Miner Weekly: The Bitcoin Treasury Movement Is Here

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

In 2017, the corporate crypto buzzwords were ICOs and blockchain. Earnings calls and conference panels were filled with talk of distributed ledgers and tokenized business models. Fast forward two halving cycles, and the conversation has radically shifted.

Today, no one’s asking about a “blockchain strategy”—they’re asking how much Bitcoin you hold. From Wall Street institutions to renewable energy firms to meme-stock veterans, public companies are increasingly turning to Bitcoin—not as a tech curiosity, but as a treasury asset in a world of debt, dilution, and monetary uncertainty.

Bitcoin miners are natural believers in the treasury use case (though some aren’t holding at all). According to data tracked by TheMinerMag, more than a dozen publicly traded mining firms collectively hold nearly 100,000 BTC on their balance sheets. But since the 2024 halving, the Bitcoin treasury trend—and the stock performance of companies embracing it—has extended well beyond the mining sector.

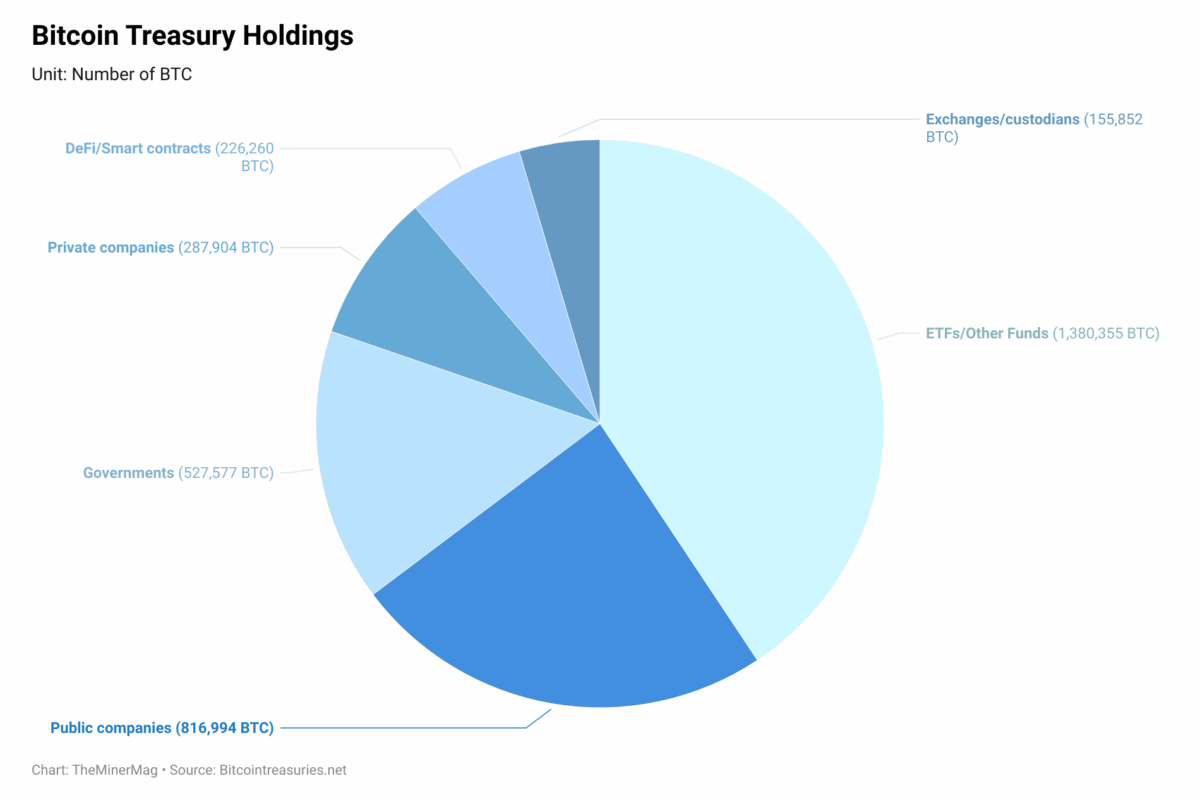

As of June 2025, the adoption of Bitcoin as a corporate treasury asset continues to gain momentum. Standard Chartered recently reported that at least 61 public companies collectively hold approximately 673,897 BTC—around 3.2% of the total supply.

