Hashrate-Shipment Coefficient Report: December 2023

In our last hashrate-shipment coefficient report in October, we projected bitcoin’s average hashrate in November to be 460 EH/s. That was based on a model with a coefficient of 0.91 between the import of miners to the U.S. and bitcoin’s hashrate growth.

In reality, the average hashrate in November continued rising to 473 EH/s and the 14-day moving average as of writing has even reached close to 500 EH/s, setting all-time highs.

Over the past month, we have identified 26 more shipment records between April and October that were related to Bitmain’s import of S19XPs and S19XP Hydros to its U.S. subsidiary. The gross weight of the newly found shipments totaled 500 metric tons, which was on top of the 4,300 metric tons in our previous report. That provides us with a more complete dataset.

In addition, Bitmain shipped another 81 metric tons of S19XPs in November to Georgia state. MicroBT’s U.S. partner Synos Corporation also imported another 99 metric tons of server and computer parts in November likely for assembling Riot’s preorders of the WhatsMiner M56++.

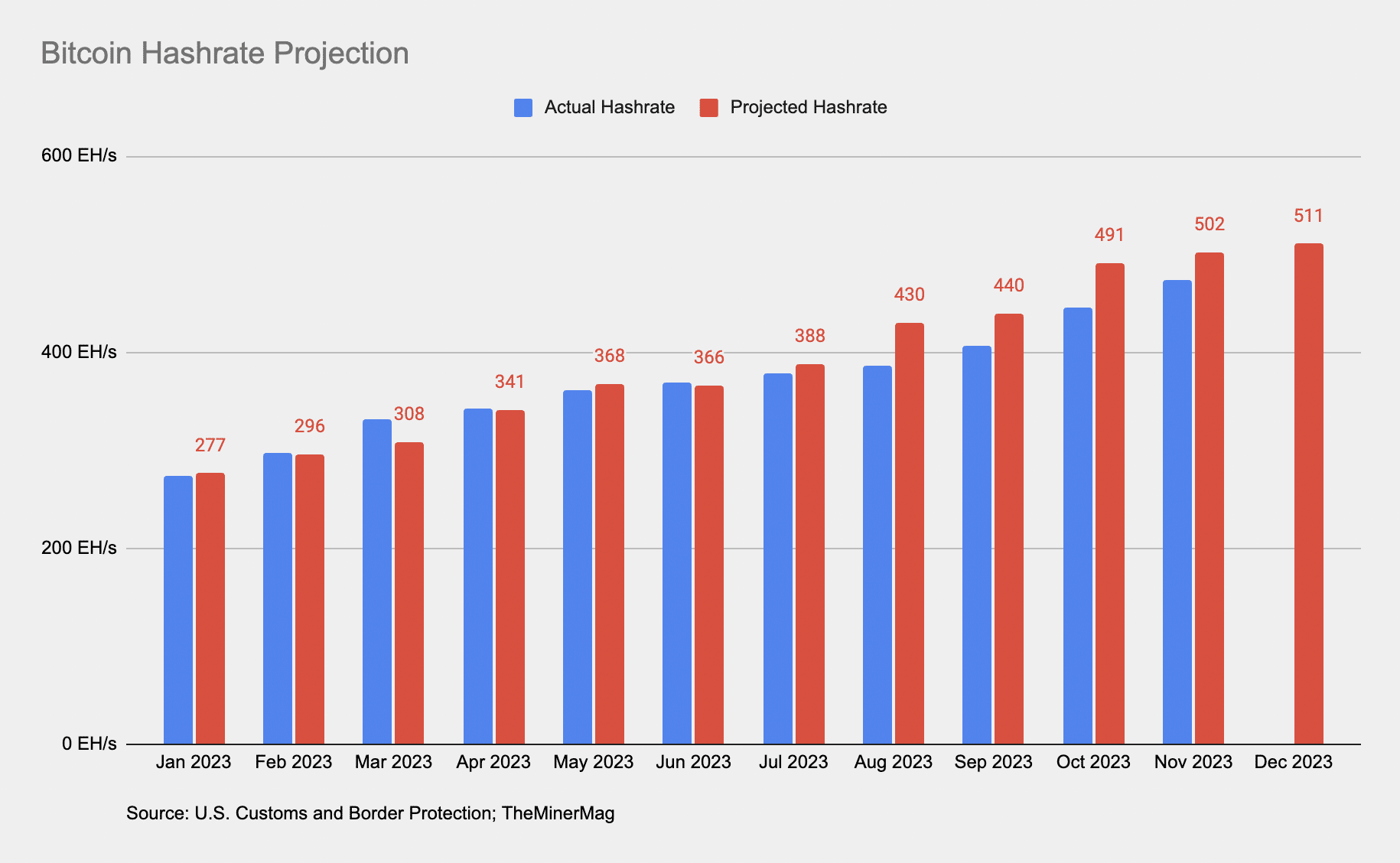

Below is an updated chart of the dataset’s projection vs. bitcoin’s actual hashrate since January. The model would project November’s hashrate to be 502 EH/s and estimates December’s to be 511 EH/s.

Interestingly, there was a wider gap during the summer months between the actual hashrate and what was projected, likely due to curtailment activities. However, that gap appears to have narrowed in the past month. In fact, the 3-day average moving hashrate as of Dec. 4 even surged to over 520 EH/s, which means an average of 510 EH/s in December could even turn out to be an underestimation.

What this means is the continuous decrease in bitcoin’s daily production benchmark.

Thanks to the surging transaction fees, November was the second-most rewarding month for bitcoin miners. That is why, despite the rising competition, the daily bitcoin production benchmark slightly increased to 2.23 BTC/EH/s last month, compared to 2.17 BTC/EH/s in October.

However, as on-chain activities such as Ordinals and inscriptions started to cool down again in the latter part of last month, we began to observe bitcoin’s transaction fees returning to normal levels.

Based on an estimated increase of the average hashrate to 510 EH/s, the daily production benchmark in December could decrease to 2 BTC/EH/s – the lowest ever in bitcoin’s history.

The good news though, is that bitcoin’s price has jumped above $40,000 to set new highs since April 2022. With the price momentum outrunning the hashrate growth, bitcoin’s hashprice is again back above $85/PH/s as of writing.