Miner Weekly: Bitcoin’s Energy Consumption May Plateau by Next Halving

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

2024 has been a landmark year for Bitcoin and bitcoin mining. From the debut of bitcoin ETFs and reaching the $100,000 milestone to the network’s fourth Halving and trends like AI pivots and mining consolidation, it’s been a transformative period.

Looking ahead, 2024 could mark the beginning of a pivotal shift: the energy consumption of bitcoin mining might finally plateau—and potentially begin to decline—by the next Halving, according to a recent report by TheMinerMag and data extrapolation from Coin Metrics and Cambridge University.

Mining Efficiency and Energy Consumption Trends

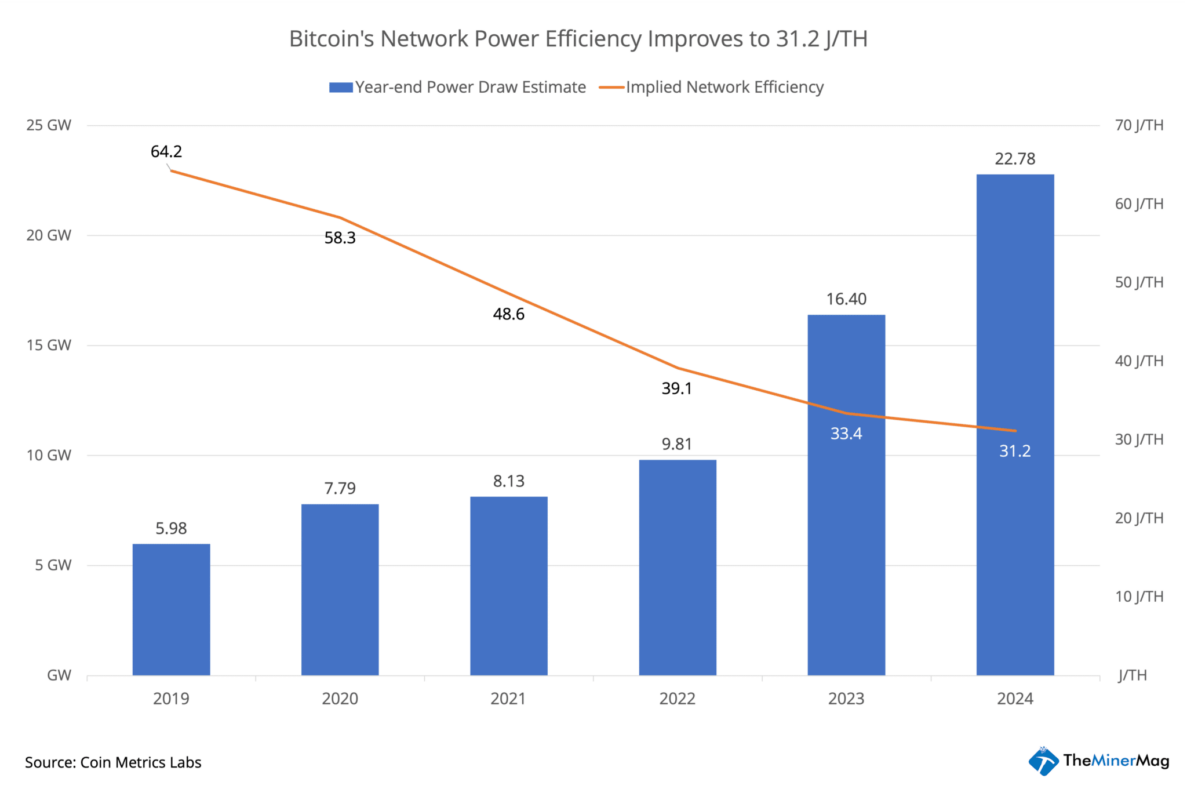

In June 2023, Coin Metrics Lab published a report analyzing nonce patterns to estimate the hardware mix of bitcoin mining. Each generation of mining hardware varies in power efficiency, with newer models offering significant improvements. The study aimed to assess the network’s hardware composition and overall power efficiency to gain insights into bitcoin’s energy consumption.

As of November 2024, the hardware mix estimated by Coin Metrics suggested the network’s power efficiency to be 31.2 J/TH, resulting in a global power draw of about 22.8 GW based on a hashrate of 731 EH/s. For comparison, the Cambridge Bitcoin Electricity Consumption Index (CBECI) estimated a draw of 20.8 GW, suggesting a midpoint of 21.8 GW.

By contrast, in May 2023, when bitcoin’s hashrate was around 350 EH/s, Coin Metrics estimated a network efficiency of 33.7 J/TH with a power draw of 11.8 GW, while CBECI estimated 14 GW, giving a midpoint of 12.9 GW.

What This Means

While the network’s hashrate more than doubled over the past 18 months, its power draw only increased by about 69%. This slower growth in energy consumption reflects the widespread adoption of next-generation, more efficient mining equipment. Efficiency improved from 33.7 J/TH in May 2023 to 31.2 J/TH in November 2024—a seemingly moderate improvement, but significant when considering the gradual market adoption of newer technology.

For context, bitcoin’s network efficiency was 58 J/TH in December 2020, based on the hardware mix estimated by Coin Metrics, despite the launch of Bitmain’s S19 series that same year with an efficiency level of 30 J/TH. It took four years for the S19 series to dominate the network, driving efficiency improvements to current levels.

Looking Ahead: Less Energy-Intensive?

With the ongoing and upcoming deployment of Bitmain’s S21 series and equivalent models by other manufacturers boasting efficiencies of 15 J/TH, bitcoin’s mining efficiency could potentially reach 20 J/TH by 2028. Meanwhile, as previously estimated by TheMinerMag, bitcoin’s network hashrate could reach 1,200 EH/s by the next Halving. If these predictions hold, the network’s power draw could stabilize at approximately 24 GW—despite the rising hashrate.

In short, bitcoin’s energy consumption may, for the first time, plateau—or even decline—during the current Halving epoch, thanks to efficiency gains in mining hardware and bitcoin’s squeezing hashprice driving out inefficient operators in the long haul. This trend could represent a critical turning point in the long-standing debate around bitcoin’s environmental impact.

Regulation News

- Order Lifted Halting Construction of Lonoke County Crypto Mine – Arkansas Money & Politics

Hardware and Infrastructure News

- Compass to Add 25 MW Texas Bitcoin Mine by January – TheMinerMag

- Terawulf Signs 70 MW AI Hosting Lease to Diversify Bitcoin Mining – TheMinerMag

- HIVE Invests $30M in GPUs Eying HPC Growth – TheMinerMag

Corporate News

- Phoenix Explores Nasdaq Listing with New CEO – TheMinerMag

- US Plans to Blacklist Bitmain Affiliate Sophgo over TSMC Chip Found in Huawei Processor – Reuters

- Oilfield services giant Halliburton invests in Bitcoin miner 360 Energy – Blockspace Media

- Cango CEO Sold 1.5M Shares, Receiving $10M after Mining Pivot Sparked Stock Rally – Link

Financial News

- The best and worst performing crypto stocks of 2024: MicroStrategy, Core Scientific lead the way – The Block

Feature

- Cango, Halliburton’s Bitcoin Mining Play, Rhodium Lawsuit, and Strategic BTC Reserve – The Mining Pod

- A Strategic BTC Reserve With Pierre Rochard – The Mining Pod