CleanSpark the Latest Bitcoin Mining Hodler to Raise $550M in 0% Bonds

CleanSpark, the second-largest public Bitcoin mining firm by realized hashrate, has joined the growing trend of issuing convertible notes, following similar moves by major competitors.

On Thursday, CleanSpark announced plans to raise $550 million through convertible bonds due in 2030, with an option for initial purchasers to add another $100 million. In a release on Friday, the company announced the pricing of the 0% convertible notes with a 20% conversion premium from the company stock’s closing price as of Dec. 12.

CleanSpark stated that it expects the net proceeds to total $536 million, or $633.6 million if the initial purchasers exercise their option. Of this amount, $76.5 million will be allocated to cover the costs of capped call transactions, a hedging strategy to protect against future equity dilution. Additionally, the company plans to use $145 million to buy back shares from investors of the convertible notes.

The remaining proceeds will be used to fully repay the outstanding line of credit owed to Coinbase and to fund other capital and operational expenses. As of Sep. 30, CleanSpark had $50 million in loans payable to Coinbase. According to the company’s November production update, 803 BTC of its Bitcoin reserves had been pledged as collateral for the loan.

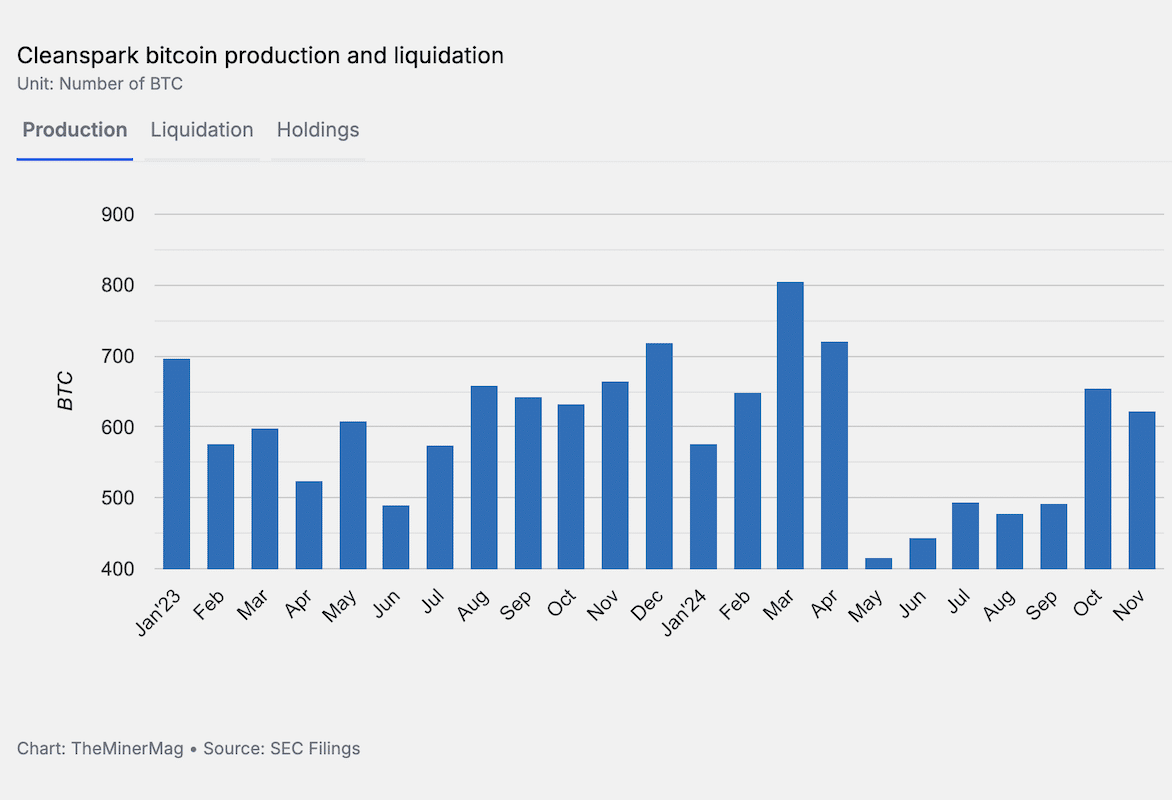

Unlike its pure-play Bitcoin mining competitors MARA and Riot, CleanSpark has not indicated plans to use the proceeds to purchase additional Bitcoin. In fact, CleanSpark liquidated 4.2% of its mined Bitcoin in November after holding more than 99% of its monthly Bitcoin production since January.

The remaining proceeds will be used to fully repay its outstanding line of credit with Coinbase and to cover other capital and operational expenses. As of September 30, CleanSpark reported $50 million in loans payable to Coinbase, with 803 BTC of its Bitcoin reserves pledged as collateral for the loan.

CleanSpark retained its position as the second-largest Bitcoin mining firm by production in November, surpassing Hut 8 in Bitcoin holdings for the first time. CleanSpark’s stock dropped 3.9% on Thursday and dropped further by 3.8% during pre-market trading on Friday.