Yet that figure may significantly understate the real picture.

Bitcointreasuries.net, a tracking site curated by Coinkite, lists 124 public companies globally with combined holdings of 816,958 BTC. Including private firms and sovereign entities, total holdings are estimated to exceed 3.3 million BTC.

Below are some of the newest entrants in the Bitcoin treasury movement.

🔑 Newest Additions to the Bitcoin Treasury Movement

🟪 GameStop Corp.

GameStop revealed it had purchased 4,710 BTC in late May—its first formal Bitcoin acquisition. Though the stock fell 10.9% on announcement day, that followed a sharp multi-day rally as rumors swirled.

🟥 Trump Media & Technology Group

The company raised $2.3 billion via share and convertible debt issuance to build a Bitcoin reserve. Its stock gained 2.1% following the news, bucking a broader market dip.

🟦 Twenty One Capital

Twenty One Capital has quickly emerged as a major player, accumulating over 42,000 BTC and raising $685 million. It’s going public via SPAC merger with Cantor Equity Partners, and Cantor’s stock soared over 460% following the announcement.

🟧 Strive Asset Management

Strive is merging with Colombier Acquisition Corp. to go public while adopting a Bitcoin-first treasury strategy. The firm, co-founded by Senate candidate Vivek Ramaswamy, brands itself as a pro-Bitcoin alternative to traditional ESG-driven asset managers.

🟩 K Wave Media (KWM)

Korean firm KWM is building what it calls the “Metaplanet of Korea,” initiating a $500 million capital facility to support Bitcoin accumulation and treasury integration.

🇨🇦 SolarBank Corp.

The Canadian clean energy developer announced it would adopt Bitcoin as a strategic reserve asset, tying its pro-renewable mission to the long-term potential of decentralized money.

🇳🇴 HarmonyChain

Norway-based HarmonyChain joined the wave in late May, becoming one of the first Nordic-listed companies to adopt a formal Bitcoin treasury strategy. The firm disclosed its first Bitcoin purchases and said it plans to make BTC a long-term reserve asset, citing inflation concerns and global monetary instability (source).

Regulation News

- Pakistan’s bold Bitcoin move draws IMF scrutiny – SAMAA

- Atlanta expands restrictions on where data centers can be built – The Atlanta Journal-Constitution

- Final Johnson City crypto mine zoning vote Thursday, miner ‘continues to’ look at site – WCYB

Hardware and Infrastructure News

- Bitcoin’s Mining Difficulty Hits Record High, Erasing Recent Hashprice Gains – TheMinerMag

- Applied Digital Shares Surge 40% on 250 MW AI Lease with CoreWeave – TheMinerMag

- Cipher Targets 71% Boost in Bitcoin Hashrate With Black Pearl Deployment – TheMinerMag

- Solo bitcoin miner wins $330K worth of block reward after renting hash power to beat steep odds, CKpool dev says – The Block

Corporate News

- Cango Founders Cede Control to Antalpha in Bitcoin Mining Shift – TheMinerMag

- Riot Hires Data Center Chief as Bitcoin Miner Ramps Up HPC and AI Hosting Plans – TheMinerMag

- MARA, CleanSpark, Riot Drive Record Bitcoin Hashrate Surge in May – TheMinerMag

- Mountain City Approves Trip to Tour CleanSpark Bitcoin Mine Amid Local Opposition – TheMinerMag

Feature

- AI could consume more power than Bitcoin by the end of 2025 – The Verge