Miner Weekly: The Hidden Message of Bitmain’s S23 Rollout

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitmain has announced the rollout of its latest Bitcoin mining machine, the Antminer S23 Hydro, at its flagship WDMS 2025 event this week. The new hardware boasts an efficiency of 9.7 J/TH and is scheduled to begin shipping in Q1 2026. This development marks a significant leap in mining technology, pushing the industry into a sub-10 J/TH efficiency era – a stark contrast to the 1,200 J/TH efficiency of the first-ever Bitcoin ASIC miner launched in 2013.

While such technological advancements might suggest a familiar growth narrative, the current market conditions paint a more complex picture. Traditionally, Bitmain and other hardware makers have launched next-generation mining rigs with major efficiency gains during bear markets, as miners prepare for the next halving cycle. However, the introduction of the S23 Hydro coincides with Bitcoin’s rally beyond $100,000 – a scenario not seen before. More tellingly, Bitmain is offering flexible payment terms during the event, including accepting Bitcoin as collateral from buyers, signaling the shifting dynamics in the mining hardware market.

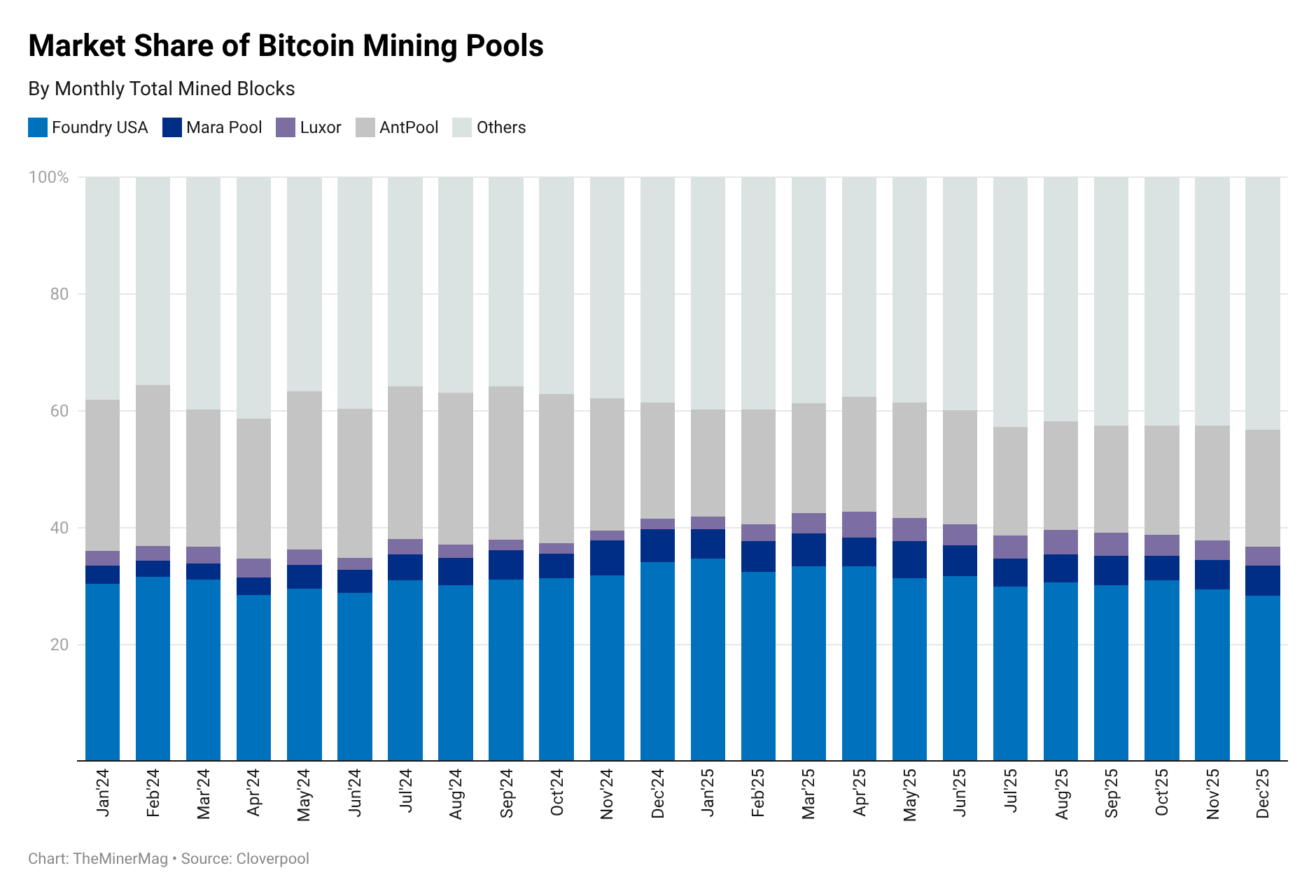

The prevailing challenge stems from the disconnect between Bitcoin’s soaring price and the lagging hashprice – the amount miners earn per unit of computational power. Bitcoin’s hashprice dipped below $39/PH/s earlier this year, while the median fleet hashcost for major public mining firms during the first quarter hovered around $35/PH/s. This squeeze on profitability has prompted several large mining firms to pause or scale back their hashrate expansion plans.

The implications of this shift are profound. Historically, new hardware cycles have been driven by growth markets and network expansion. Today, however, much of the demand for the latest mining technology, including sub-10 J/TH equipment like the S23 Hydro, is expected to come from miners upgrading existing fleets rather than pursuing aggressive expansion. This change is driven by a compressed hashprice and concerns about future profitability.

As TheMinerMag projected in a previous research, the rate of hashrate increase may gradually plateau after the current halving epoch. The widespread adoption of highly efficient mining equipment could not only stabilize but potentially reduce the network’s overall power consumption – a trend not seen in previous cycles.

Looking ahead, the combination of an evolving hardware landscape, muted hashrate growth, and the uncertain trajectory of hashprice raises critical questions for the industry. If Bitcoin’s hashprice struggles to recover to pre-2024 halving levels (about $100/PH/s) during a bull market, miners may face heightened pressures during future downturns.

The rollout of the Antminer S23 Hydro is thus not just a technological milestone but also a reflection of the industry’s shifting realities, where efficiency gains are no longer solely a catalyst for growth but a necessity for survival.

Regulation News

- Pakistan Allocates 2GW Power Capacity to Boost Bitcoin Mining - TheMinerMag

Hardware and Infrastructure News

- HIVE Surpasses 10 EH/s of Bitcoin Hashrate as Expansion in Paraguay Accelerates - Link

- Bitmain Unveils S23 Bitcoin Miner Touting 9.5 J/TH Efficiency - TheMinerMag

- Russia Could Relocate Bitcoin Miners To Northern Regions: Report - Decrypt

- Green Flare Plans 53 MW of Flare Gas Bitcoin Mine in Nigeria - TheMinerMag

Corporate News

- MARA Closing in on Record Realized Bitcoin Hashrate Above 50 EH/s - TheMinerMag

- Compass Mining Partners with Synota's "Impact Mining" Initiative to Transform Bitcoin Hashrate into Community Impact - Link

- IREN co-founder and co-CEO Dan Roberts smashes Central Coast record with AU$ 15.5 million beachfront pad - AFR

- Ionic Digital Issues Statement Following Delaware Chancery Court Ruling - Link

- TeraWulf Acquires Beowulf Electricity & Data, Streamlining Corporate Structure - Link