Breaking Down Q3 Cost of Bitcoin Mining and New Hashcost Metric

Despite curtailment measures in various U.S. states during the summer, bitcoin’s average monthly network hashrate surged notably from 368 EH/s in June to 445 EH/s in October. Though growth has slightly decelerated since October, November’s average hashrate continued to climb, reaching 475 EH/s.

This escalating competition is expected as the network approaches the next halving. Every mining operation is driven to heighten its competitiveness to maximize remaining block rewards before they undergo a 50% reduction.

This analysis delves into how mounting mining competition has changed the cost of bitcoin production in Q3 for public mining operations and breaks down a new hashcost metric derived from their costs of bitcoin production.

Cost of bitcoin production

The cost of bitcoin production is a fundamental metric in evaluating the competitiveness of a mining operation since it shows whether it could generate gross profits, to begin with. It typically consists of energy bills or hosting costs as well as necessary site expenses, such as electrical materials or site staff compensations.

Throughout Q3, bitcoin’s average market prices were around $28k. Each of the mining operations that have released Q3 earnings was able to make gross profits although their cost of bitcoin production and gross margin had a wide distribution, ranging from negative to north of $22k.

Several factors can determine the cost of bitcoin production: fleet efficiency, energy rate, and the network’s competition, as shown in the formula below. The main factors affecting fleet efficiency include miner models in use and their uptime rate.

Cost of bitcoin production ($/BTC) = Fleet efficiency (J/TH) * Energy rate ($/mWh) * Network Hashrate (EH/s) / Hourly Block Rewards (BTC).

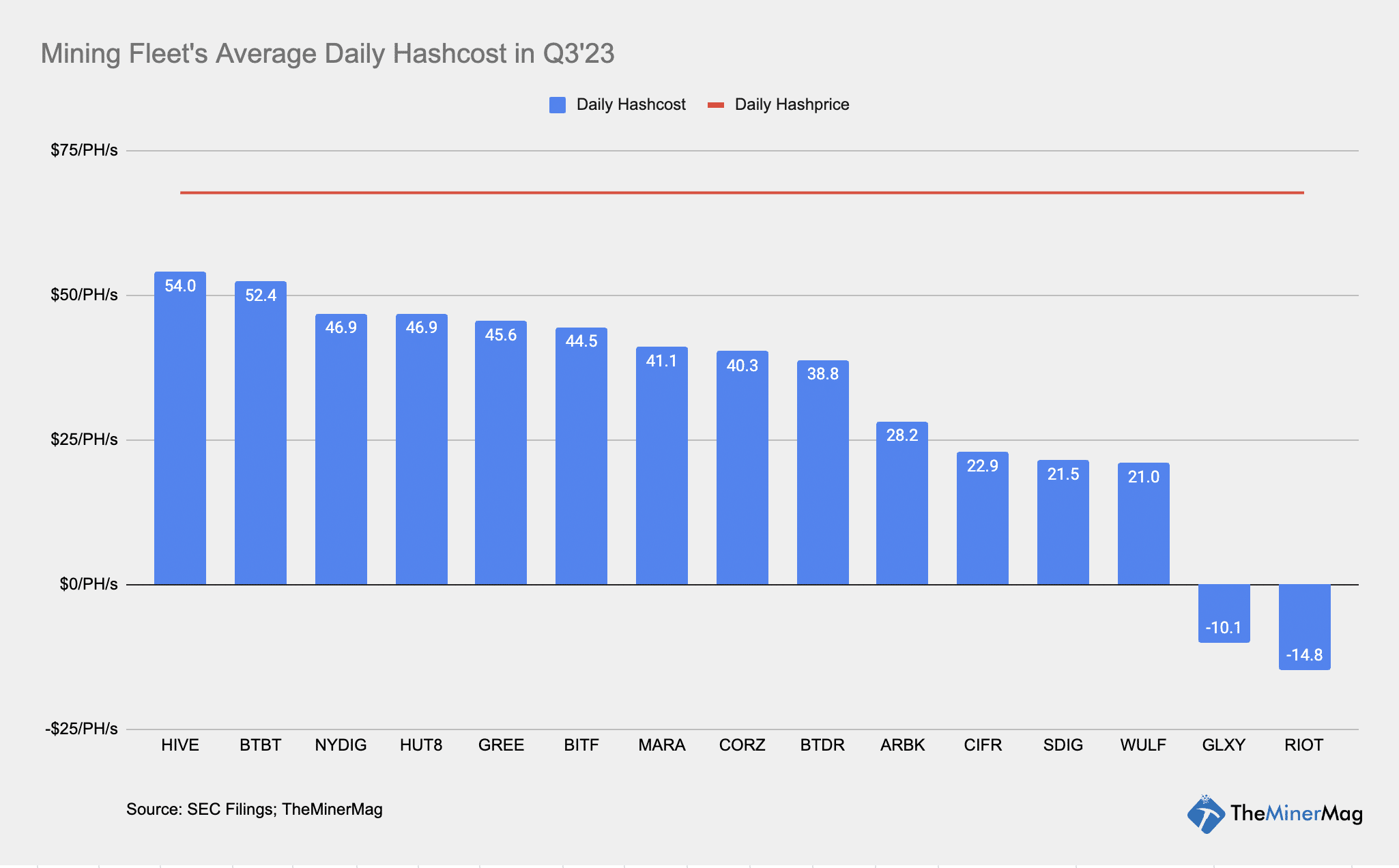

Galaxy Digital and Riot Platforms recorded negative bitcoin production costs because they received power curtailment credits that were more than enough to offset their power bills, which effectively turned their energy rates negative. HIVE had the highest cost of bitcoin production mainly because of the legacy miner equipment in use.

Since fleet efficiency and energy rate are relatively more constant, the surge of network hashrate and difficulty becomes the largest factor in pushing up the cost of bitcoin production. Nine out of the 15 companies shown in the chart above recorded a growth in the cost of bitcoin production in Q3 compared to Q2, ranging from 3% to as much as 30%.

The six companies that had a decline in the cost of bitcoin production were Galaxy, Riot, Argo (power credits again), Marathon, Greenidge, and Hut 8. They each had managed to beat the network hashrate growth by improving fleet efficiency or reducing power rates, or both. For instance, Marathon had largely improved its hashrate realization rate from July to September while Hut 8 and Greenidge said the declining gas prices were mostly helpful in Q3.

Hashcost Metric

In the equation above, we want to highlight the result of fleet efficiency (J/TH) times power rate ($/mWh), a metric we call Hashcost.

For a certain miner model, the hashcost refers to the cost of running each TH/s every hour or every day. The lower the number is, the better. That can be extended to a mining company’s entire fleet:

Fleet Daily Hashcost ($/EH/s) = Fleet Efficiency (J/TH) * Power Rate ($/mWh) * 24 (Hours) = Cost of Bitcoin Production ($/BTC) * Daily Block Rewards (BTC) / Network Hashate (EH/s)

Take HIVE as an example. Its cost of bitcoin production was $22,485/BTC in Q3 when the average daily bitcoin hashrate was 390 EH/s and average daily block rewards were 938 BTC.

That means the daily hashcost of HIVE’s fleet was 22485*938/390=$54,025/EH/s, or $54/PH/s. It is worth comparing that with bitcoin’s average daily hashprice during the same quarter, which was $67,670/EH/s, or $67.67/PH/s.

While it is intuitively easier to compare one’s cost of bitcoin production against bitcoin’s market prices, it does not take into consideration the fluctuation of bitcoin’s network hashrate. Since bitcoin’s hashrate is set to become more dynamic than ever as we move closer to halving, we believe it is more important to keep track of bitcoin’s hashprice and hence use hashcost to measure if a company remains competitive.

For example, if we hold HIVE’s hashcost constant at $54/PH/s, the company needs bitcoin’s hashprice to be more than $108/PH/s prior to the halving so that it can continue making gross profits immediately after the halving. It is a question of whether the hashprice can hit that level in the coming months, which is currently around $80/PH/s.

The hashcost metric is also useful in estimating a company’s blend-in power cost or fleet efficiency if either one of the two parameters is given. In the same HIVE example, its hashcost in Q3 was $54,025/EH/s, which equals Fleet Efficiency (J/TH) * Power Rate ($/mWh) * 24 (Hours).

According to HIVE’s recent miner purchase announcement, its existing fleet efficiency is about 38 J/TH and it aims to improve that significantly to 24 J/TH. That suggests HIVE’s blend-in power rate in Q3 was estimated to be 52912/38/24=$59.2/mWh.

If HIVE manages to improve the efficiency to 24 J/TH, then its daily hashcost will be reduced to 24*59.2*24=$33,984/EH/s, or $34/PH/s. That would make it better positioned after the next halving.

Below is the Q3 hashcost of a dozen public bitcoin mining operations as well as the estimated blend-in power rate for those that have disclosed fleet efficiencies.

The all-in cost of mining

At bitcoin’s current hashprice, most of the public bitcoin mining operations will still be able to make gross profits even after the halving next year. But it will be a different story if other general cash costs are factored into the equation.

The chart below for the all-in cost of mining takes into consideration corporate overhead and interest expenses that also form an integral part of public mining companies. As it shows, almost every one of the analyzed companies had an all-in cash cost of more than $20,000 per bitcoin mined in Q3. Holding bitcoin’s hashprice constant, those figures will double to more than $40,000.

That means if we assume bitcoin’s hashrate remains at 500 EH/s into the halving, bitcoin’s price needs to be significantly higher than $40,000 for these public mining operations to mine enough bitcoin to cover their total operation expenses.

It appears paramount for many companies to not only optimize their fleet efficiency, and secure low energy rates but also streamline their entire selling, general, and administrative (SG&A) expenses. Many of them have managed to deleverage their financial positions since 2022 so the interest expenses included in the Q3 all-in cash cost have declined materially.

It was interesting to see Core Scientific at the lower end of the scale and that it managed to slash the all-in cash cost of mining since Q3’22 despite bitcoin’s rising hashrate and its diminishing production market share.

That had everything to do with its efforts to improve the fleet uptime and cut down expenses to better emerge from the Chapter 11 proceedings.

For context, Core incurred more than $24 million and $28 million in cash-based SG&A in Q3’22 and Q4’22, respectively. In Q3’23, it was cut down to just over $13 million and Core still operated its businesses fine.

That does make one wonder whether other public mining companies may still have plenty of room where they can cut down SG&A expenses.