This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

According to the new Bitfinex report citing on-chain data analyzed by CryptoQuant, the outflow of reserves held by bitcoin miners catalyzed the recent market pullback.

CryptoQuant tracks bitcoin addresses that receive coinbase rewards from mining pools and analyzes if those addresses send further transactions to crypto exchanges to cash out.

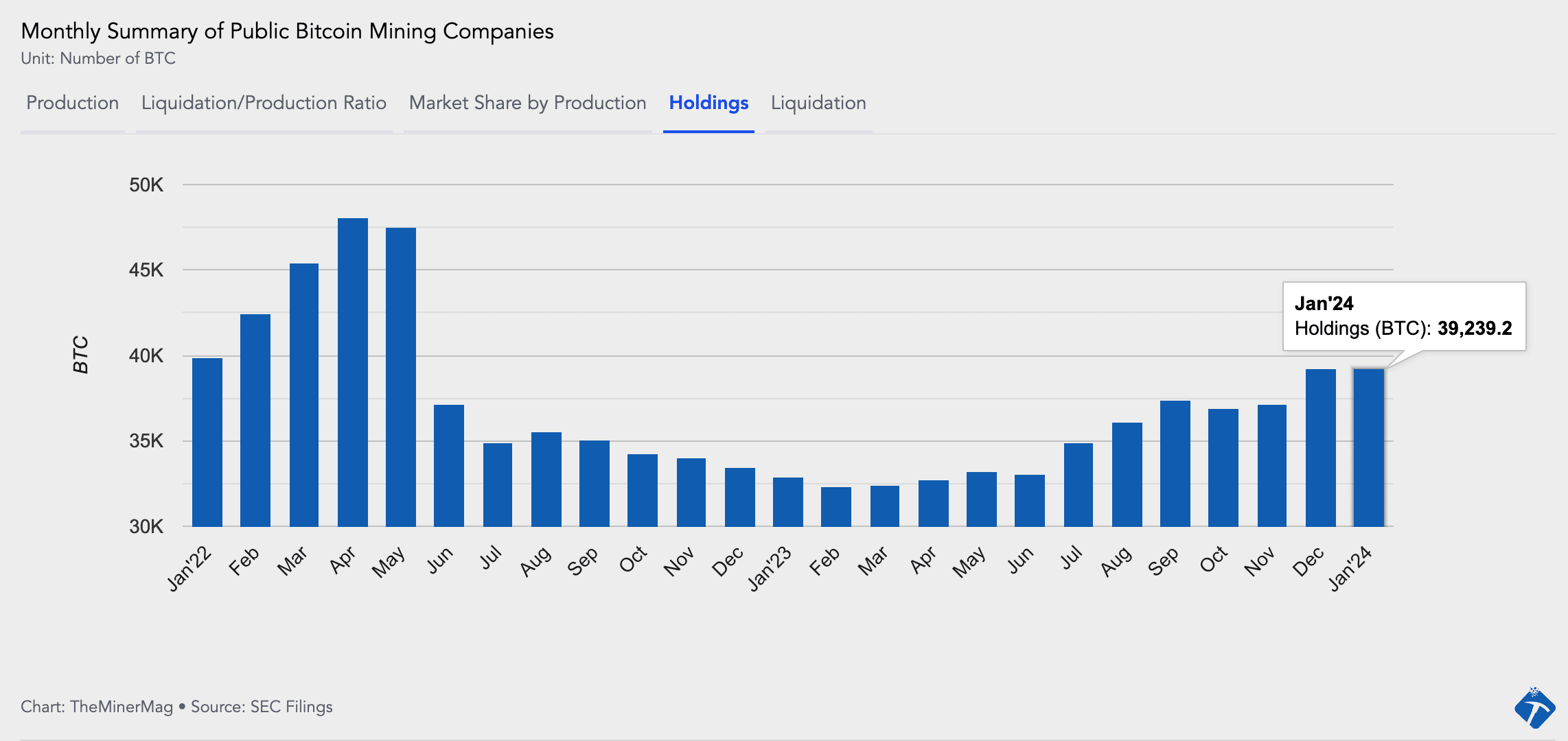

But evidently, some public mining companies did the opposite in January. In fact, the total bitcoin reserves held by public mining companies have finally got back to the 40,000 BTC level.

