Miner Weekly: A $400M Bitcoin Mining Pivot and 290% Rally

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

If you’ve been regularly reading the Miner Weekly newsletters, you may recall a story from October 2023, which discussed the significant influx of Antminer S19XPs imported by Bitmain to its U.S. subsidiary, Bitmain Technologies Georgia Limited, in 2023.

Earlier this year, Bitmain ramped up its imports once again in anticipation of the bitcoin halving. According to TheMinerMag’s analysis of shipment records, Bitmain Georgia imported roughly 50 EH/s of S19XP units between July 2023 and March 2024. These imports coincided with an increase in hashrate connected to Antpool at the time, leading to speculation that Bitmain energized its inventory during a period of weak demand for mining hardware, particularly for the second-newest generation miners.

So, why is this context important now? In a surprising move last month, Bitmain Technologies Georgia and Bitmain Development Limited sold 32 EH/s of deployed Bitcoin miners to Cango, a Chinese automotive services company listed on the NYSE, for $256 million in cash. Bitmain will continue to operate the miners, meaning Cango will effectively run an asset-light mining model.

Additionally, Cango agreed to purchase another 18 EH/s of on-rack bitcoin miners from Golden TechGen—a company owned by Max Hua, Bitmain’s former CFO—and other entities, valued at $144 million in stock. The exact timing and reasons for Hua’s departure from Bitmain remain unclear, although his most recent appearance as Bitmain’s CFO was during a speech at the WDMS event in September 2023.

This deal resembles the typical bitcoin mining pivot we’ve seen during previous bull cycles, such as Bioptix/Riot Blockchain and Marathon Patent Group in 2017, or 500.com/BIT Mining and CleanSpark in 2020. However, Bitmain’s involvement in Cango’s case adds another layer of intricacy.

While Cango has not specified which hardware models were purchased, TheMinerMag suggested that it was the S19XP series, and Blockspace Media reported that Cango’s initial fleet consisted entirely of S19XPs. Is Cango buying the S19XP inventory that Bitmain imported to the U.S. since 2023? Are these miners new or used? We don’t know for sure, but this transaction marks the first indication that Bitmain had been operating over 30 EH/s of miners prior to the sale, possibly even before the halving. If true, this means Bitmain could have been both the largest miner seller and operator for some time!

Bitmain and Cango redacted key details of their colocation service agreement, so the hosting fees Cango will pay remain undisclosed. However, based on bitcoin’s current hashprice of $63/PH/s, an S19XP miner has a revenue per kilowatt-hour (kWh) of $0.12 to $0.13. Interestingly, Bitmain advertises a hosting offering for the S19XP Hydro model in the U.S. with a default hosting fee of $0.1/KWh.

It’s unclear why Cango would make such a large investment in the second-newest generation miners while not owning the data center infrastructure. On November 4, Cango’s management hosted an earnings call to discuss its third-quarter results but did not hint at any revenue growth plans outside its existing business. Yet two days later, on November 6, the company announced plans to purchase $400 million worth of bitcoin miners—an investment larger than its market capitalization.

