Luxor Facilitates Financing of 5,000 Avalon Bitcoin Miners in Partnership With Canaan

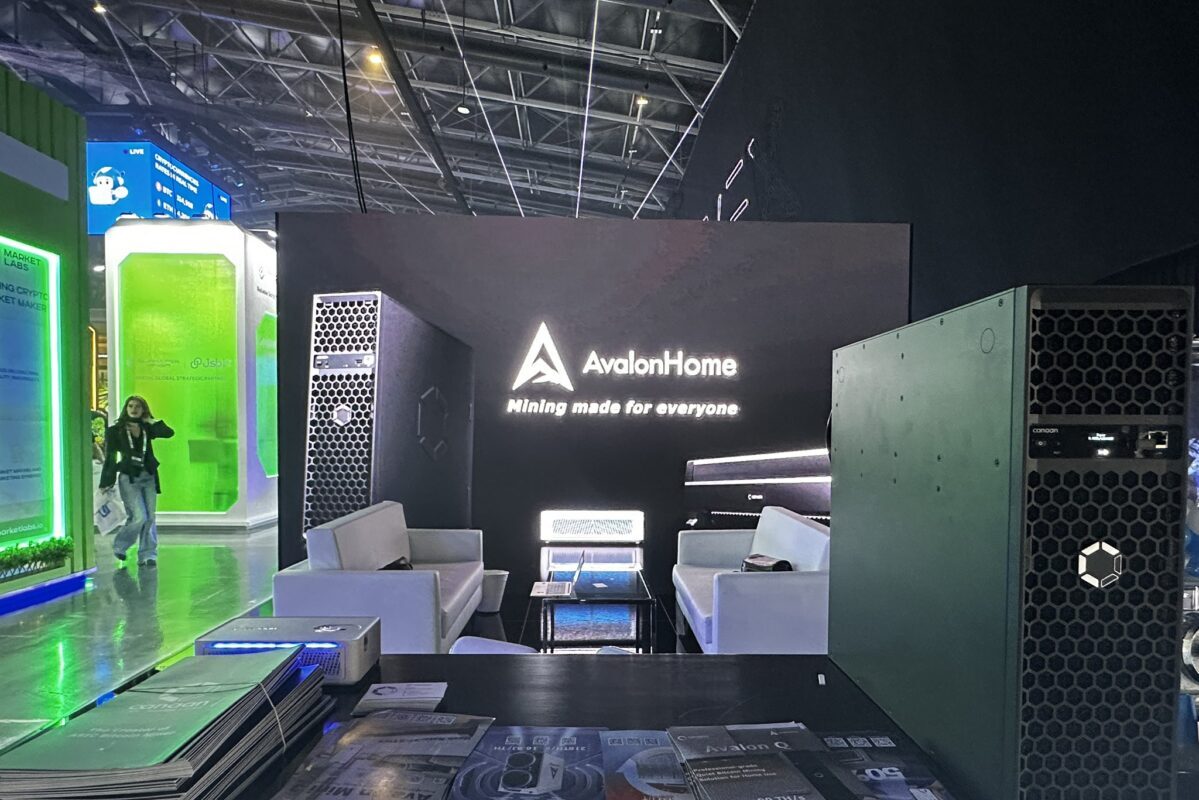

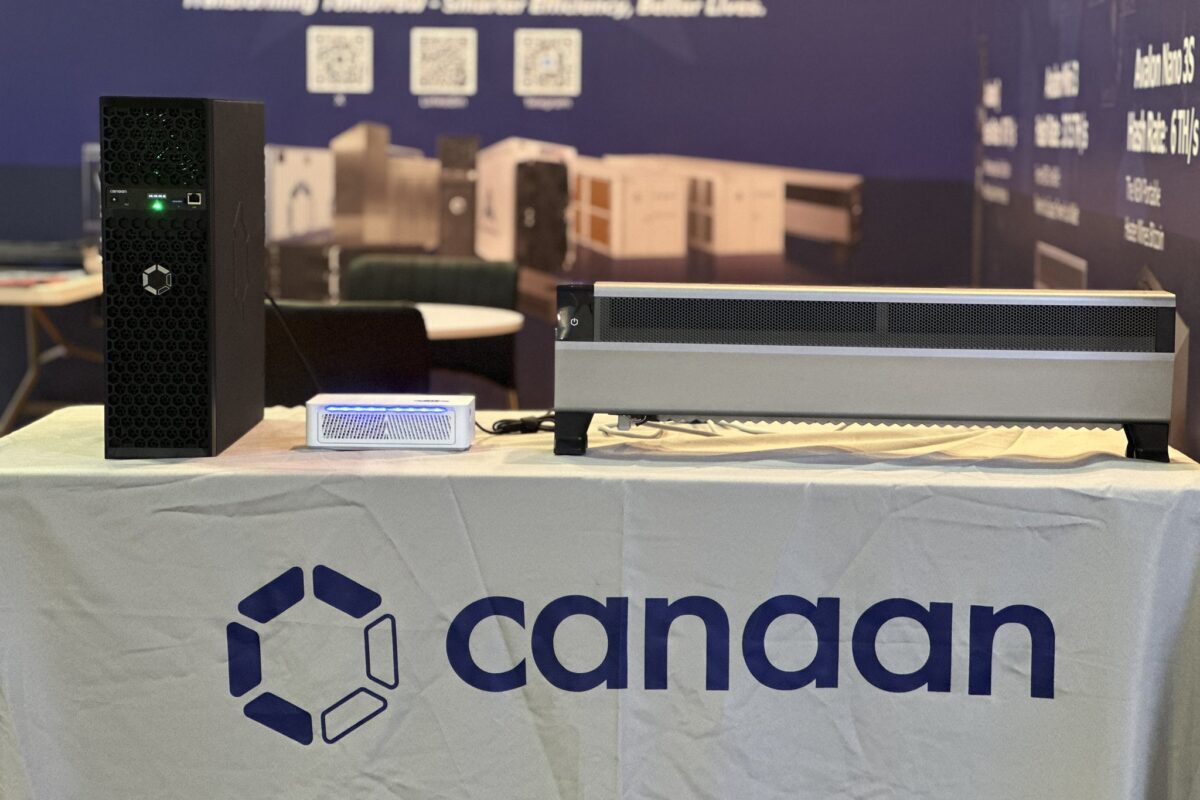

Luxor has partnered with Canaan to provide financing for bitcoin mining machines, beginning with a deal that enabled an unnamed U.S. institutional miner to acquire over 5,000 Avalon A15 Pro rigs in August.

The collaboration, announced Monday, establishes a miner financing program touting non-dilutive funding at “competitive rates” and with “lower collateral requirements.” Luxor chief operating officer Ethan Vera said the capital will come from Luxor’s lending partners.

The financing partnership comes as the hardware arms race cools among large-scale North American bitcoin mining companies, leaving chipmakers and manufacturers to bear the burden of excess inventory.

Canaan’s A15 Pro is the company’s latest generation of Avalon miners, marketed for efficiency and uptime performance. The Beijing-based manufacturer sold about 12 EH/s of hashrate in the first half of 2025 while increasing its proprietary hashrate to more than 8 EH/s.

Canaan hopes the financing option could spur greater institutional adoption of its equipment and support sales growth despite challenging industry conditions.

With the latest all-time high in network difficulty, persistently subdued transaction fees, and bitcoin’s price slipping below $110,000, mining hashprice has fallen below $55/PH/s again, reaching $53/PH/s on Monday.