So far, the 14 most-traded public mining companies have released production updates for January. They sold 3,907 BTC, representing 68.68% of their total production—the lowest ratio since July.

Notably, about half of them, including Core Scientific and Iris Energy, have been consistently selling 100% of their monthly productions. Others adopt a hybrid treasury strategy where they sell a portion of their production depending on the market environment.

Even though bitcoin retreated from a local high of $49,000 after a dozen bitcoin spot ETFs began trading, it found support above $40,000 and some public mining companies reduced the amount of bitcoin they needed to sell to fund operating expenses.

Currently, eight public mining companies hold more than 100 BTC on their balance sheets: Bitfarms, Bit Digital, CleanSpark, DMG, HIVE, Hut 8, Marathon, and Riot.

While HIVE has not provided updates for January as of writing, the other seven companies sold 1,616 BTC last month, representing 47% of their combined production of 3,447 BTC. As of the end of January, these seven companies were holding 39,221 BTC. HIVE had about 1,707 BTC on its balance sheet as of Dec. 31. Unless it offloaded a significant amount of its reserves in January, then the eight of them should carry 40,000 BTC into February. That would be the highest level since the market sell-off began in May 2022.

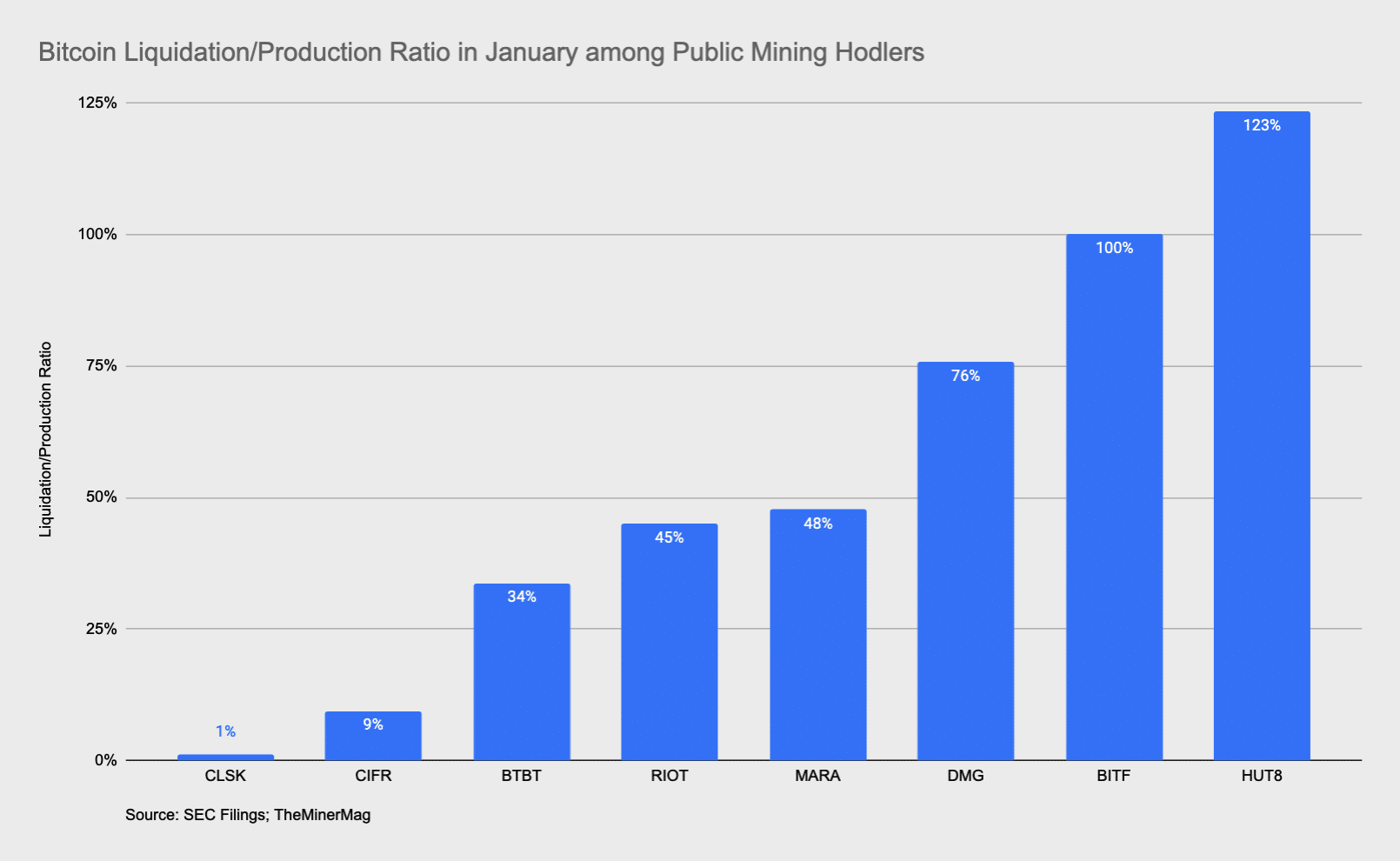

Also interesting is the sharp contrast of the bitcoin liquidation ratio within the mining holder group. As shown in the head image, Cipher and CleanSpark sold less than 10% of their productions while Hut 8 sold 125% of what it mined, meaning it sold some of its bitcoin reserves on top of the amount they mined that month.

Riot, on the other hand, hinted that it would further reduce the liquidation. The company said in its January production update that it intends to “retain a greater proportion of its monthly bitcoin production in the near term.”

Regulation News

- British Columbia Court Backs Ban on Crypto Mining in Canadian Province – CoinDesk

- Green Block Mining Must Pay C$400K Fine, Cease Operations in Alberta – CBC.ca

- What the US Wants to Know Exactly in the Bitcoin Mining Survey – TheMinerMag

- US Abused Power in Bid to Get Crypto Energy Data, Groups Say – Bloomberg

- Rise of crypto mines in region raises concerns; TVA stops giving grants to crypto, meets with miners – WUOT

Hardware and Infrastructure News

- GRIID Expands Bitcoin Mining in Tennessee Amid Financial Concerns – BNN Breaking

- CleanSpark Expands Bitcoin Mining to Mississippi with $20 Million Acquisition – TheMinerMag

- Electricity Costs Shot Up for Bitcoin Miners in January – TheMinerMag

- Chinese Bitcoin Miners Find a New Crypto Haven in Ethiopia – Bloomberg

Corporate News

- EPA Settles with Greenidge Generation on Actions to Address Compliance with Coal Ash Regulations – Link

- Bitmain’s S19XP Sales Transform into 5.5% Stake in Core Scientific – TheMinerMag

- Marathon Pays Hut8 $13.5M to Accelerate Control of 390MW Sites – TheMinerMag

- Hut 8 Shares Slide as CEO Departs Weeks After Short-Seller Report – CoinDesk

Financial News

- Applied Digital Secures $20M Loan with 25% Annualized Cost – TheMinerMag

- This PE Firm Owns 6% of Core Scientific After Chapter 11 – TheMinerMag

- BitFuFu Inches Closer to Public Debut with F-4 Effectiveness – TheMinerMag

Feature

- The Celsius Mining Scoop With ChazzonKe – The Mining Pod

- Enter Swan Mining With Rapha Zagury – The Mining Pod

- Anxiety, Mood Swings and Sleepless Nights: Life Near a Bitcoin Mine – NYT

Share This Post: