Miner Weekly: US Accounts for 40%+ of Bitcoin Hashrate

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

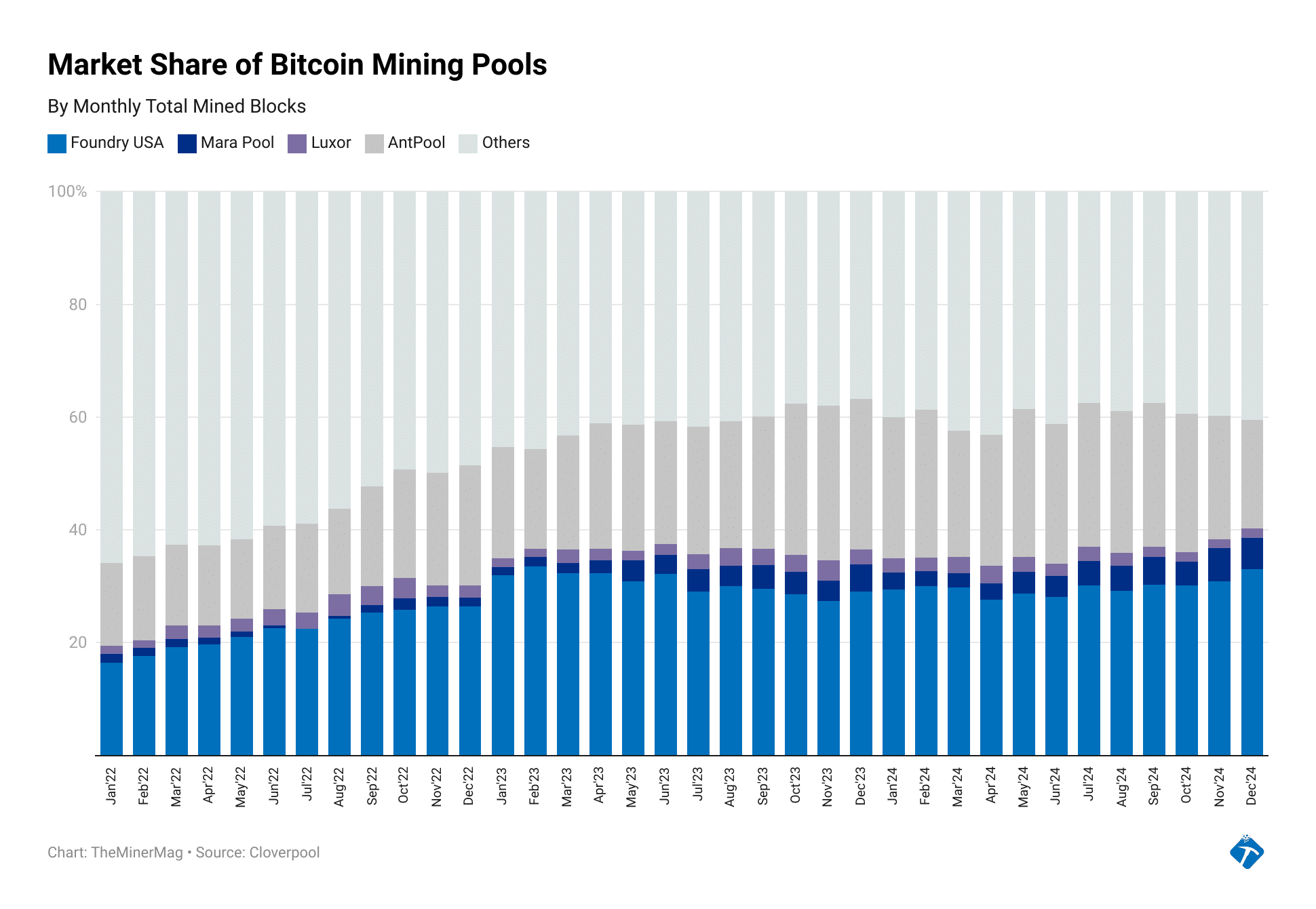

The year 2024 marked a significant turning point for North American bitcoin mining. As described in an October 2023 issue of Miner Weekly, Bitmain-affiliated, Asia-based Antpool had seen a notable surge in hashrate (a measure of bitcoin mining compute-power), posing a challenge to the dominance of the U.S.-based Foundry USA Pool as the largest bitcoin mining pool. However, as 2024 comes to a close, the bitcoin mining landscape has shifted dramatically.

Foundry USA’s hashrate grew exponentially over the year, widening its lead over Antpool by nearly 100%. According to real-time data from Cloverpool (formerly BTC.com), Foundry’s hashrate increased from 157 EH/s at the beginning of the year to approximately 280 EH/s by December 2024. In contrast, Antpool’s growth was more modest, rising from 130 EH/s to just 147 EH/s—well below bitcoin’s overall network hashrate growth of 49%, which surged from 521 EH/s to 778 EH/s during the same period.

By December, two U.S.-based pools—Foundry and MARA Pool—were responsible for 38.5% of all bitcoin blocks mined, up from 32.4% at the start of the year and a mere 18% in January 2022, as shown in the chart above. This percentage doesn’t even account for U.S.-based hashrate connected to smaller pools like Luxor, which mines about 1.5% of bitcoin blocks with 60-80% of its hashrate from U.S. customers. Additionally, there’s the opaque segment of U.S.-based hashrate tied to international pools. For example, Bitmain sold approximately 32 EH/s of U.S.-energized hashrate to a Chinese company in November, potentially contributing another 4% to the U.S.-based total, albeit likely connected to Antpool.

It’s worth noting that some of Foundry’s growth may stem from U.S.-based miners redirecting their hashrate from international pools. Nevertheless, Foundry and MARA Pool posted annual growth rates of 68% and 168%, respectively—outpacing bitcoin’s network growth and underscoring the rapid acceleration of North American bitcoin mining.

This shift marks a significant departure from the past. Not long ago, mainstream media reports were rife with FUD about five Chinese pools controlling more than 50% of Bitcoin’s hashrate. However, since China’s mining ban in 2021, the U.S. has taken the lead in Bitcoin mining. Will we see the media stirring FUD again—this time about the centralization of mining in the U.S.?

Regulation News

- Russia Bans Bitcoin Mining in Regions to Balance Energy Demand – TheMinerMag

Hardware and Infrastructure News

- Bit Digital Eyes $20M HPC Revenue with New AI Client – TheMinerMag

Corporate News

- Foundry Refunds 8.18 BTC in ‘Inadvertent’ Bitcoin Transaction Fees – TheMinerMag

- Rhodium Sold Temple Bitcoin Mine for $40M; co-CEO Departs – TheMinerMag

- Bitcoin Miner HIVE Relocates Head Office to Texas – TheMinerMag

Feature

- The Mining Metrics That Matter With Pennyether – The Mining Pod

- The Best Used ASICs w/ James Scaggs and Will Middleton – The Mining Pod

- Block’s Proto ASIC With Max Guise – The Mining Pod