Investors Sue Rhodium Executives over Alleged Bitcoin Mining Fraud

A group of investors who loaned $33 million to Rhodium in 2021 is suing executives of the now-bankrupt Bitcoin mining firm, alleging fraud and “a scheme of deception and brazen self-dealing.”

According to a legal petition filed Thursday in Tarrant County, Texas, 14 investors have brought a suit against Nathan Nichols, Chase Blackmon, Cameron Blackmon, Nicholas Cerasuolo, and Imperium Investments Holdings, a controlling shareholder in the company. The four individuals served as Rhodium’s co-CEOs, CTO, and CFO, respectively.

The lawsuit sheds new light on the rise and collapse of a Bitcoin mining venture that once sought a $1.7 billion initial public offering (IPO) but later filed for bankruptcy amid the cryptocurrency bear market.

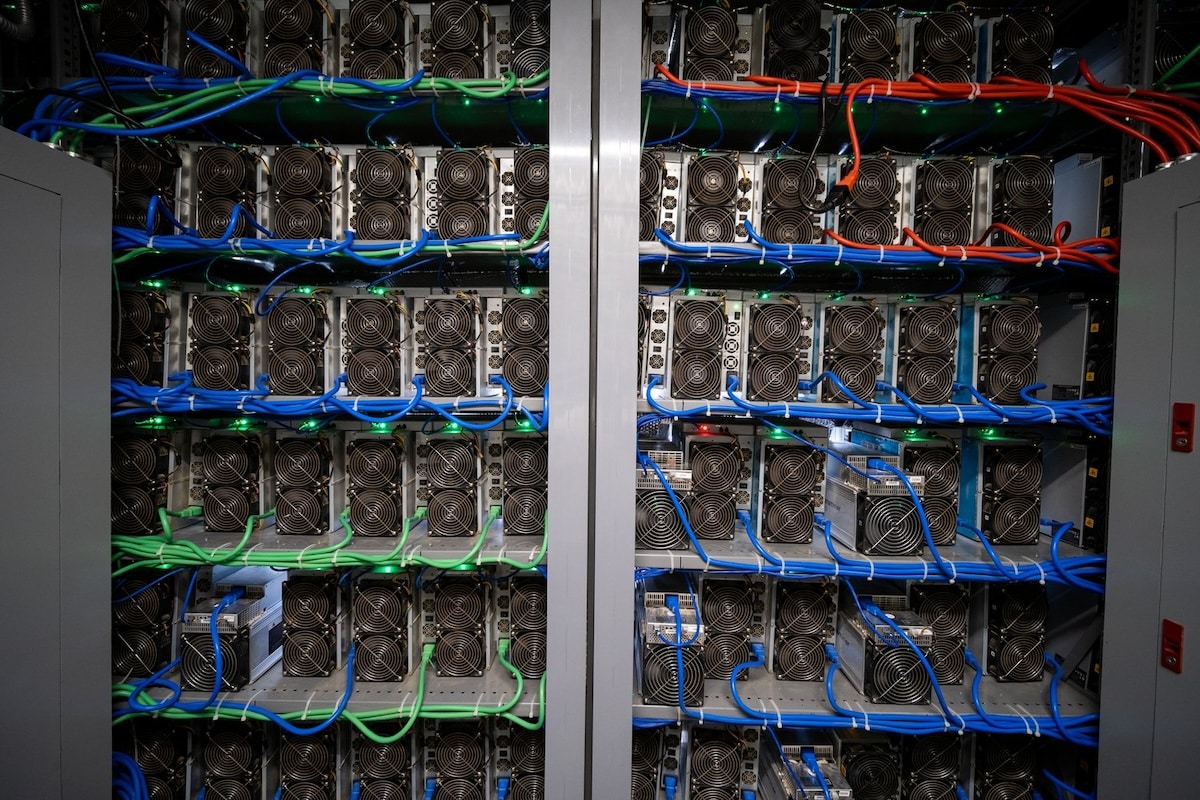

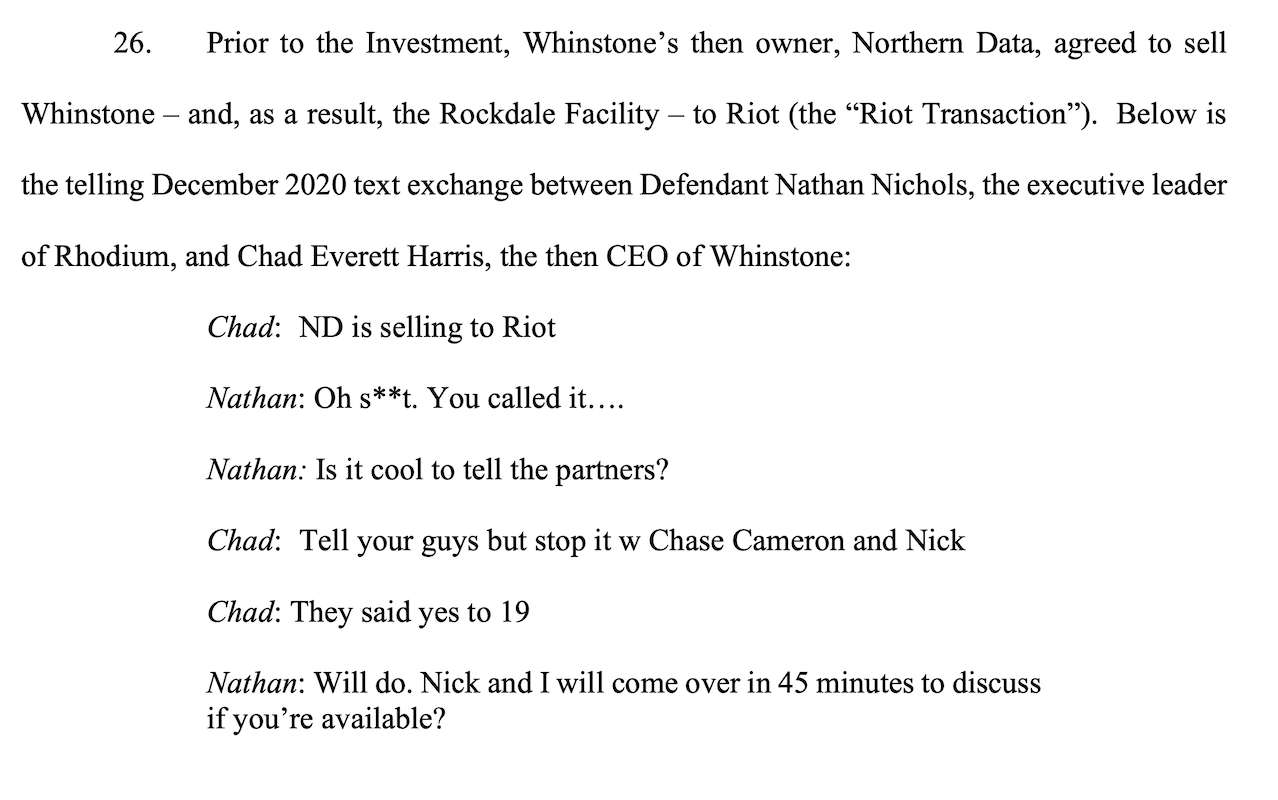

The plaintiffs claim Rhodium executives “intentionally concealed” material information during fundraising efforts, specifically their knowledge of Riot’s acquisition of Whinstone U.S., a Texas colocation facility. The plaintiffs argue that this information, which they say executives were aware of as early as December 2020, would have materially impacted their decision to invest in Rhodium in February 2021.

The investors claimed they did not know about Riot’s acquisition of Whinstone until April 2021 when Riot announced the news to expand its proprietary mining operations. At the time, Whinstone was purely a colocation provider, hosting customers like Rhodium. Riot’s purchase meant Whinstone would become both host and competitor to Rhodium and other colocation clients.

“Frankly, it is hard to imagine a more material disclosure event and had Defendants disclosed this critical information, as they were required by law, Plaintiffs would not have invested in the first place,” the complaint reads.

