Cipher Taps Google-Backed $3B AI Hosting Deal, Plans $800M Notes Offering

Cipher Mining said Thursday it signed a $3 billion, 10-year high-performance computing (HPC) hosting deal with Fluidstack in Texas and will separately raise $800 million through a private convertible notes offering due 2031.

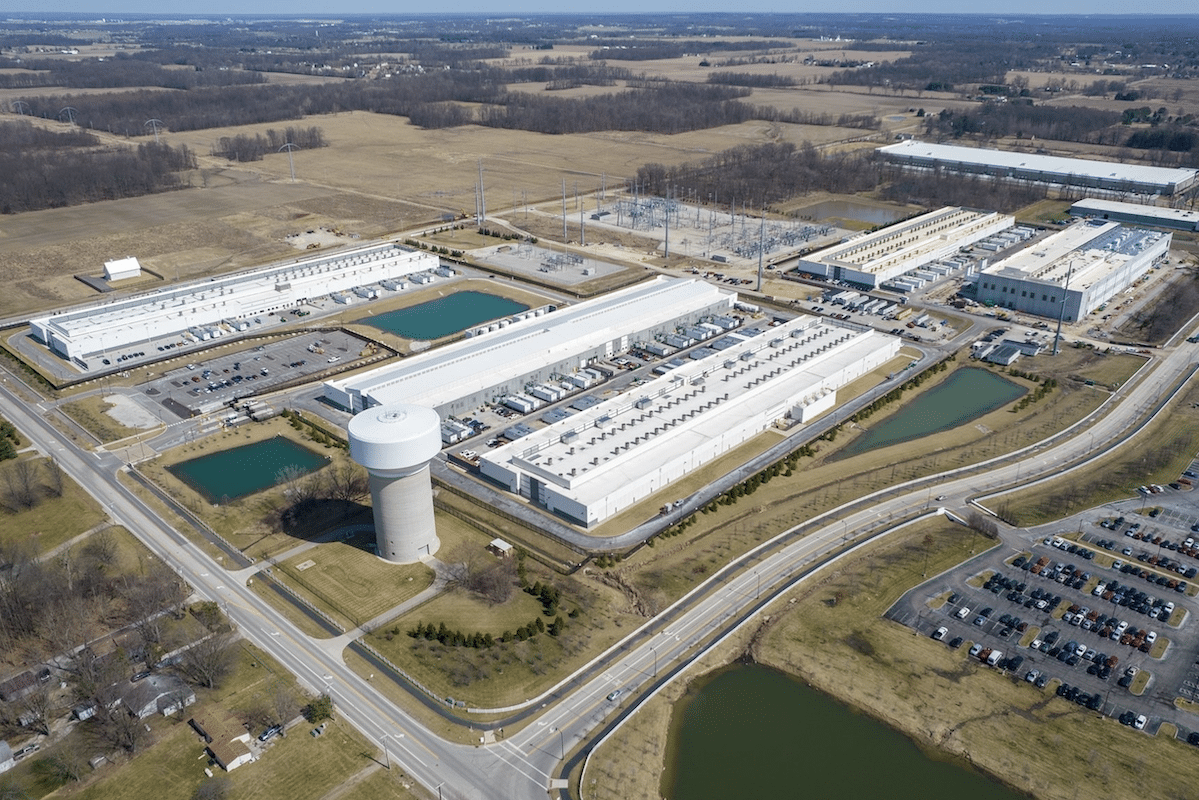

Under the agreement, Cipher will deliver 168 megawatts (MW) of critical IT load, supported by a maximum of 244 MW of gross capacity, at its Barber Lake site in Colorado City. Shares of Cipher rose 4.5% in premarket trading following the announcements.

The contract could expand to $7 billion if two five-year extension options are exercised, Cipher claimed. Google will backstop $1.4 billion of Fluidstack’s lease obligations to support project financing and will receive warrants equal to about a 5.4% equity stake in Cipher.

The deal comes months after Fluidstack struck a similar agreement with TeraWulf to develop HPC data centers, part of a broader trend of bitcoin miners repurposing large-scale energy infrastructure to meet surging demand for AI and cloud computing. Cipher said its own pipeline now spans 2.4 gigawatts, which it is prioritizing for HPC growth.

Separately, Cipher announced plans to raise $800 million through the issuance of 0.00% convertible senior notes due 2031 in a private offering to qualified institutional buyers under Rule 144A. The company may grant initial purchasers an option to buy an additional $120 million of notes.

The notes will be senior, unsecured obligations that do not bear interest or accrete principal. They will mature on Oct. 1, 2031, unless earlier converted, redeemed, or repurchased. Prior to July 1, 2031, conversion will be subject to conditions; afterward, they will be convertible at any time until two days before maturity. Cipher may settle conversions in cash, stock, or a combination, subject to shareholder approval for additional authorized shares.

The company intends to use proceeds to help fund capped call transactions designed to limit dilution from note conversions, as well as to finance construction at Barber Lake, accelerate HPC development across its 2.4 gigawatt pipeline, expand its development portfolio, and for general corporate purposes.