BitRiver Insolvency Looms as Bitcoin Miner Founder Placed Under House Arrest

Russia’s largest bitcoin mining operator, BitRiver, is facing a deepening financial and legal crisis after a regional arbitration court opened insolvency proceedings against its holding group.

According to a news report on Monday by local media Kommersant, the Arbitration Court of the Sverdlovsk region has introduced a supervision procedure against Fox Group LLC, which owns 98% of BitRiver’s management company.

The move followed a bankruptcy petition filed by Infrastructure of Siberia, a unit of En+ Group, over a debt exceeding $9.2 million, or roughly 700 million rubles, including penalties. The claim has been included in the third tier of creditors’ demands, according to court records dated Jan. 27.

Additionally, Kommersant reported that data from Moscow’s Zamoskvoretsky District Court show that BitRiver founder and chief executive Igor Runets has been detained on charges related to tax evasion and placed under house arrest on Jan. 31.

The Infrastructure of Siberia said it had paid more than 700 million rubles in advance under a contract with Fox Group for the supply of mining equipment, but the hardware was never delivered. The contract was subsequently terminated, and the company sought repayment of the advance and penalties for late delivery. An arbitration court in the Irkutsk region ruled in favor of Infrastructure of Siberia in April 2025. However, enforcement proceedings failed to uncover sufficient assets at Fox Group to satisfy the judgment, prompting the bankruptcy filing.

Court disputes between En+ entities and BitRiver-related companies have also led to the freezing of defendants’ bank accounts, a step that lawyers previously warned could paralyze operations.

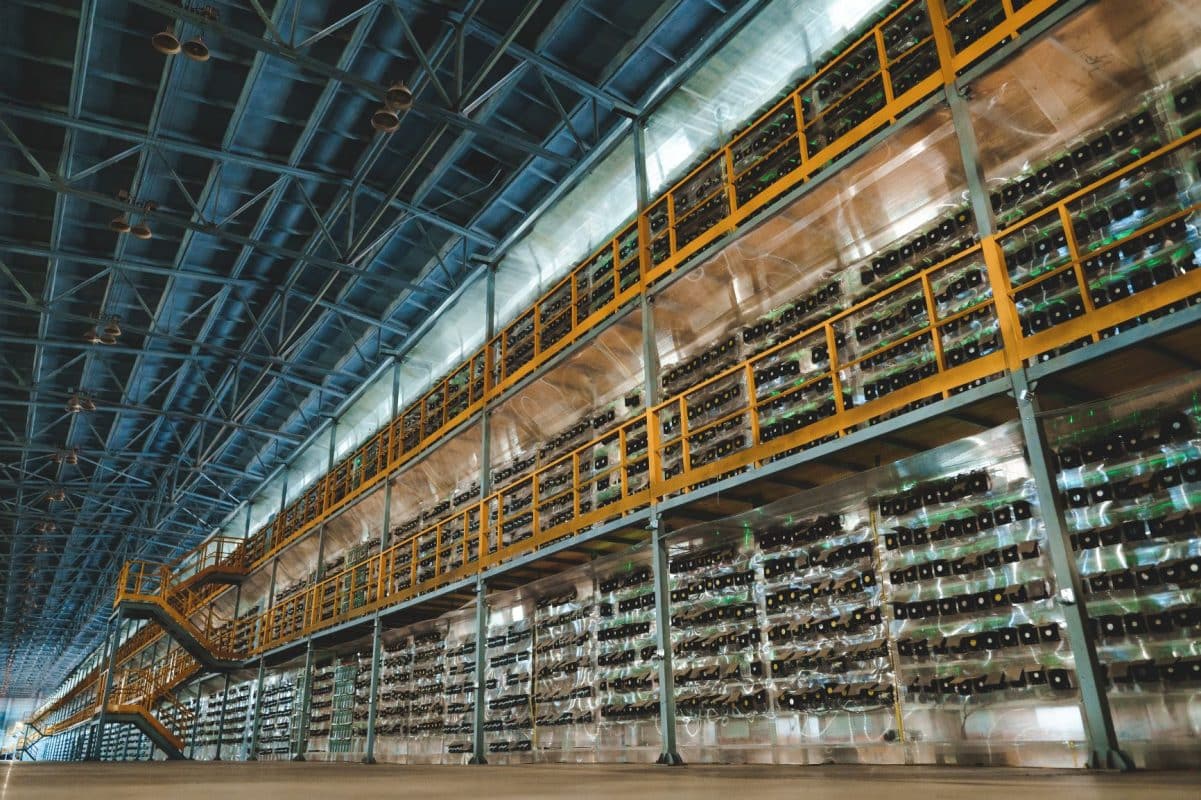

BitRiver operates through a complex group structure that includes Crypto Leader, BitRiver-A, BitRiver Rus, the Vikhorevka data center and about 70 other legal entities. At its peak, the group controlled 15 data centers with a total capacity of more than 533 megawatts and hosted over 175,000 pieces of mining equipment. Facilities in the Irkutsk region are no longer operating, partly due to a regional ban on mining in the south of the area. A planned 100-megawatt data center in Buryatia was never commissioned, and the region is set to introduce a year-round mining ban starting in 2026.

According to a source cited by Kommersant, a 40-megawatt site in Ingushetia was shut down in February 2025 with the involvement of law enforcement, despite operating under a mining ban introduced earlier that year. BitRiver’s partner sites with Gazprom Neft were also closed following contract terminations.

Layoffs reportedly began at BitRiver in early 2025, followed by wage payment delays. By the end of 2025, around 80% of top management had left the company, multiple offices were closed, and equipment and corporate documents were removed.

The crisis comes as demand for mining and data center infrastructure in Russia continues to grow. The System Operator of Russia’s power grid estimates that connected capacity for miners and data centers rose 33% in 2025 to 4 gigawatts, accounting for about 2% of national electricity consumption. While mining still dominates energy-intensive computing, data center demand is expected to accelerate, with annual market growth potentially reaching 30% to 35% by 2030, according to Alfa-Bank.