The plaintiffs further allege that Rhodium executives knew Riot’s acquisition could negatively impact Rhodium’s business. Internal communications cited in the lawsuit show Nichols expressing concerns to Whinstone’s then-CEO, Chad Harris. Nichols warned the acquisition could “open a Pandora’s box of possibilities,” “complicate things for [Rhodium’s] growth trajectory,” and create “less control than [they had] now.”

The investors went as far as to state that “the wildly dysfunctional and adversarial relationship between Rhodium and Riot (which includes shutdowns led by Riot’s armed security) is one of, if not the, key reasons behind Rhodium’s bankruptcy filing and substantial harm to Plaintiffs.”

Despite these internal concerns, the plaintiffs claim Rhodium executives falsely reassured them after Riot’s acquisition, asserting that the partnership between Rhodium and Whinstone had “never been stronger” and that Rhodium’s expansion at Whinstone’s Rockdale facility was “100% a go.”

The investors alleged these statements were part of a broader effort to convince them to convert some of their bonds into equity in preparation for an IPO.

The plaintiffs alleged that, however, by late April 2021, Nicholas already admitted to Winstone’s CEO that the economics of Rhodium’s expansion at Whinstone’s Rockdale facility was “unsustainable.” Nicholas allegedly told Chad: “I need it to make economic sense to build here, and $550k/megawatt is not that.”

The lawsuit also accuses Rhodium executives of enriching themselves by embezzling corporate funds and exaggerating the company’s prospects. The investors claim these actions ultimately led to Rhodium defaulting on its loans.

In early 2022, Rhodium abruptly canceled its $100 million IPO just one day before its planned listing. A subsequent attempt to go public via a SPAC merger failed in late 2023. The company filed for bankruptcy protection earlier this year after failing to repay loans due by August 30.