Cango Founders Cede Control to Antalpha in Bitcoin Mining Shift

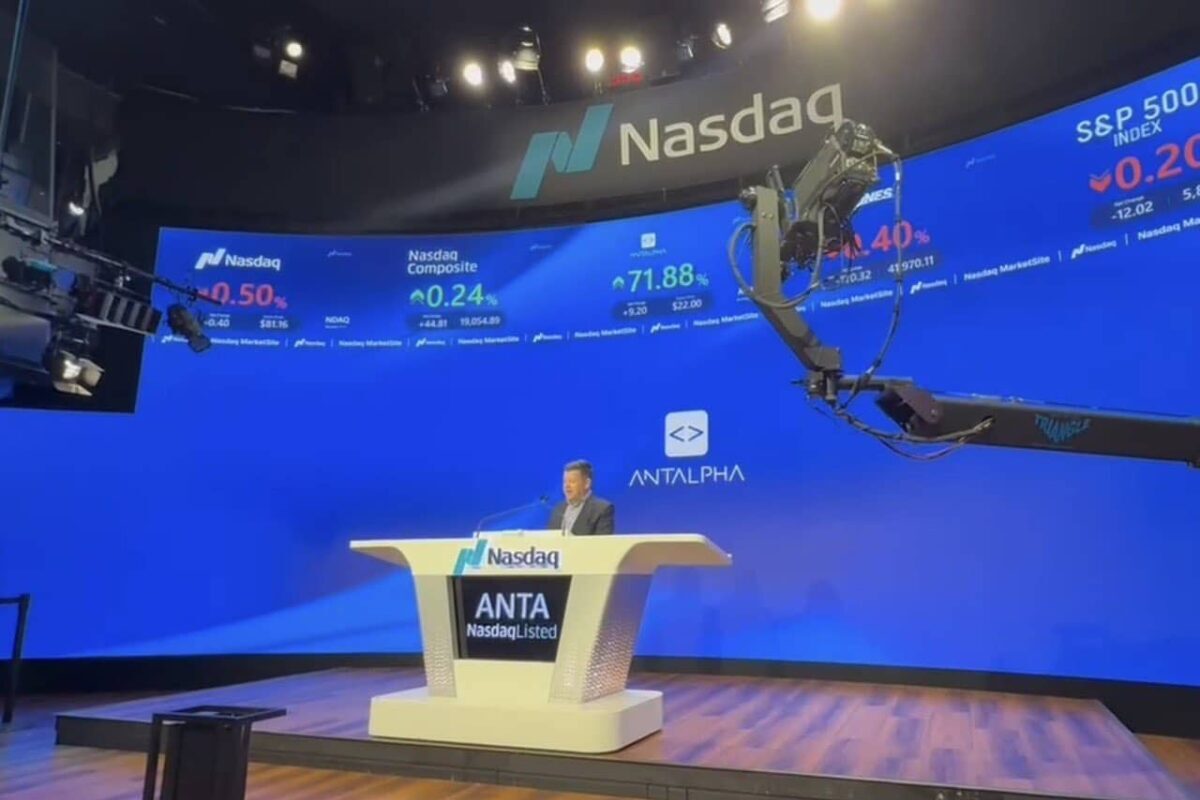

Cango (NYSE: CANG) has finalized the terms of a $70 million ownership and governance restructuring as part of its transformation into a Bitcoin mining proxy for Bitmain’s financing arm, Antalpha.

The former Chinese auto financing company announced on Monday the sale of 10 million Class B ordinary shares owned by its co-founders to Enduring Wealth Capital Limited (EWCL) for a total purchase price of $70 million. This deal marks a significant shift in the company’s trajectory, following its disposal of all business operations in China last week.

The agreement entails several key changes to Cango’s ownership structure and management. Under the deal, co-founders Xiaojun Zhang and Jiayuan Lin, along with their holding companies, will transfer the shares to EWCL.

As part of the transaction, the Class B shares—each carrying 20 votes per share—will be preserved for EWCL, while the founders will convert their remaining Class B shares into Class A shares, each carrying a single vote. This restructuring will effectively consolidate EWCL’s voting power while diluting the founders’ control.

Depending on the completion of Cango’s previously announced acquisition of 18 EH/s of on-rack Bitcoin mining machines through share issuances, EWCL’s total voting power could range from 36.81% to 50.28%, with an equity stake between 2.83% and 4.81%. The founders’ voting power would correspondingly decrease to between 12.09% and 16.52%. Completion of these transactions remains contingent on shareholder approval and other closing conditions.

Cango had previously estimated that it would finalize the 18 EH/s acquisition by the end of July. If completed, the acquisition would increase Cango’s operational hashrate to 50 EH/s. As previously reported, EWCL is an entity established by Bitmain’s Antalpha, which also created a separate entity, Ursalpha, to acquire Cango’s Chinese business in a recent $320 million transaction. Subsequently, Cango has fully disposed of its legacy auto business.

EWCL issued a preliminary non-binding letter of intent in March, proposing a broader set of changes for Cango, including board and management restructuring. This shift follows Cango’s strategic pivot into Bitcoin mining, highlighted by its planned acquisitions of mining equipment.

As reported by TheMinerMag, Cango has repurposed itself from a once-struggling Chinese auto-financing firm into a Bitcoin mining proxy closely tied to mining hardware titan Bitmain. With 29.71 EH/s in realized hashrate, the company effectively represents Bitmain as the fifth-largest public bitcoin mining company by market share.