American Bitcoin Shares Slide in Pre-Market Sell-off Despite Q3 BTC Output Surge

American Bitcoin Corp reported a notable increase in third-quarter production on Friday while shares slid 13.5% in pre-market trading amid a broad sell-off in crypto and equities.

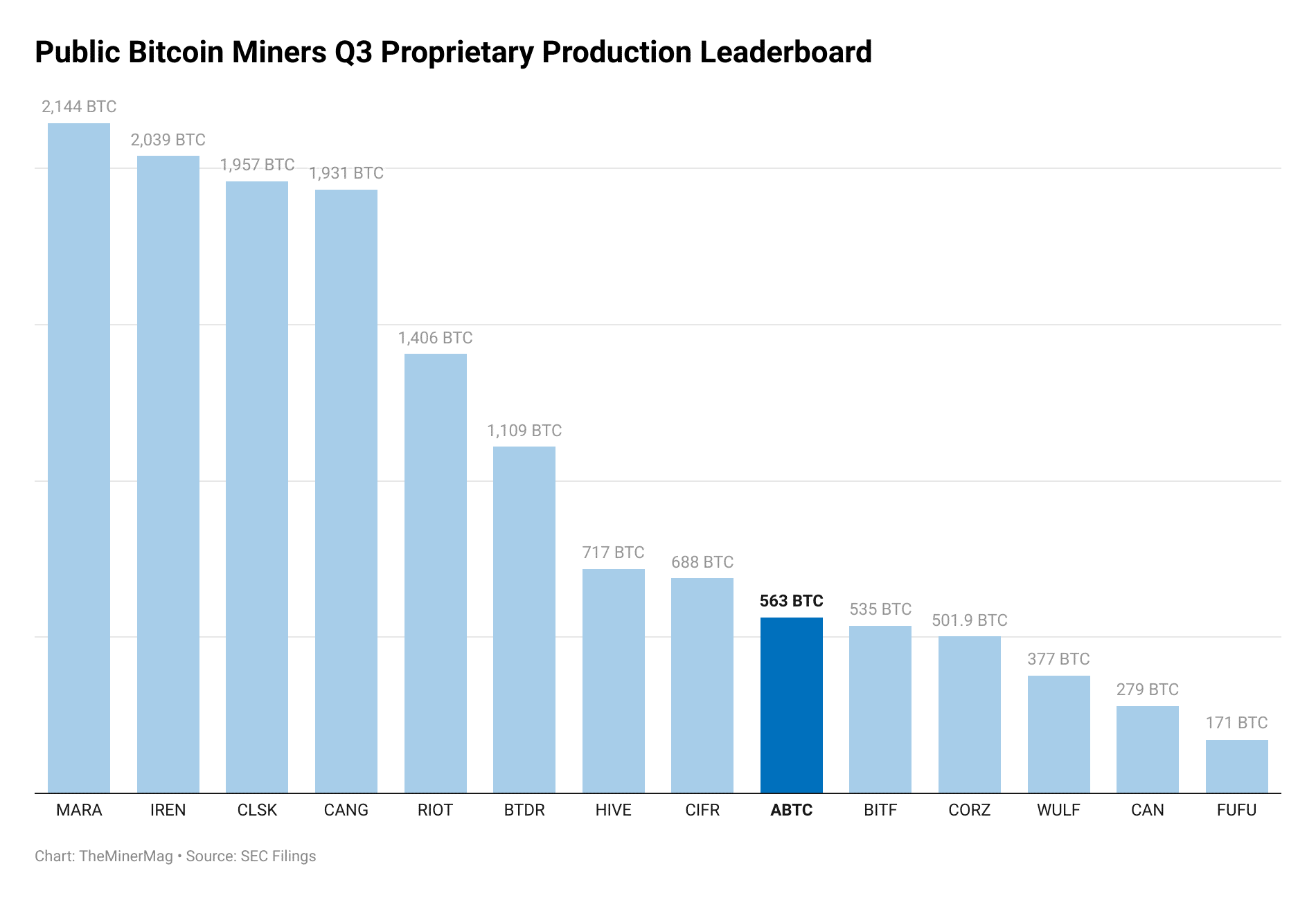

In a 10-Q filed Friday, the company said it mined 563 BTC in Q3—more than half of the 1,006 BTC it produced in the first nine months of 2025. The jump stems from American Bitcoin exercising an option to purchase 17,280 Bitmain U3S21EXPH miners totaling 15 EH/s, which lifted its realized hashrate above 12.5 EH/s. By proprietary production, the company now ranks among the ten largest publicly traded miners.

American Bitcoin said it added more than 3,000 BTC to its strategic reserve during the quarter through mining and at-market purchases, bringing its total to 3,418 BTC as of September 30. Including coins added after quarter-end, the reserve had grown to approximately 4,090 BTC by November 13.

Notably, a majority of its holdings remain pledged as collateral related to its Bitmain purchase program, as detailed in a previous Miner Weekly issue.

The miner also underscored the scale of its platform following the Gryphon merger and its spin-out from Hut 8 earlier this year. As of September 30, it operated 77,944 machines with 25 EH/s of fleet capacity—21.9 EH/s of which was energized—at an average efficiency of 16.3 J/TH.

The operational growth figures, however, were overshadowed in Friday’s pre-market session as ABTC traded sharply lower in line with sector-wide risk-off sentiment. Bitcoin itself dropped 8% to around $95,000, pushing bitcoin’s hashprice below the critical $40/PH/s mark.