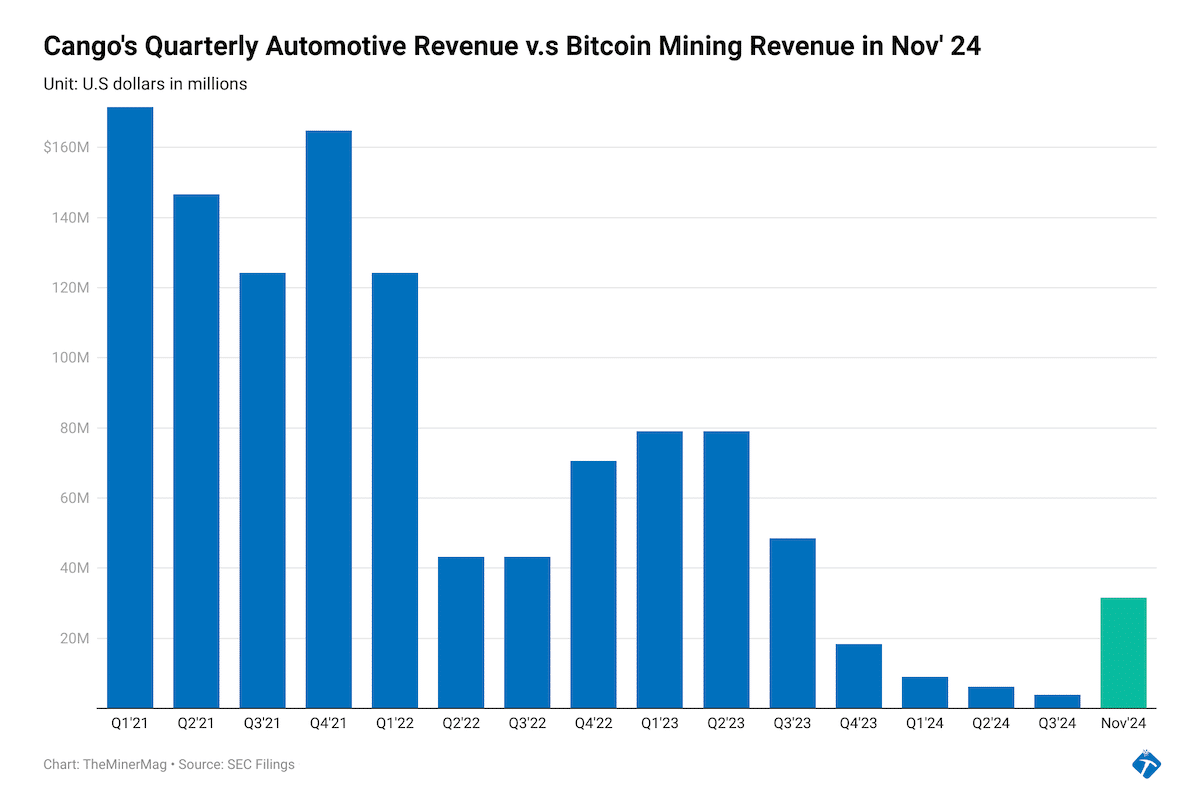

What is clear, however, is that Cango’s core business has significantly declined and the pivot into mining sparked a 290% stock rally. In November, Cango mined 363.9 BTC, a figure that far exceeded its third-quarter revenue from its traditional automotive services business. It will be interesting to watch how Cango reports its fourth-quarter earnings, especially concerning the cost of mining revenue. That would give us more clues on how much Bitmain is charging on the hosting front.

Founded in 2010, Cango originally facilitated automotive loans and insurance for lower-tier cities in China. The company went public on the NYSE in 2018 at an IPO price of $10.83 per share, with a market cap of $1.3 billion. However, in recent years, Cango has struggled to pivot to a car dealership platform alongside its loan business. The company’s 52-week low reached $0.96, but it surged 290% in mid-November following its mining pivot announcement. The first move after the pivot? Two board directors of Cango, one of them being the CEO, are selling $2 million worth of the company’s shares.

Regulation News

- Order Lifted Halting Construction of Lonoke County Crypto Mine – Arkansas Money & Politics

Hardware and Infrastructure News

- Canaan sells 2,000 Avalon A15 HydU Bitcoin miners AGM Holdings – Link

- Bitcoin Hits New Records – So Does Mining Difficulty – TheMinerMag

- Cango Acquires 32 EH/s Deployed Bitcoin Miners from Bitmain in $256M Mining Pivot – TheMinerMag

Corporate News

- Texas Lawyer, Client Sued for $10 Million Over Bitcoin Mining Deal – Law.com

- Ionic Digital Appoints Anthony McKiernan as Interim Chief Executive Officer – Link

- Investors Sue Rhodium Executives over Alleged Bitcoin Mining Fraud – TheMinerMag

- Hut 8 Acquires 990 Bitcoin, Pushing Reserves Over 10,000 BTC – TheMinerMag

Financial News

- Riot Platforms stock jumps 10% after activist firm Starboard takes a stake in the bitcoin miner – Business Insider

- CleanSpark the Latest Bitcoin Mining Hodler to Raise $650M in 0% Bonds – TheMinerMag

- Cango Directors Sell $2M in Shares After Bitcoin Pivot Sparks Rally – TheMinerMag

Feature

- Hut 8, Crusoe’s $600M, DCG’s Fortitude, Riot’s HODL and Coinbase’s PNUT – The Mining Pod

- CleanSpark’s $650M Convert Deal – The Mining Pod