Ohio-headquartered bitcoin mining firm Griid Infrastructure has received approval from the Securities and Exchange Commission (SEC) to list on the Nasdaq exchange.

The company said in a statement on Monday that it will begin trading on the Nasdaq on Jan. 29 under the ticker GRDI. The announcement came after the Nasdaq sent a letter to the SEC’s Division of Corporate Finance on Friday, informing the regulator that the stock exchange has approved the listing of Griid’s common stocks and redeemable warrants.

In support of Griid’s request, the Nasdaq exchange also sought the SEC to declare effective Griid’s Form 8-A 12(b), a filing required by a company before the final listing on a national securities exchange.

Griid completed the merger with Adit EdTech, a special purpose acquisition company (SPAC), earlier this month. This came almost two years after the initial business combination proposal. However, Griid’s path to going public wasn’t smooth.

Griid’s SPAC was initially listed on the NYSE but had been relocated to NYSE American, a trading venue for much smaller market capitalization firms. However, despite the approval from shareholders of Griid and Adit EdTech shareholders on the merger proposal, the NYSE American exchange did not give the green light on the listing of the merged entity.

After completing the merger, Griid went public on Cboe Canada on January 2. Data from the Canadian exchange indicates that Griid’s market capitalization is about $500 million, but the daily trading volume so far has been less than $5,000.” Griid said it will remain listed on Cboe Canada after the listing on the Nasdaq.

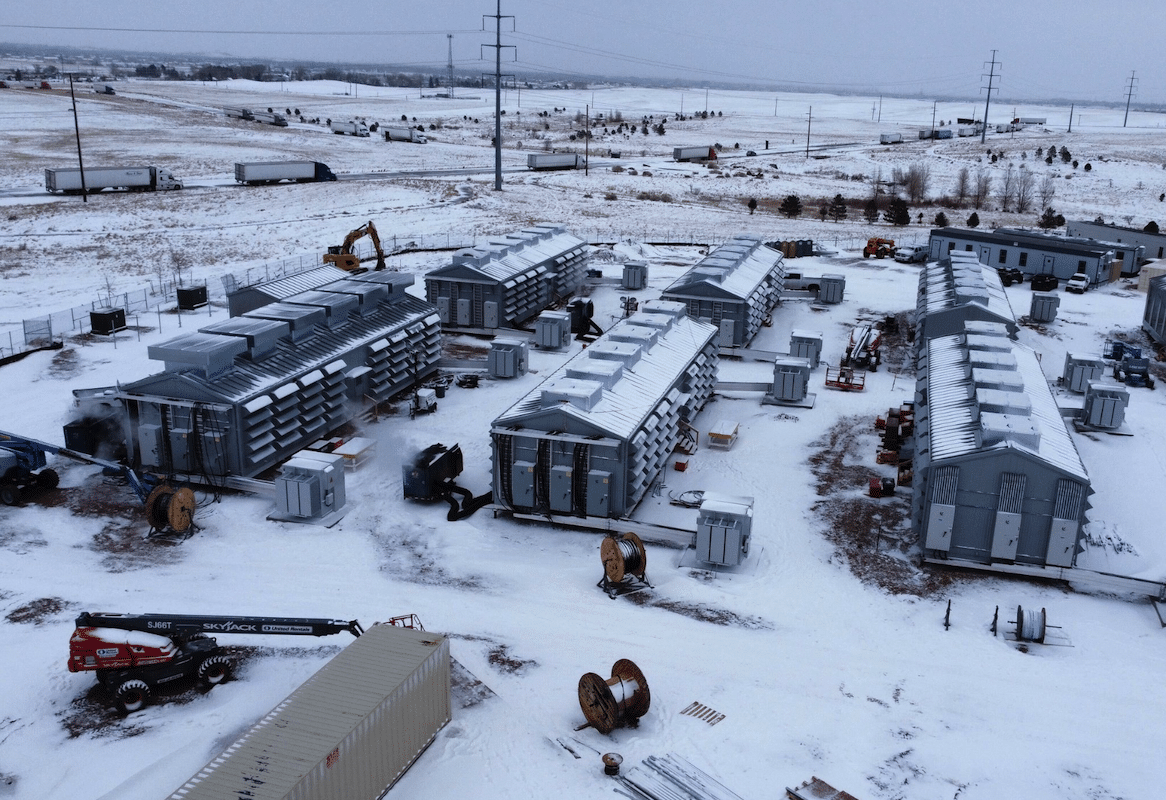

Griid’s mining operation scale appears to be significantly smaller than most of the public mining companies that command a market capitalization of half a billion dollars, although its energy rate appears to be advantageous.

According to Griid’s S-1 filing with the SEC on Jan. 19, it effectively generated a revenue of about $2.4 million in Q3’23 by self-mining mining 86 BTC and also profit-sharing with its hosting client.

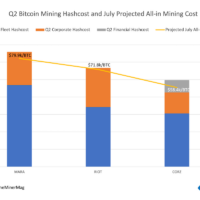

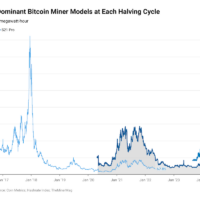

As of Sept. 30, it installed 20,623 bitcoin ASIC miners with a total hashrate of 447 PH/s operational. That translates to 21 TH/s per miner, implying that Griid’s fleet consisted of a significant amount of obsolete equipment from the 2017 era. For context, each unit of Bitmain’s S19XP miner is capable of computing 141 EH/s of hashrate.

Nevertheless, Griid managed to achieve a 25% gross margin in Q3 with such an inefficient fleet, suggesting that Griid’s access to substantially low energy rates.

The company reported its energy rate to be $30 per megawatt-hour (mWh). That was lower than almost all the public mining companies tracked by TheMinerMag. Meanwhile, TheMinerMag estimated Griid’s cost of bitcoin production for the quarter to be around $14,244 per BTC.

However, for Griid’s revenue and mining fleet size, it is worth noting that the company had $122 million in total stockholder deficit as of Sept. 30, which was largely due to the $60 million notes payable and $95 million in warrant liability.

Share This Post: