Arms Race Flips: Manufacturers Are the New Bitcoin Miners

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

The bitcoin mining industry has entered a new phase in its cyclical arms race. In past bull markets, public mining firms rushed to secure the latest generation of rigs, pouring billions into hardware orders to convince investors they could outpace rivals in hashrate expansion. But this time, the script has flipped.

With hashprice still under pressure from continued, albeit slower, hashrate growth and subdued transaction fees — and with the spotlight shifting to artificial intelligence and high-performance computing — miners are slowing their buying spree. The result: manufacturers, not operators, are now carrying the burden of excess inventory. And unlike miners, chipmakers cannot easily pause wafer orders from foundry partners without risking long-term supply relationships.

That tension has transformed the arms race into a contest among manufacturers themselves — a race to find ways to energize and monetize their own machines.

Canaan has always been a clear example of this pivot, but the recent ramp-up in installed hashrate shows how the OG chipmaker has accelerated its efforts. The Nasdaq-listed manufacturer sold about 12 EH/s of computing power during the first half of 2025. At the same time, it increased its proprietary hashrate from less than 5 EH/s at the end of December to more than 8 EH/s as of July.

Bitdeer has moved even faster. The Singapore-based operator ramped its proprietary hashrate from 8.9 EH/s in December to 22.5 EH/s by July, largely by energizing its own SEALMINER fleet. In both cases, surplus inventory that once would have been shipped to customers is now being deployed in-house.

The most telling shift comes from industry bellwether Bitmain. Facing weaker U.S. institutional demand, the Beijing-based giant has leaned into selling hosted hashrate tied to its Antminer S21 Hydro and S21e Hydro rigs.

Rather than targeting seasoned mining operators, Bitmain is pitching the product to new entrants. Ruihe Data — a Hong Kong-listed fintech firm with a market capitalization of about HK$1.9 billion (US$240 million) — recently signed up. In a filing last week, Ruihe described bitcoin mining as a “distinct business segment” that would diversify revenues beyond its core big data and AI services.

The deal effectively makes Ruihe a cloud-mining client. Customers like Ruihe pay service fees to Bitmain in exchange for a share of mining rewards, with flexible options to keep, return, or upgrade machines after cumulative payouts reach 105% of the upfront cost. That is in addition to the proprietary hashrate capacity that Bitmain is tied to via BitFuFu and Cango, which totals close to 100 EH/s.

Per TheMinerMag’s analysis of July production updates, Bitdeer was the sixth-largest proprietary mining force by realized hashrate. The company targets a year-end range of 30 to 40 EH/s with its own SEALMINERS. If that plays out, Bitdeer may catch up to or overtake Riot. In that case, three of the five largest public mining companies will operate with machines designed either in-house or by direct affiliates: Bitdeer with SEALMINERS, Cango with Antminers, and MARA with Teraflux miners.

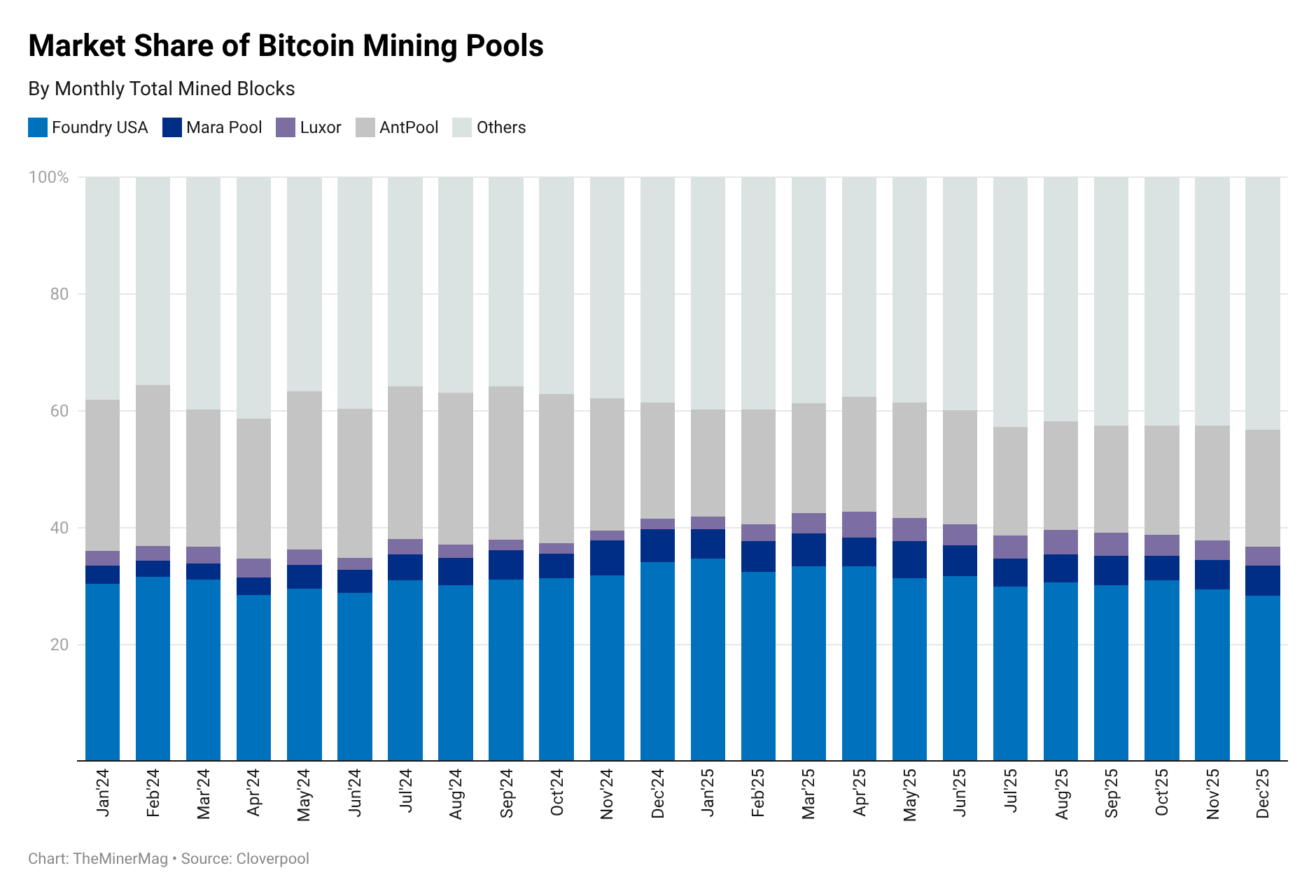

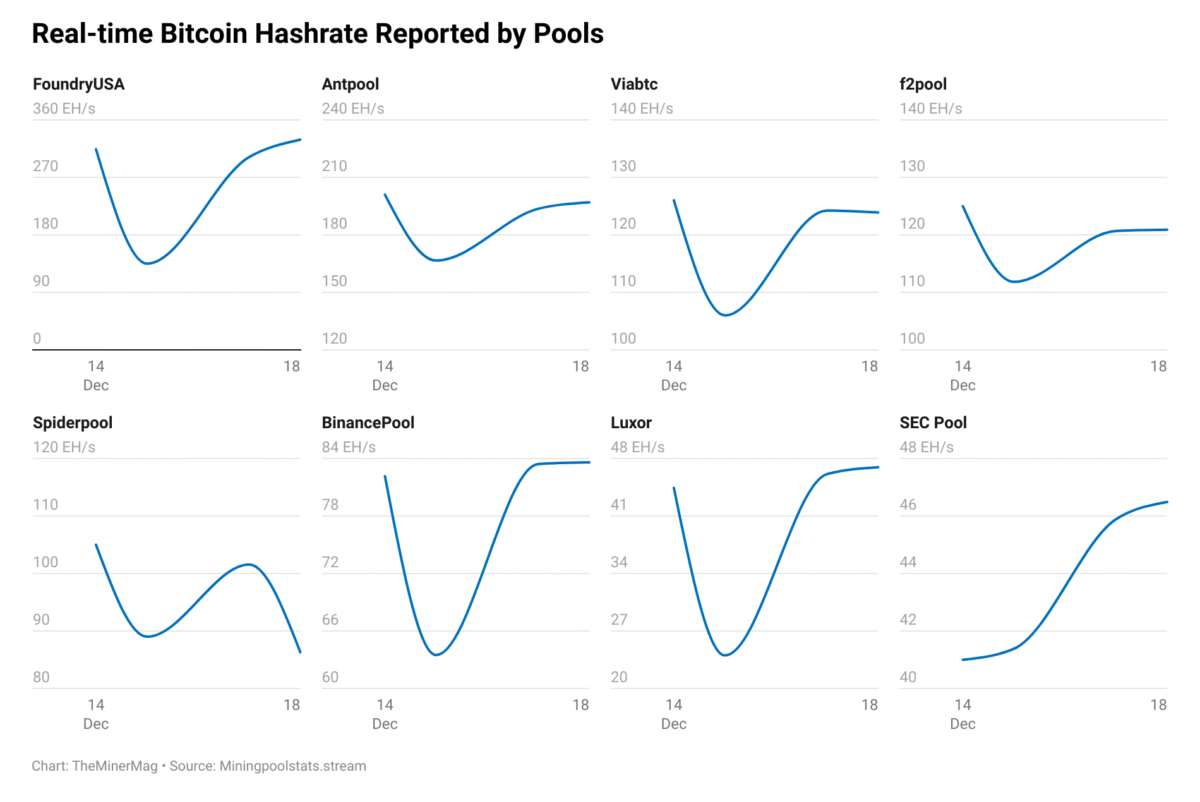

In reality, this seemingly perpetual production capacity will continue driving network hashrate growth, which already crossed the 1 zetahash milestone over the past week on a seven-day moving average basis. With bitcoin’s transaction fees accounting for less than 0.8% of the block rewards, the question is whether miner manufacturers will ever slow down production or even stop.

Hardware and Infrastructure News

- Bitmain Sells Hosted Bitcoin Hashrate to Hong Kong-Listed Firm Amid US Mining Retreat - TheMinerMag

- Bitcoin’s 7D Hashrate Hits 1 ZH/s Milestone as Fees Slide to Multi-Year Lows - TheMinerMag

- HIVE Completes Phase 2 of Its Yguazú Project in Paraguay Reaching 18 EH/s - Link

Corporate News

- IREN Discloses $20M Settlement With NYDIG, Expands GPU Fleet as Stock Hits Record High - TheMinerMag

- American Bitcoin Debuts on Nasdaq After Completing Gryphon Merger - TheMinerMag