Bitcoin Miner Phoenix Explores Nasdaq Listing with New CEO

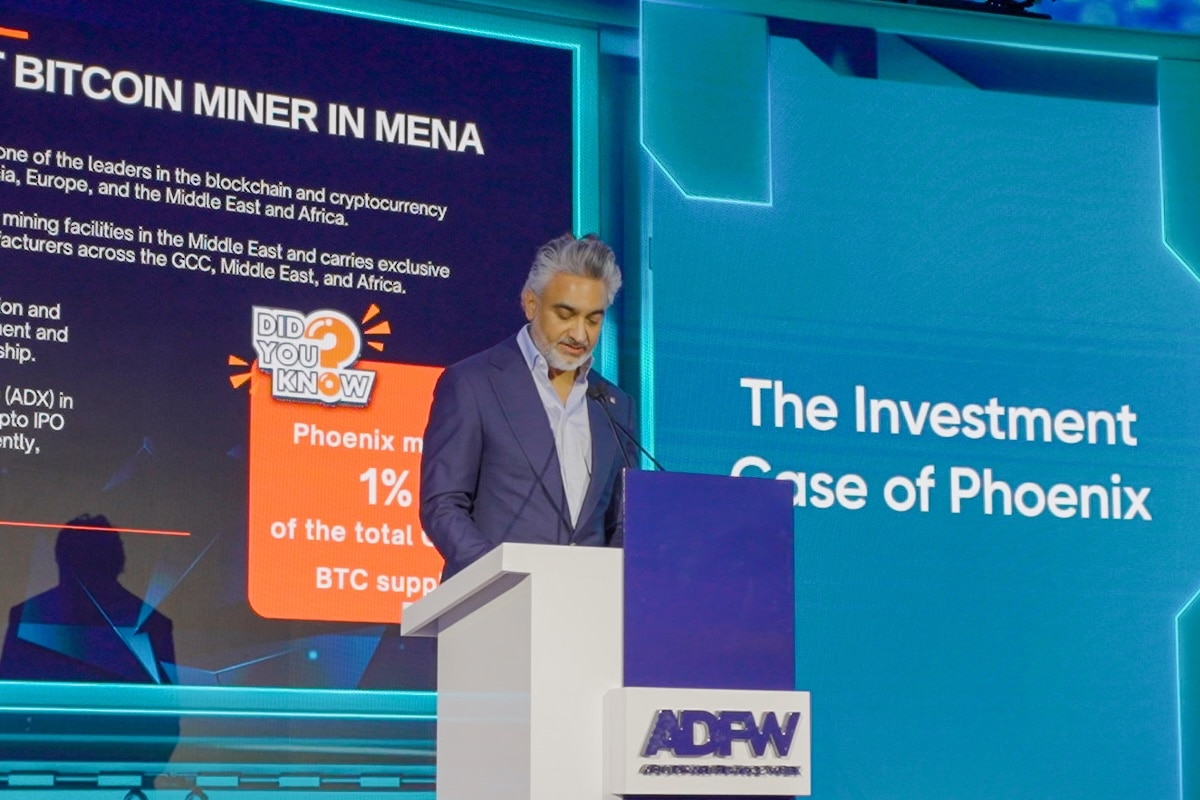

UAE-based Bitcoin mining, hosting, and hardware brokerage firm, Phoenix Group, has announced its plans to explore dual listing opportunities, including a potential Nasdaq listing in 2025, alongside the appointment of a new CEO.

In a statement released on Friday, Phoenix confirmed that Munaf Ali, currently serving as co-founder and group managing director, has been appointed as CEO. Ali succeeds fellow co-founder and outgoing CEO, Seyed Mohammad Alizadehfard (Bijan), who will step down to focus on his investment fund, Cypher Capital.

Earlier this year, Phoenix garnered attention in the Bitcoin mining industry following its initial public offering on the Abu Dhabi Stock Exchange, achieving a market capitalization of approximately $1.9 billion at the time.

The company revealed that it is already collaborating with investment banks and cryptocurrency advisors to evaluate potential dual listing opportunities in international markets for 2025.

“Looking ahead, we are exploring dual listing opportunities, including on Nasdaq in 2025, as we continue to expand our global presence,” said Munaf Ali.

Phoenix reported $36 million in revenue for the third quarter of 2024, with $26.6 million generated from proprietary mining operations and $6.1 million from hosting services. Sales of ASIC miners, cryptocurrency wallets, and related equipment contributed an additional $2.7 million.

According to its Q3 presentation deck, Phoenix boasted 6.9 EH/s of proprietary hashrate, 1.1 EH/s of hosting capacity, and 0.675 EH/s through its share of investments in ventures operating with 4.1 EH/s of capacity. The firm reported a blended energy cost of $0.057/kWh and a total power usage of 375 megawatts, reflecting a mining efficiency of 32 J/TH.