Miner Weekly: Charting Bitcoin Miners’ $11 Billion – and Rising – Convertible Bond Boom

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Over the past two weeks, three major Bitcoin miners — TeraWulf, Bitfarms, and IREN — have announced or closed a combined $2.5 billion in convertible bond offerings, underscoring the strongest capital-raising streak the sector has seen in years. TeraWulf alone upsized its planned issuance from $500 million to $900 million this week following institutional demand, while Bitfarms and IREN each completed over half-billion-dollar rounds carrying coupon rates as low as 1.375% and 0%.

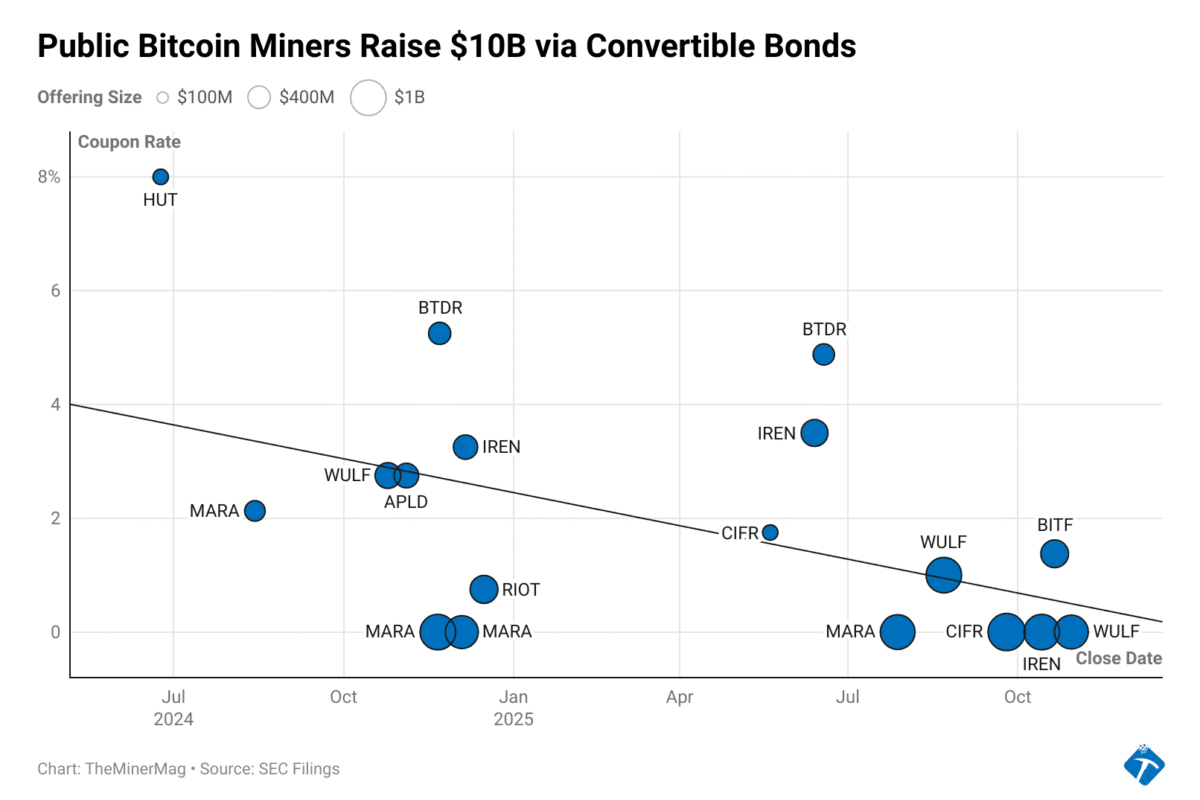

These latest financings bring total convertible-bond proceeds among public miners to more than $11 billion in just over a year. According to TheMinerMag’s compilation of SEC filings, at least 18 convertible deals have been completed since mid-2024 after the Halving.

The trend shows a clear shift in market dynamics: offering sizes have expanded sharply, with several miners—including MARA, Cipher Mining, IREN, and TeraWulf—each securing around $1 billion in a single issuance. By contrast, most deals struck a year ago were in the $200–$400 million range.

