Miner Weekly: $5 Billion of Debt for Bitcoin Miners

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

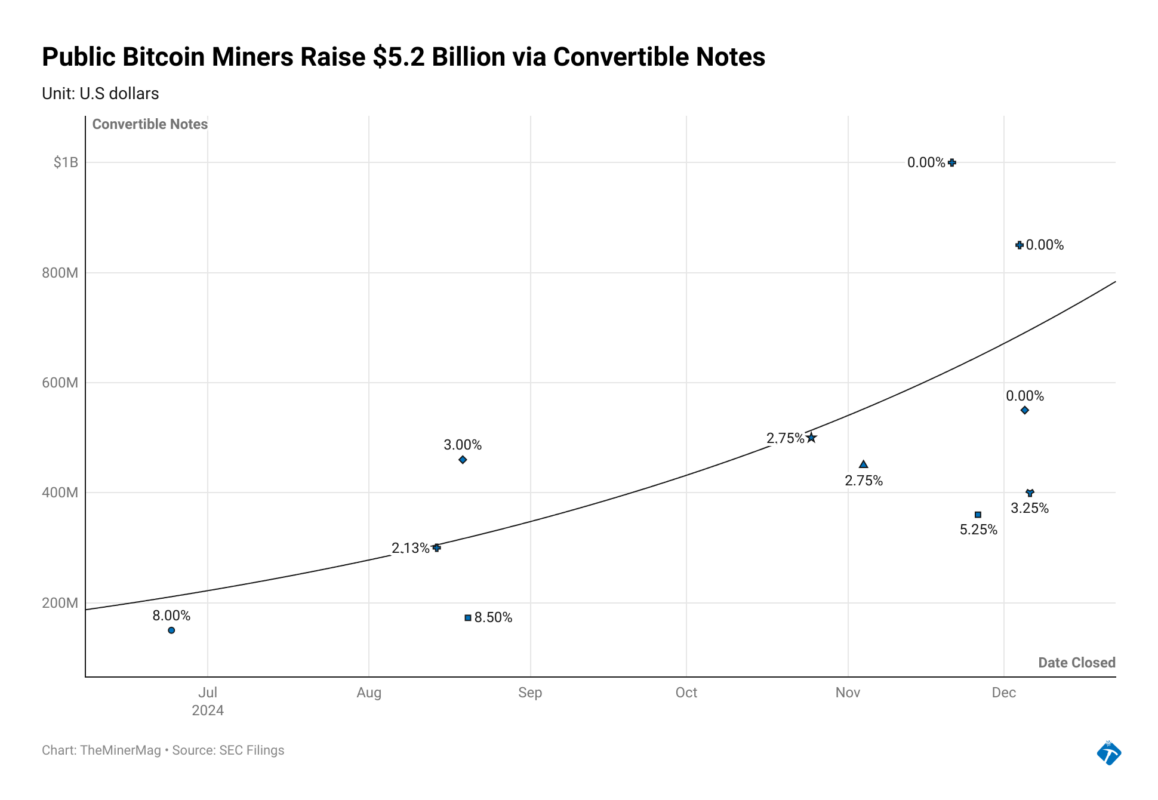

This week in Bitcoin mining has been marked by a wave of convertible note issuances. MARA raised an additional $850 million, continuing its MicroStrategy-inspired strategy of stockpiling Bitcoin. Core Scientific secured $550 million, while IREN increased its offering from initially $300 million to $400 million.

In fact, seven publicly traded bitcoin mining and data center companies have raised a combined $5.2 billion via convertible notes since June. Of this total, 70% (or $3.6 billion) has been raised in just the past four weeks.

What Are Convertible Notes?

For those unfamiliar, convertible notes are a hybrid debt instrument that allows companies to raise funds by issuing debt that can later be converted into equity under specific conditions. Typically, these notes:

- Pay interest regularly to investors as part of the debt structure.

- Include criteria for debt-to-equity conversion, allowing investors to benefit from a company’s stock appreciation.

Here’s how it works: If a company’s stock surpasses the conversion threshold—for example, a conversion price of $20—and trades at $25, investors can opt to convert their principal debt into equity at the $20/share rate, capturing the upside.

Bet on the Future

What’s notable is that MARA and Core Scientific have raised over $2.4 billion—including $1.85 billion by MARA alone—via zero-coupon convertible notes in recent weeks. Both companies set their conversion prices approximately 40% above their average stock prices at issuance.

Effectively, investors are forgoing interest payments (zero-coupon) and instead betting on the companies’ stock prices rising by 40% or more from current levels, provided that other conversion conditions are met.

This suggests that investors subscribing to these zero-coupon notes are confident that both MARA and Core Scientific are poised for further stock rallies and that their stocks will continue to be volatile enough for arbitrage opportunities.

MARA ($8 billion) and Core Scientific ($4.6 billion) are currently the two largest publicly traded bitcoin mining companies by market capitalization. Both operate significant bitcoin mining fleets, but their business strategies differ sharply:

- MARA retains all bitcoin it mines each month. It is leveraging convertible notes to cover operating expenses and acquire additional bitcoin from the market.

- Core Scientific, on the other hand, has diversified into high-performance computing and AI hosting. It now holds none of its mined bitcoin, marking a shift away from its prior “hodl” approach.

Core Scientific was once a 100% bitcoin hodler, holding all its mined Bitcoin in 2021. At its peak, it emerged as the largest public bitcoin mining company, but the dynamics of convertible notes played a pivotal role in its downfall.

Back in the summer of 2021, Core issued $500 million in convertible notes with a 10% interest rate. This high interest burden significantly strained the company’s finances during the bear market and ultimately contributed to its bankruptcy protection filing in late 2022. After emerging from bankruptcy protection in early 2024, Core’s stock has rallied by 377% amid its diversification into HPC and AI.

It remains to be seen how MARA’s aggressive bitcoin acquisition strategy and Core’s diversification into AI hosting will play out, but the shift in the debt market dynamics over the four-year cycle towards both pure-play and mullet miners has been anything but boring.

Regulation News

- Smoke reveals covert cryptocurrency mine in basement of university law department – TVP World

Hardware and Infrastructure News

- HIVE Buys 4.3 EH/s of S21+ Hydro Bitcoin Miners for $60M – TheMinerMag

- MARA Buys Texas Wind Farm as AI Crowds Out Crypto – Bloomberg

- BIT Mining Acquires 51 MW Ethiopia Bitcoin Mine for $14 Million – TheMinerMag

- Ionic Ends Hut 8’s Management of 302 MW Bitcoin Mines – TheMinerMag

Corporate News

- MARA Pool Mines Record Bitcoin Since January – TheMinerMag

- Bitcoin mining pool Foundry lays off 27% of workforce – Blockspace

- Bitcoin miner Hut 8 argues to toss ‘short and distort’ shareholder suit – CoinTelegraph

- Greenidge Sells South Carolina Property for $12M and 8% Stake in Future Profits – TheMinerMag

Financial News

- Core, MARA Propose $1.2B in Convertible Notes Issuance – TheMinerMag

- MARA Set to Raise Another $1 Billion to Buy Bitcoin – TheMinerMag

- Argo Raised £4.2 million via Subscription by Institution – Link

Feature

- Bitmain’s Border Dispute, Trump’s Tariffs, ERCOT’s Mining Registration and Hosting Market Check In – The Mining Pod

- Block’s New ASIC Miner With Core Scientific and Proto – The Mining Pod