Miner Weekly: $30bn Opportunity for Bitcoin ASIC Makers

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

After Bitcoin surged past the $100,000 milestone last week, the network’s hashprice rebounded to $60/PH/s, offering miners a much-needed breather. However, despite Bitcoin’s all-time highs, the hashprice remains well below its pre-halving levels.

According to the latest research by TheMinerMag, Bitcoin’s hashprice may not surpass its pre-halving levels, even in the anticipated bull run next year.

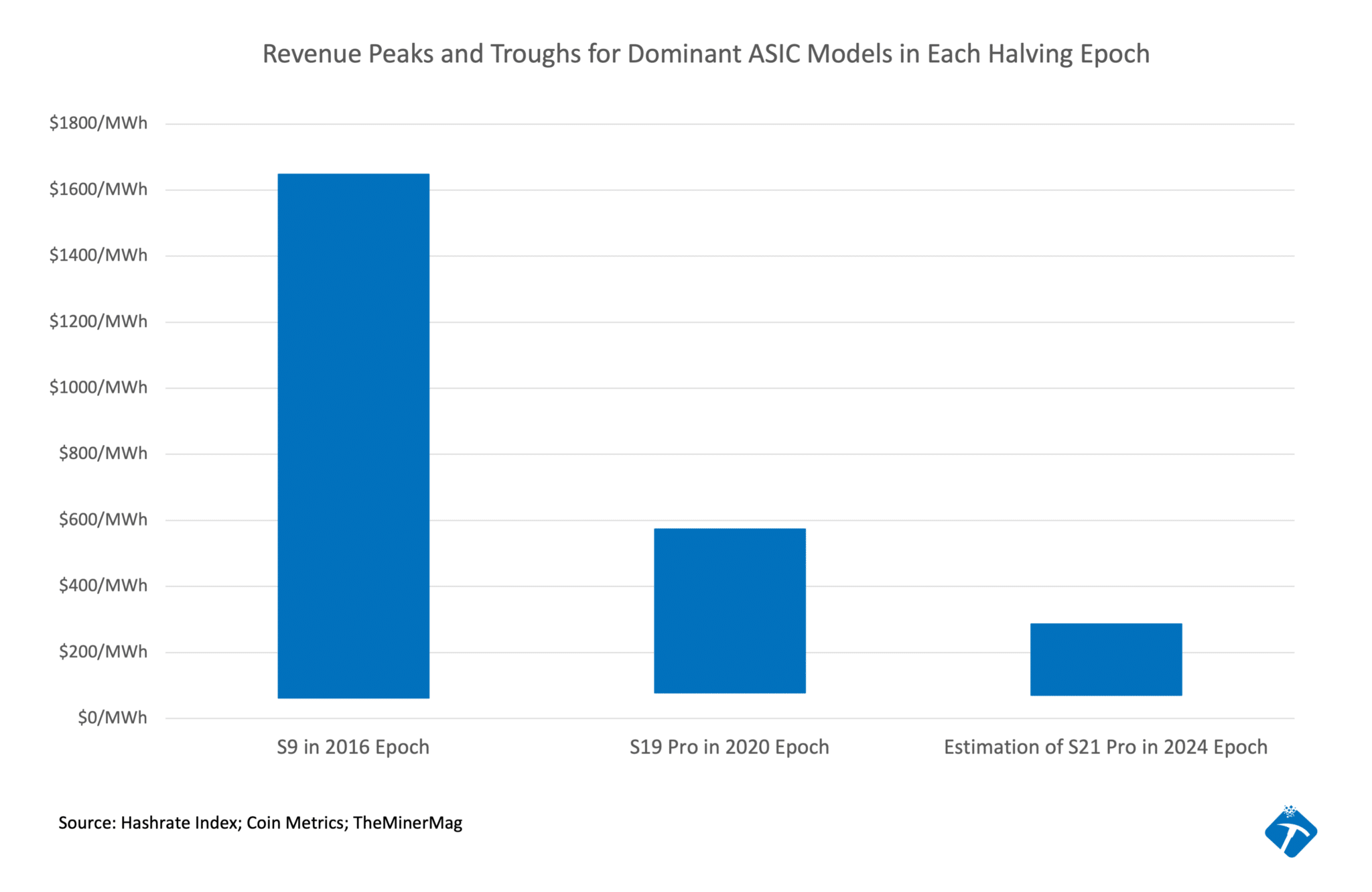

A key takeaway from the report highlights that revenue peaks for dominant miners in each halving epoch—measured in dollars per megawatt-hour—have been steadily declining, almost in proportion to improvements in power efficiency. For example, the revenue peak of the S19 Pro in 2021 was just one-third of the S9’s revenue peak in 2017, mirroring that the S19 Pro is three times more power-efficient than the S9. Quite a coincidence!

Conversely, revenue troughs across mining hardware generations have shown much greater alignment. This trend offers a framework for estimating the revenue peak and trough for the S21 Pro during the 2024 halving epoch (2024–2028), as shown in the chart above.

The revenue projection for the S21 Pro suggests that Bitcoin’s hashprice could peak at around $105/PH/s in 2025, decline to a low of $25/PH/s in the following year, and recover to roughly $50/PH/s by the next halving. Assuming Bitcoin’s cyclical price patterns persist, this outlook further anticipates a net increase of 300 EH/s in Bitcoin’s network hashrate, valued at approximately $18.6 billion, over the next two years. Additionally, an opportunity exists to replace 600 EH/s of older-generation equipment with newer ASIC miners worth $10.8 billion after the market hits the bottom in 2026. Combined, this represents an almost $30 billion market opportunity for ASIC manufacturers.

Regardless of these numbers, the competitive dynamics in the ASIC market—driven by established hardware players and new entrants—will be interesting to watch. Over the past week, MicroBT has launched new WhatsMiner models with a 15.5 J/TH efficiency to match Bitmain’s S21 Pro while Bitmain has set up production lines in the U.S. amid concerns of tariff hikes.

But ultimately, how much of this potential hashrate can be energized will depend on the successful buildout of global energy capacity for Bitcoin mining. This growth must compete with increasing demand from AI and high-performance computing (HPC) data centers, which are also vying for power resources and have more margin room to outspend Bitcoin miners.

Hardware and Infrastructure News

- Review: WhatsMiner M6XS++ Targets 15.5 J/TH Efficiency – TheMinerMag

- Luxor Buys $93.2M of WhatsMiners for Bitcoin ASIC Trading – TheMinerMag

- BitFuFu Signs 10-Year Lease for Two Mining Facilities with 33 MW Capacity in the U.S. – Link

Corporate News

- Benchmark sees even more upside in Bitdeer’s stock after share price quadruples – The Block

- Bitmain Sets Up US Bitcoin Miner Production Amid Tariff FUD – TheMinerMag

- Bitcoin Mining Giant MARA Buys 11,774 BTC for $1.1 Billion – TheMinerMag

- Wyoming Bitcoin Company Gets $4.1 Million In Chinese Crypto Mine Settlement – Cowboy State Daily

- DCG creates new company, Fortitude, from Foundry’s self-mining business – Blockspace Media

Financial News

- Riot Plans $500M Convertible Notes to Acquire Bitcoin – TheMinerMag

- Arkon Energy’s Nscale Raises $155 Million in Funding to Power AI Cloud Roll-out – Datacenter Dynamics

Feature

- Foundry Layoffs, $5 Billion In Raises and MARA’s Windfarm Purchase – The Mining Pod

- Monetizing Energy, From Mining To AI – The Mining Pod

- AI Giants Outspend Crypto Firms on Powering Data Centers – Bloomberg