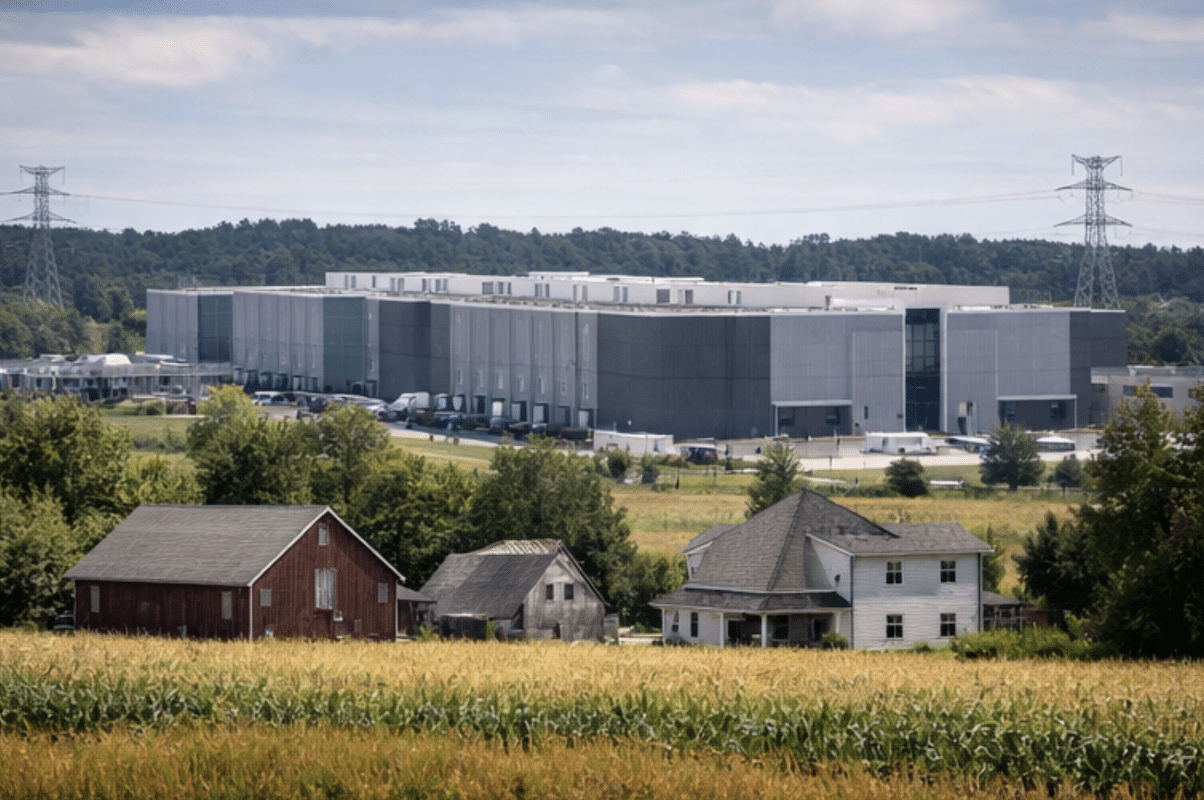

The surge reflects how miners are capitalizing on renewed investor appetite for Bitcoin-linked equities and the broader AI-infrastructure trade. Convertible debt has emerged as the preferred instrument for firms seeking to fund both treasury accumulation and large-scale data-center buildouts aimed at high-performance computing and GPU hosting.

At the same time, borrowing costs have dropped significantly. Coupon rates that averaged above 2% in 2024 have compressed toward zero in 2025. Marathon, Cipher, and IREN have all priced recent notes with a 0% coupon, signaling that institutional investors are prioritizing upside exposure to the equity conversion option over fixed interest income.

The decline in coupon rates reflects both improving market sentiment and a re-rating of miners’ equity linked to the AI data-center pivot. With several companies now repurposing or expanding their power-intensive infrastructure for GPU hosting and HPC workloads, convertible bonds have become a preferred vehicle for investors to capture optionality across two fast-growing themes: Bitcoin accumulation and AI infrastructure.

The largest recent offerings apart from Terawulf’s $900 million 0% notes include Cipher’s $1.1 billion zero-coupon notes due 2031 and IREN’s $1 billion zero-coupon notes maturing the same year. MARA has completed four separate offerings over the period, totaling more than $3 billion.

In this market, it’s go big or go home.

Hardware and Infrastructure News

- TeraWulf Expands AI Infrastructure With $9.5 Billion Fluidstack Joint Venture Backed by Google – TheMinerMag

- Canaan Launches A16 Series Bitcoin Miner With 12.8 J/TH Efficiency – TheMinerMag

- CleanSpark Acquires Land and Power in Texas for AI Data Center Push Beyond Bitcoin – TheMinerMag

- Indiana Police Recover Stolen Bitcoin Mining Rigs—And $75K Worth of Frozen Turkeys – Decrypt

- HIVE Surpasses 22 EH/s and Accelerates Conversion from Tier-1 to Tier-3 Data Centers for AI Cloud Expansion in Sweden – Link

Corporate News

- American Bitcoin Adds 1,414 BTC Since September as Mining Expansion Gains Pace – TheMinerMag

- Bitcoin Miner Ionic Digital Files Confidential S-1 for US IPO Following Turnaround Efforts – TheMinerMag

- BitFuFu Launches ANTMINER S21+ Hyd. Hosted Mining at $15.3/TH – Link

Financial News

- Cipher, Bitfarms Lead Bitcoin Miners Rally After Jane Street Discloses Stakes – TheMinerMag

- TeraWulf Plans $500M Convertible Notes Following AI Expansion with Fluidstack – TheMinerMag

Feature

- ‘And Then You Win’ Book Tells The Secrets Of Bitfury’s Bitcoin Empire – Forbes