Miner Weekly: Bitcoin Miners Roar Back—AI Bets Separate the Winners

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

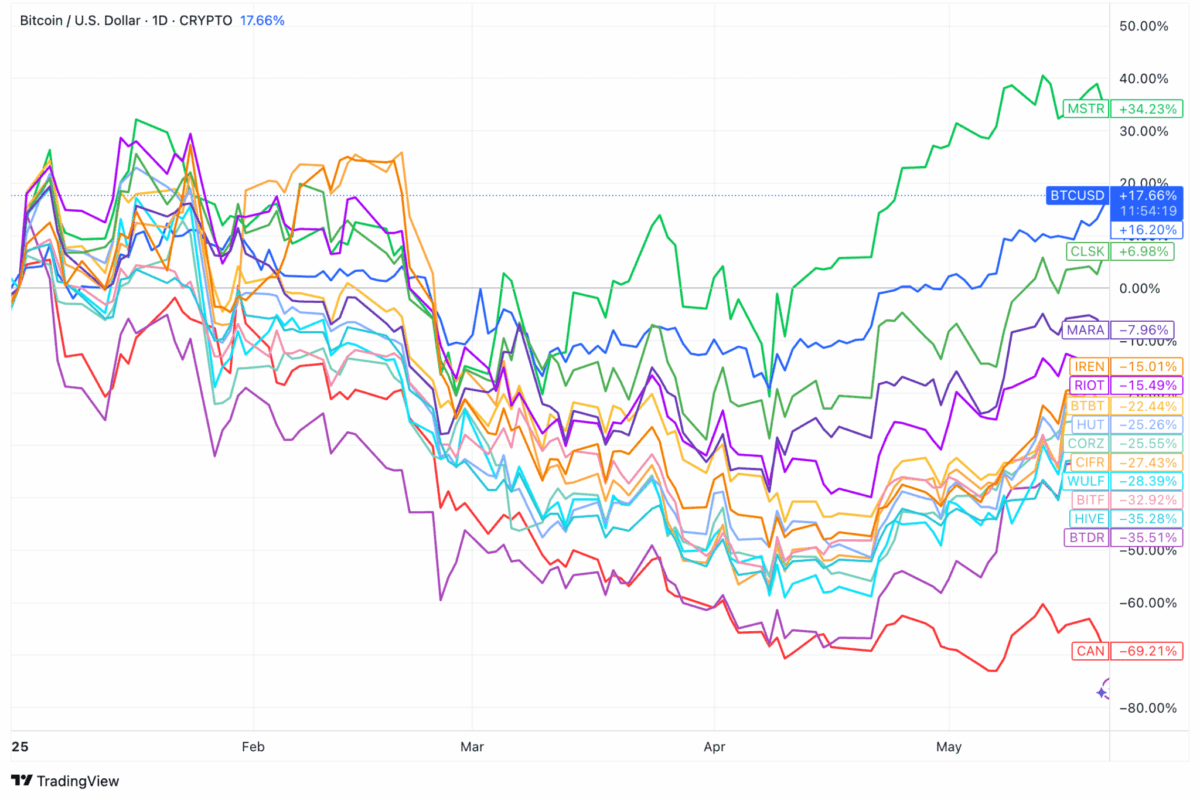

After a steep sell-off that lasted much of Q1, Bitcoin mining stocks are showing new signs of life—bouncing back as Bitcoin sets fresh all-time highs above $100,000. But this isn’t a rising-tide-lifts-all-boats story. The sharpest rebound has been concentrated among miners with active high-performance computing (HPC) or AI hosting initiatives, as investors begin to differentiate based on growth potential beyond Bitcoin.

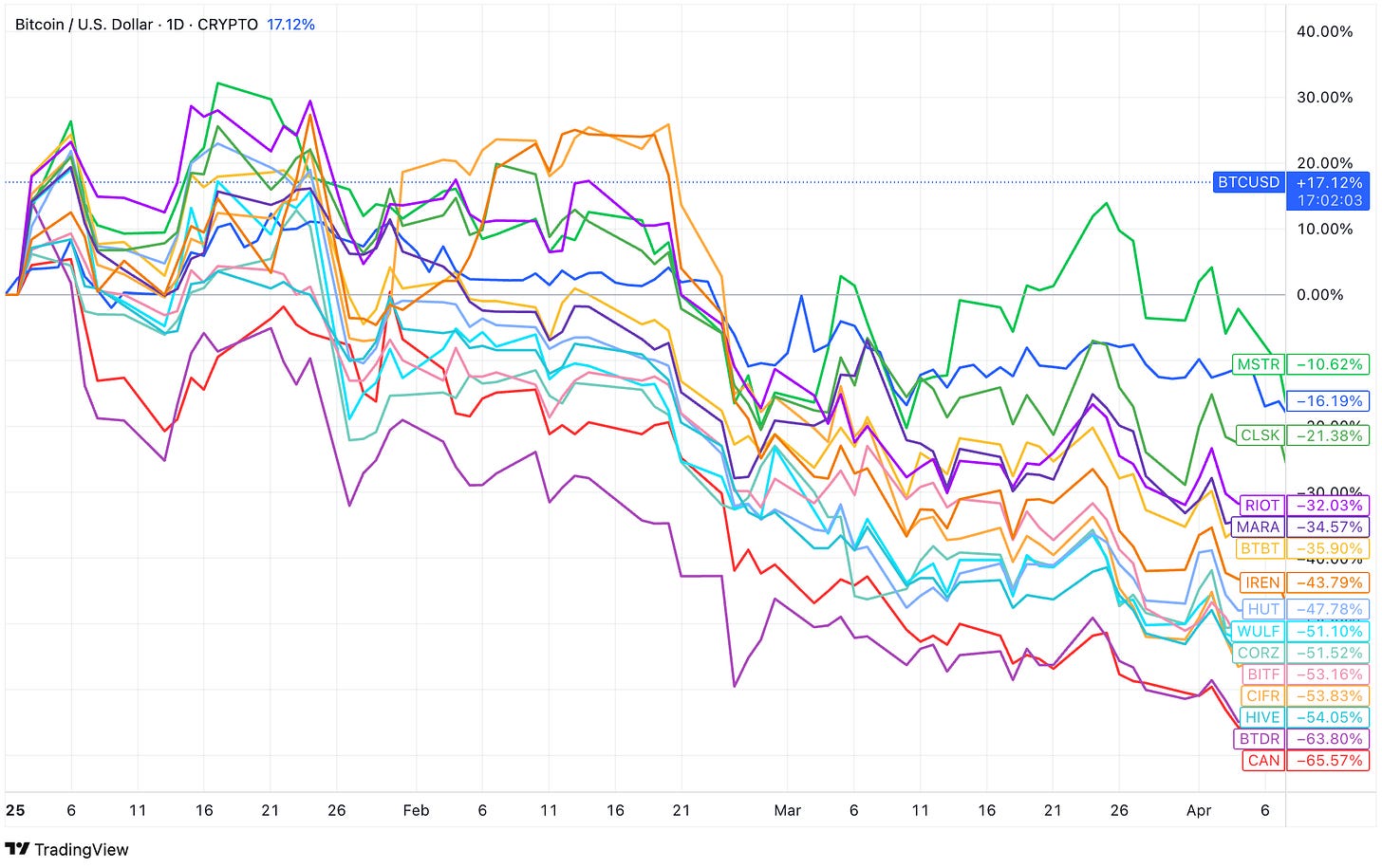

The turnaround follows Bitcoin’s recovery from a low of $75,000 in early April, triggered by geopolitical tensions and broader market volatility. During the decline, most publicly listed miners underperformed BTC significantly. Bitdeer (BTDR), Cipher (CIFR), Core Scientific (CORZ), and Terawulf (WULF) all shed more than 50% of their value between January and early April.

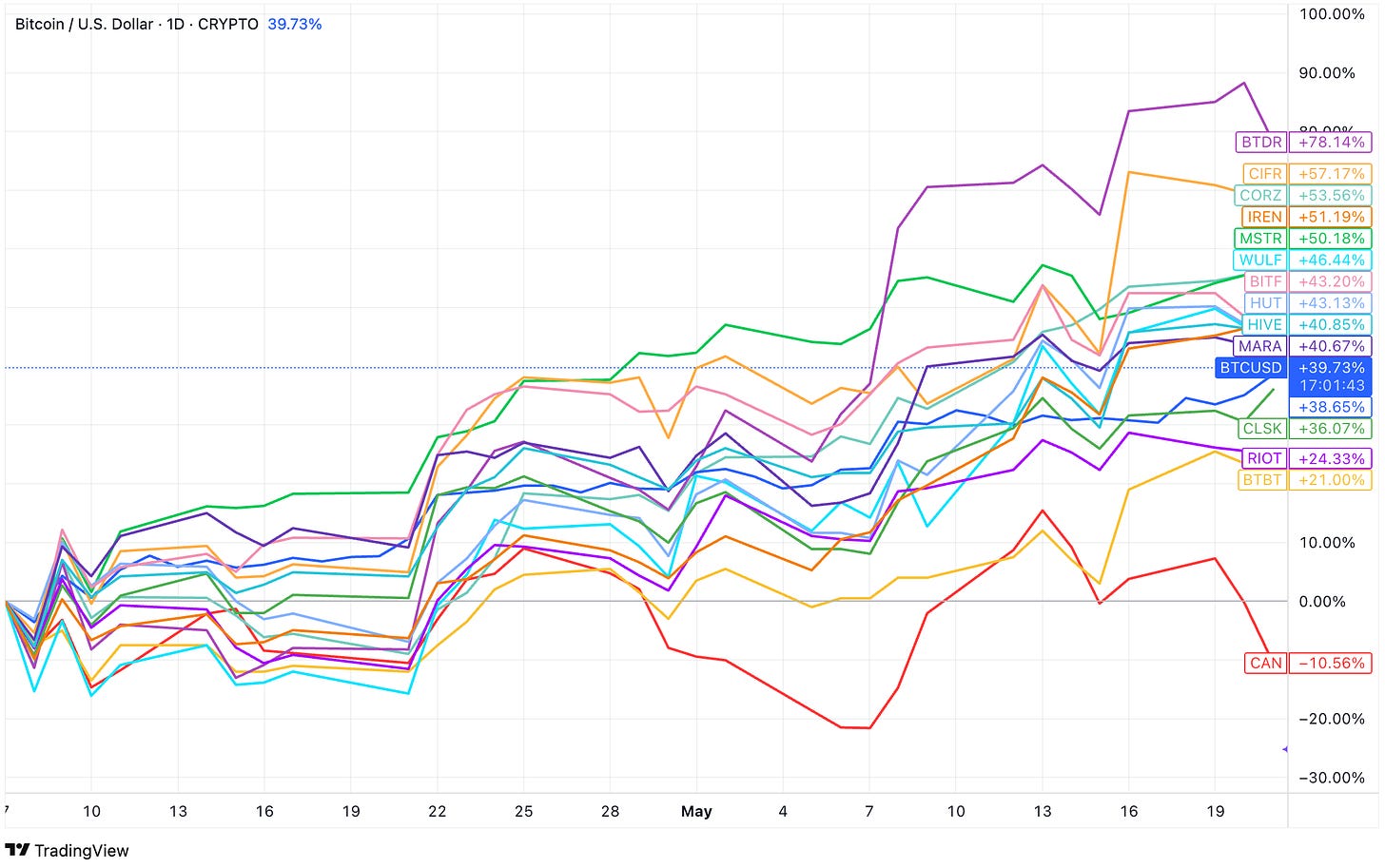

But since Bitcoin bottomed on April 7, the rebound has been swift and selective. Bitdeer, previously the most heavily sold stock among miners, has rallied nearly 80%. Core Scientific, Terawulf, Cipher, and Iris Energy (IREN) have each posted gains over 50%, outpacing Bitcoin’s own recovery. Notably, these are the companies that have either launched or committed to scaling their data center footprint to support AI or HPC workloads.

In contrast, miners with pure-play Bitcoin exposure and no diversification strategy have seen a slower recovery. While most names have bounced from the April lows, those lacking a compelling growth narrative—especially around AI or hosting—have posted relatively slower recovery over the past month. With that being said, CleanSpark is the only mining stock that maintains a YTD gain thanks to consistent operational execution and select expansion moves, but it too is treading carefully.

The message seems clear: while the market is rewarding Bitcoin mining stocks again, it is doing so selectively, favoring those with a forward-looking strategy and diversified infrastructure growth. In this new phase of the cycle, investors appear increasingly attuned to which miners are building for the next decade, not just the next halving.

Hardware and Infrastructure News

- Cango Set to Add 18 EH/s Bitcoin Hashrate by July, Approves $352M Sale – TheMinerMag

- Auradine Expands Bitcoin Mining Solutions with ASIC chips, Range of Advanced Cooling Systems and Modular Megawatt Containers – Link

- Crusoe Enters Second Phase of Building an OpenAI Texas Data Center – Bloomberg

- HIVE Crosses Record 9.5 EH/s Milestone – Link

- Soluna to Launch First Solar-Powered Data Center With 75 MW Project – Link

Corporate News

- Core Scientific Appoints Elizabeth Crain to Board of Directors – Link

- MARA to allocate 500 BTC to Two Prime in expanded yield strategy – The Block

Financial News

- Riot Doubles Bitcoin-Backed Credit Facility with Coinbase to $200 Million – TheMinerMag

- Cipher Mining Raises $150M to Accelerate Bitcoin Miner Shipments – TheMinerMag

- Sangha Raises $14M for Texas Solar Bitcoin Mining Project – TheMinerMag

- Low Hashprice Forces Bitcoin Miners to Sell Record BTC Ahead of $109k ATH – CoinDesk