Vistra Raises $2.25B for Cogentrix Acquisition Amid Growing AI Data Center Load

Vistra has completed a $2.25 billion bond offering, finalizing a major financing step tied to its previously announced acquisition of Cogentrix Energy amid rising energy demand from AI data centers.

According to a filing on Tuesday, the $56 billion energy giant closed the transaction on January 22, including $1.0 billion of 4.700% senior secured notes due 2031 and $1.25 billion of 5.350% senior secured notes due 2036.

Vistra said it received approximately $2.225 billion in net proceeds after fees and expenses. The company plans to use the proceeds, together with cash on hand, to fund a portion of the cash consideration for the $4 billion Cogentrix acquisition, as well as for general corporate purposes, including debt repayment and transaction-related costs.

The notes are secured by a first-priority lien on substantially the same collateral backing Vistra’s credit agreement, including a significant portion of the issuer’s assets and equity interests. The collateral would be released if Vistra’s senior unsecured long-term debt were to receive investment-grade ratings from at least two major rating agencies, subject to potential reversion if those ratings are later withdrawn or downgraded.

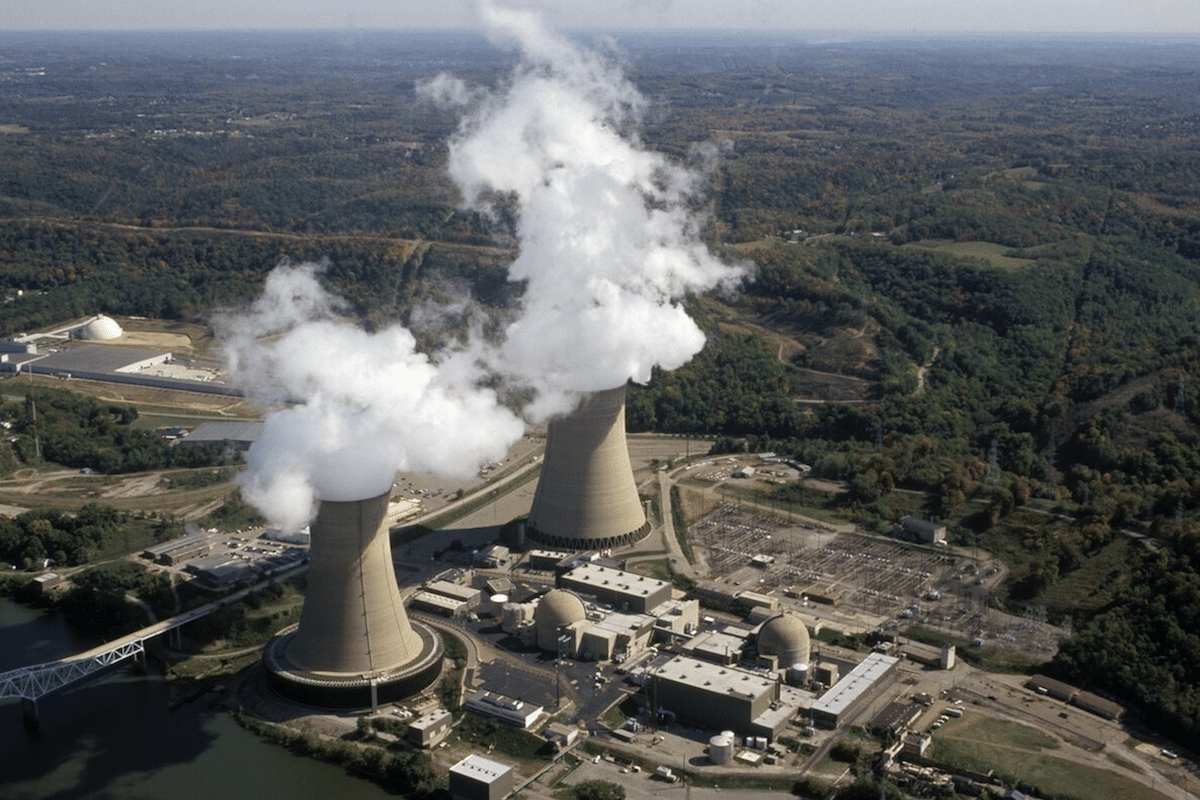

The financing comes as power producers and utilities reposition their balance sheets amid a sharp increase in projected electricity demand, driven in part by the rapid buildout of large-scale AI data centers. Hyperscale computing facilities, which often require continuous, high-load power, are prompting renewed interest in flexible and dispatchable generation assets, particularly natural gas-fired plants.

Vistra has framed the Cogentrix acquisition as a way to expand its owned generation fleet across multiple U.S. markets at a time when grid operators are warning that load growth from AI, electrification and industrial expansion could strain supply. The company has said the added capacity and geographic diversity could improve its ability to serve rising demand while maintaining reliability.

Interest on the new notes will be paid semiannually beginning in July, with maturities in 2031 and 2036. Vistra is expected to provide additional detail on the Cogentrix transaction and its broader capital allocation strategy in upcoming earnings disclosures.