Core, MARA Propose $1.2B in Convertible Notes Issuance

Bitcoin mining firms Core Scientific and MARA are intensifying their reliance on convertible notes, albeit with markedly different business strategies.

MARA announced its proposal to issue zero-coupon convertible notes totaling $700 million in principal, due in 2031. Additionally, initial purchasers will have the option to increase the offering by $105 million.

The company plans to use up to $50 million of the net proceeds to repurchase a portion of its existing convertible notes due in 2026, originally issued in late 2021. The remaining proceeds will fund Bitcoin acquisitions and general corporate purposes.

This latest offering follows MARA’s recent $1 billion raise via zero-coupon convertible notes due in 2030. Over $600 million of that amount has already been allocated for Bitcoin purchases, mirroring the strategy employed by MicroStrategy.

As of November 30, MARA held 34,959 BTC on its balance sheet. In November alone, the company mined 907 BTC and purchased an additional 6,474 BTC from the market.

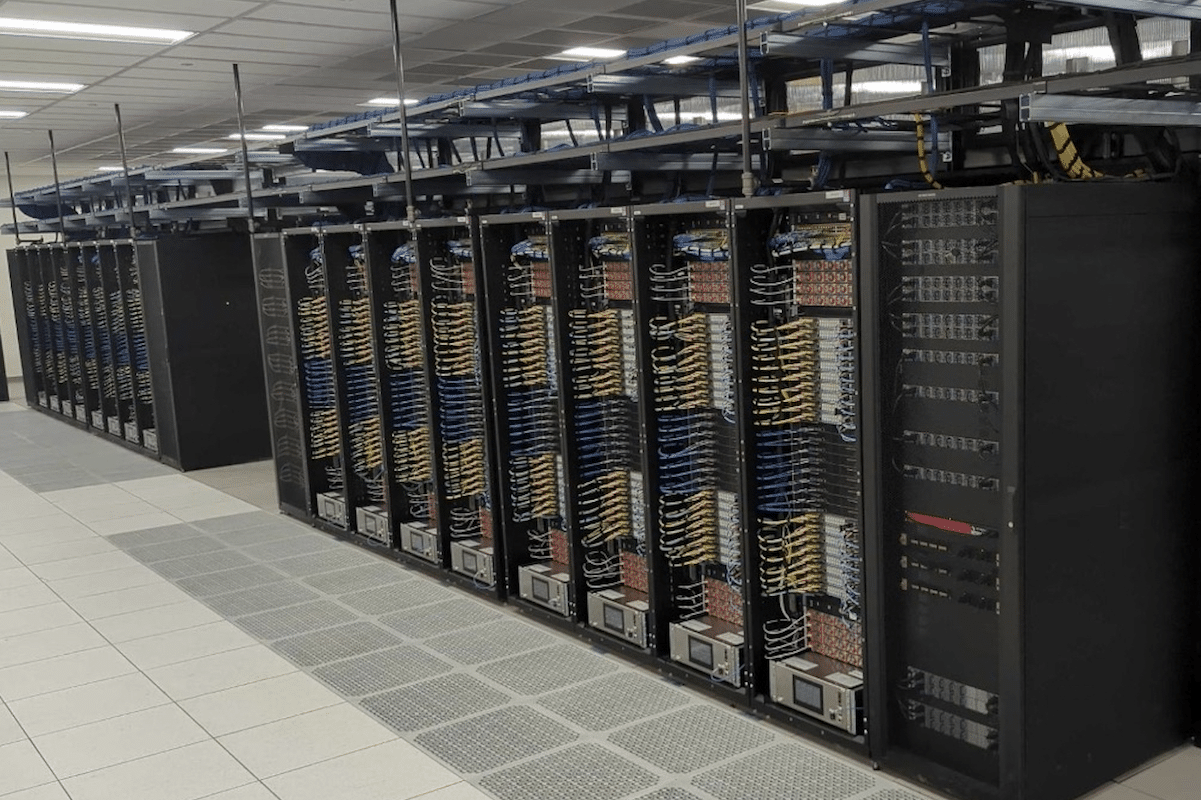

Meanwhile, Core Scientific revealed plans on Monday to issue $500 million in convertible notes, with an option for initial buyers to increase the offering by $75 million. Unlike MARA’s Bitcoin-focused approach, Core Scientific does not retain any of its mined Bitcoin. Instead, the company has been heavily investing in scaling its data center capacities to support high-performance computing and hosting services.

Core Scientific stated that the net proceeds from the offering would be used for general corporate purposes, including working capital, operating expenses, capital expenditures, acquisitions of complementary businesses, or repurchasing its securities.

In the third quarter of this year, public mining companies have shifted away from equity financing, opting instead for increased leverage as the broader market shows signs of recovery.