Miner Weekly: Make Bitcoin Mining Profitable Again

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitcoin’s recent price rally has driven up hashprice—a measure of daily mining revenue per unit of computing power—to over $58 per petahash per second ($/PH/s), marking its highest level in five months.

In their Q3 earnings reports, ten public mining companies provided updates on their performance, revealing the impact of the first full quarter after Bitcoin’s halving.

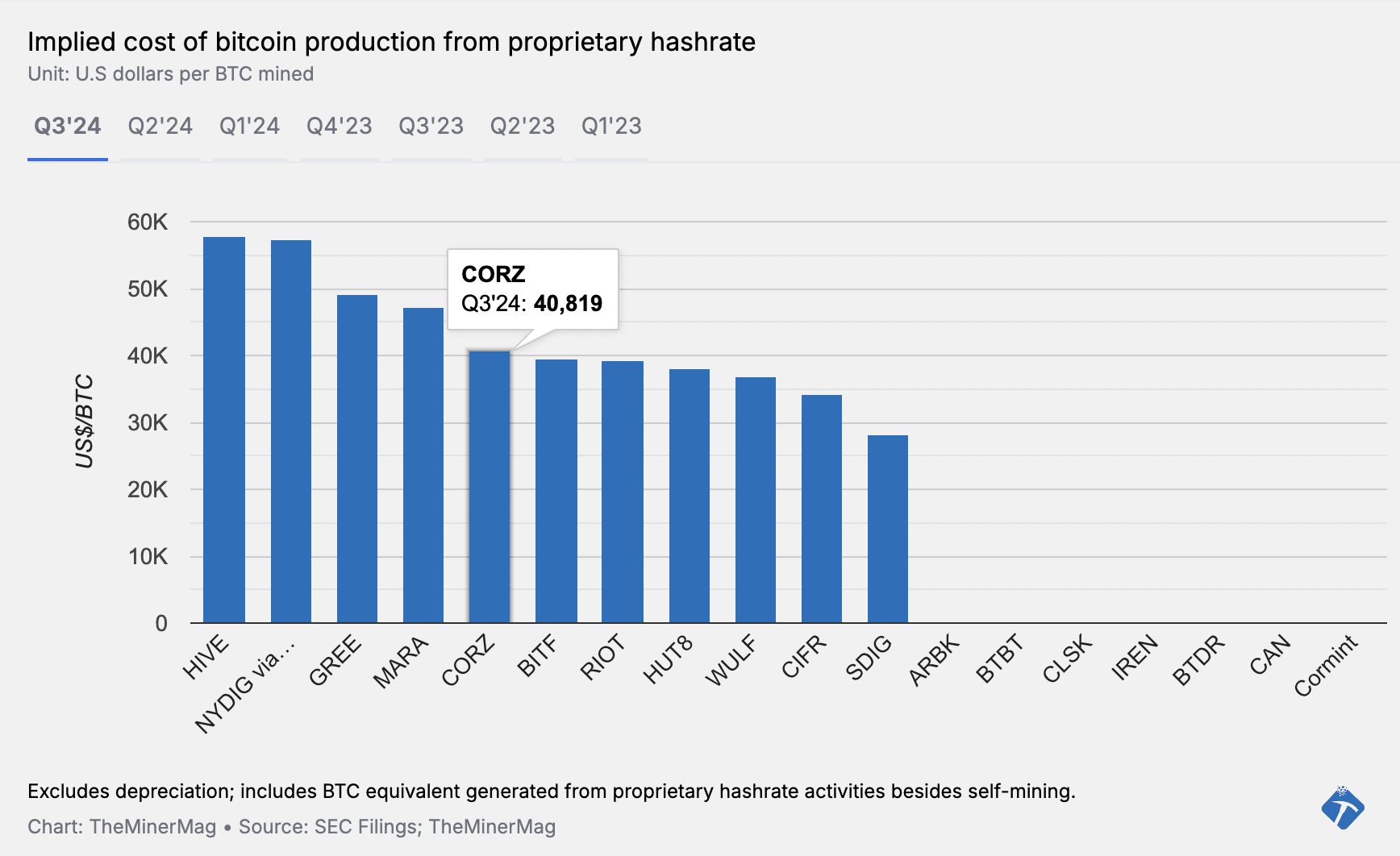

As expected, the cost of Bitcoin production (covering expenses like power, hosting, and site costs, divided by the total Bitcoin mined) rose in Q3. This increase is due to both the halving’s reduced block rewards and rising network difficulty. According to TheMinerMag’s latest data, the median production cost for 11 major mining companies jumped to $40,000 per Bitcoin in Q3, up from $35,000 in Q2.

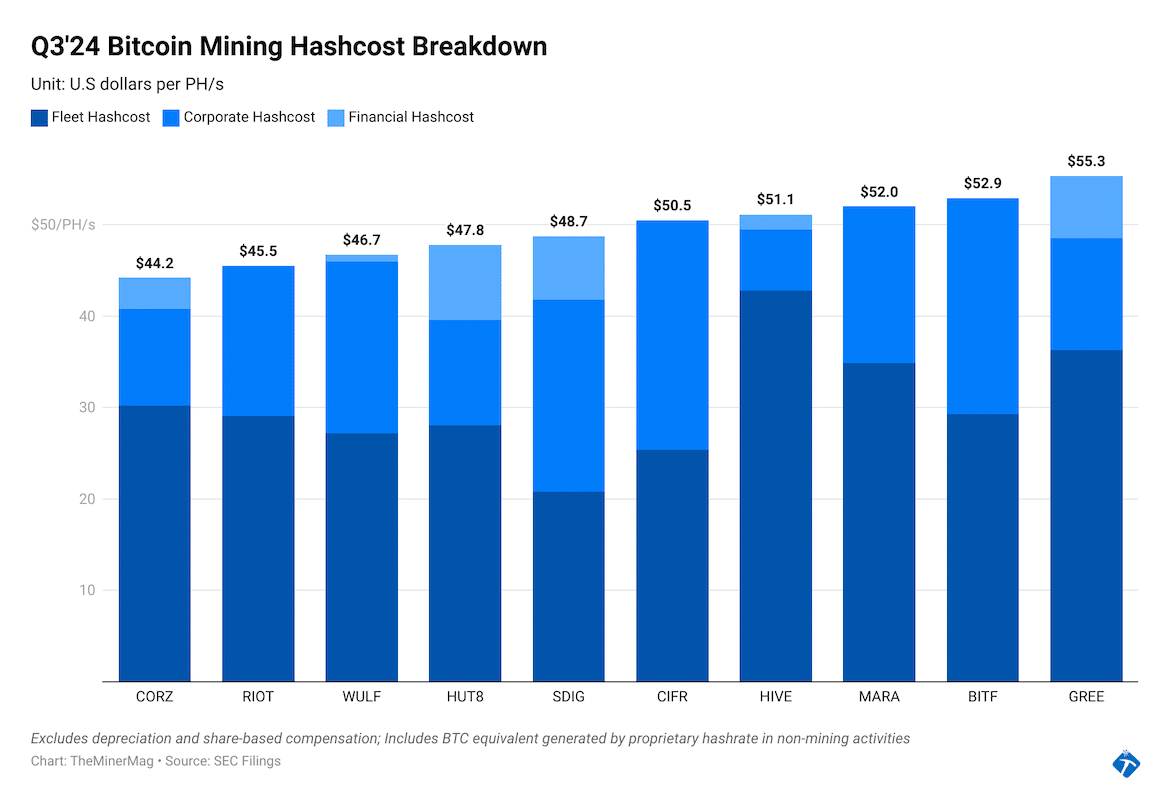

However, the cost of Bitcoin production only tells part of the story. To adjust for fluctuations in Bitcoin’s network hashrate and block rewards, TheMinerMag uses the Fleet Hashcost metric, which reflects a company’s power and hosting costs plus site expenses divided by its realized hashrate in a quarter.

Many of the 11 companies managed to reduce their fleet hashcosts in Q3 or kept them steady thanks to continuous fleet upgrades. Check out this live chart and toggle between quarters.

Since the fleet hashcost metric isolates the impact of hashrate fluctuations, Q3 data offers a reliable snapshot of the current landscape. With bitcoin’s hashprice at $58.6/PH/s, public mining companies are seeing notably higher gross profits. TheMinerMag’s Total Hashcost metric, which adds corporate and financial hashcosts to the fleet hashcost, indicates that mining firms are now generating net profits in their proprietary mining segments. Corporate and financial hashcosts account for a company’s SG&A and interest expenses divided by realized hashrate.

After a challenging start to the year, it seems that strategic fleet upgrades, industry consolidation, and, for some companies, a hodling strategy are beginning to pay off.

Regulation News

- Thai police bust nine illegal bitcoin mining rigs – The Star

Hardware and Infrastructure News

- Galaxy to End Hosting for Argo’s Bitcoin Miners as It Shifts Focus to HPC Hosting – TheMinerMag

- HIVE Acquires 1.2 EH/s of Avalon A1566 Bitcoin Miners – TheMinerMag

- MARA Adds 152 MW in Ohio to Aim for 50 EH/s by 2024 – TheMinerMag

- Bitfarms Upgrades Pending T21 Bitcoin Miners to S21 Pro for $33.2M – TheMinerMag

Corporate News

- Jack Dorsey’s Block Shifts Focus to Bitcoin Mining Amid Trump’s Crypto Promises – Decrypt

- Stronghold to Settle Class Action Suit with $4.75M and 25 Bitcoin – TheMinerMag

Financial News

- BitFuFu Secures $100M Bitcoin-Backed Loan Facility with Antpool – TheMinerMag

- MARA misses Q3 revenue expectations, increases reserves to 26,747 BTC – The Block

Feature

- Bitcoin Mining Capital Markets, How the Elections Benefit BTC with Mostafa Al-Mashita – The Mining Pod

- In the Kentucky Mountains, a Bitcoin Mining Dream Turned Into a Nightmare – Wired