI Cloud Services Contract with Iris Energy – Link

Financial News

- Public Miners Raise $1.6B in Q1 Ahead of Bitcoin Halving – TheMinerMag

- Terawulf Repays $30m Term Loan, Reducing Debt Balance to $76m – Link

- Miners Keep Adding to BTC Stockpiles in Homestretch Before Halving – Blockworks – Blockworks

Feature

- The Big Empty: A Documentary on Bitcoin Mining in Texas – Blockspace Media

- Taiwan’s Earthquake, Franklin Templeton on Ordinals and Poolin’s Asset Sale – The Mining Pod

- The Fourth Bitcoin Halving Is Coming: What It Means – Axios

- ‘BTC Will Have to Hit $79K’: At-Home Miners Brace for the Bitcoin Halving – Blockworks

- Bitcoin Mining: Get Poor Slow? With Steve Barbour – The Mining Pod

- Bitcoin Miners Face Survival Test in ‘Halving’ – AFP

Share This Post: