This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

The world’s largest asset manager has not only been answering client demands for its spot bitcoin ETF but also scooping up mining stocks.

As reported last week, a list of BlackRock’s asset and investment management subsidiaries increased their stakes in Marathon and Riot in 2023.

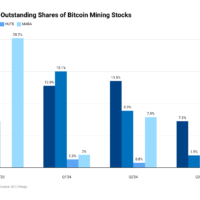

Recent SEC filings show that BlackRock’s subsidiaries loaded up even more shares of CleanSpark. The table below provides a quick breakdown of how BlackRock funds picked up more shares in Marathon, Riot, and CleanSpark by 100%, 36%, and 205%, respectively.

The increase in positions, partially fueling the price rally of bitcoin mining stocks, saw BlackRock’s total holdings in Marathon, Riot, and CleanSpark reach $775 million as of Dec. 31. That ballooned from $76 million a year ago, although most of the mining stocks have seen their prices nearly halved since the New Year amid bitcoin’s price pullback.

One underlying trend from the data above is the scale of equity dilution among these mining companies, which was used to fund their growth and capital expenditure as the industry learns from the lesson of over-leveraging during the 2021 bull run.

Separately, a new filing this week shows that a German fund manager Hansainvest has notably increased its position in Iris Energy with 4.3 million shares as of Dec. 31, representing a 7.8% stake.

Hansainvest manages a fund called BIT Global Crypto Leaders. According to the fund’s annual report in August 2023, it owned 1.16 million shares of Iris Energy at the time, which made up for 11% of its managed assets and was the largest portfolio followed by Riot and CleanSpark.

Further, SEC filings from July last year showed that asset management giant Vanguard also increased its positions in Marathon and Riot. But as Blockworks reported, the nuance was that Vanguard’s ownership of these mining stocks was almost entirely through its ETFs or index funds instead of directly buying into company-facilitated stock offerings.

BlackRock’s investment may just be different in that only a portion of its ownership appears to be in ETFs. According to Yahoo Finance, out of the top ten mutual fund holders of Marathon as of Sept. 30, five were managed by Vanguard and two were managed by BlackRock: the iShares Russell 2000 ETF and the iShares Russell 2000 Growth ETF.

As of Jan 29, the two iShares ETFs were holding about 7.2 million shares of Marathon, which were less than half of BlackRock’s ownership of Riot. And it is a similar case for Riot and CleanSpark.

Regulation News

- US Energy Data Agency to Track Crypto Mining Power Use – Reuters

- Syndicate stealing electricity for Bitcoin mining busted – The Malaysian Reserve

Hardware and Infrastructure News

- Russian Crypto Miners Blamed for Siberia Power Outages – Cryptonews

- OKX to discontinue Mining Pool and related services – Link

- MARA Pool’s Bitcoin Production Dropped by 45% in January – TheMinerMag

- Hut 8 Touts $81M in 4-Year Fees for Managing Celsius’ Bitcoin Mining Assets – TheMinerMag

Corporate News

- Downtime or Bad Luck? Marathon’s Pool Mines No Bitcoin Blocks – TheMinerMag

- Jihan Wu Will Take Over as Bitdeer CEO in March – CoinTelegraph

- Bitcoin Miner Griid Receives Green Light to List on Nasdaq – TheMinerMag

- Hut 8 Shares Up as CCO Transitions to CEO of Newly-Formed Celsius Bitcoin – MarketWatch

- Swan Bitcoin Unveils Mining Unit as Parent Company Prepares to Go Public – CoinDesk

Feature

- Is Bitcoin Mining Actually Good For Texas? With Tom Masiero – The Mining Pod

- Are You Ready For The Bitcoin Halving, Anon? – The Mining Pod

- Blackstone Is Building a $25 Billion Empire of Power-Hungry Data Centers – Bloomberg

Share This Post: