Miner Weekly: Another Distressed Bitcoin Mine Set for Auction

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

It’s been close to six months since the halving and there have been quite many mergers and acquisitions resulting from miner capitulation, as previously reported.

Now a new bid is emerging after Rhodium Enterprises filed Chapter 11 for two of its subsidiaries, which came less than a month after bitcoin’s hashprice–a measure of bitcoin mining profitability–set a record low of $36/PH/s.

The court overseeing the Rhodium Chapter 11 case has established an order granting Rhodium’s motion to sell all or parts of its assets at the Temple location in Texas through an auction.

According to the court’s order, Rhodium will solicit and select the highest or best offer for all or part of its Temple assets through one or more sales. A proposed timeline for the auction has been outlined.

Rhodium has not provided a detailed breakdown of its assets in Temple, but previous SEC filings may offer insights into its data center leases, power agreements, and installed miners at the location. Initially, in 2021, Rhodium signed a data center lease with its landlord, Temple Green, which was amended in 2022 to increase the electrical capacity from 185 MW to 225 MW via a three-phase construction plan. The lease grants Rhodium exclusive use of the site for 10 years.

As of December 2022, only the first construction phase was completed, resulting in 50 MW of operational capacity with 1.1 EH/s of WhatsMiner M30 series online. Despite this, the Temple lease required a base rent of $0.6 million per month, which began accruing in August 2022 and could not be deferred beyond February 2023.

Regarding energy, Rhodium’s initial power supplier faced difficulties in meeting the company’s long-term demand and informed Rhodium of this in July 2022, just before the first phase of the Temple data center commenced. Rhodium then switched to another power supplier, paying market rates temporarily, before securing a fixed-price energy supply agreement with a subsidiary of Shell Energy North America. This Shell agreement would provide up to 102.5 MW of capacity for a period of 60 months, starting on January 1, 2023.

Rhodium will need to consult with its Debtor-in-possession (DIP) creditor (i.e. Galaxy Digital) before making any changes to the auction plan or schedule unless the DIP creditor is a participating party in the auction itself. This raises the question of whether Galaxy might acquire another distressed mining site, similar to its acquisition of Argo’s Helios site. Here’s a background story about Galaxy providing DIP loans to Rhodium.

On the topic of miner capitulation, it appears that the worst may be behind us for now. Bitcoin’s hashprice has recovered to a relatively stable level above $43/PH/s, a 20% increase from its August low.

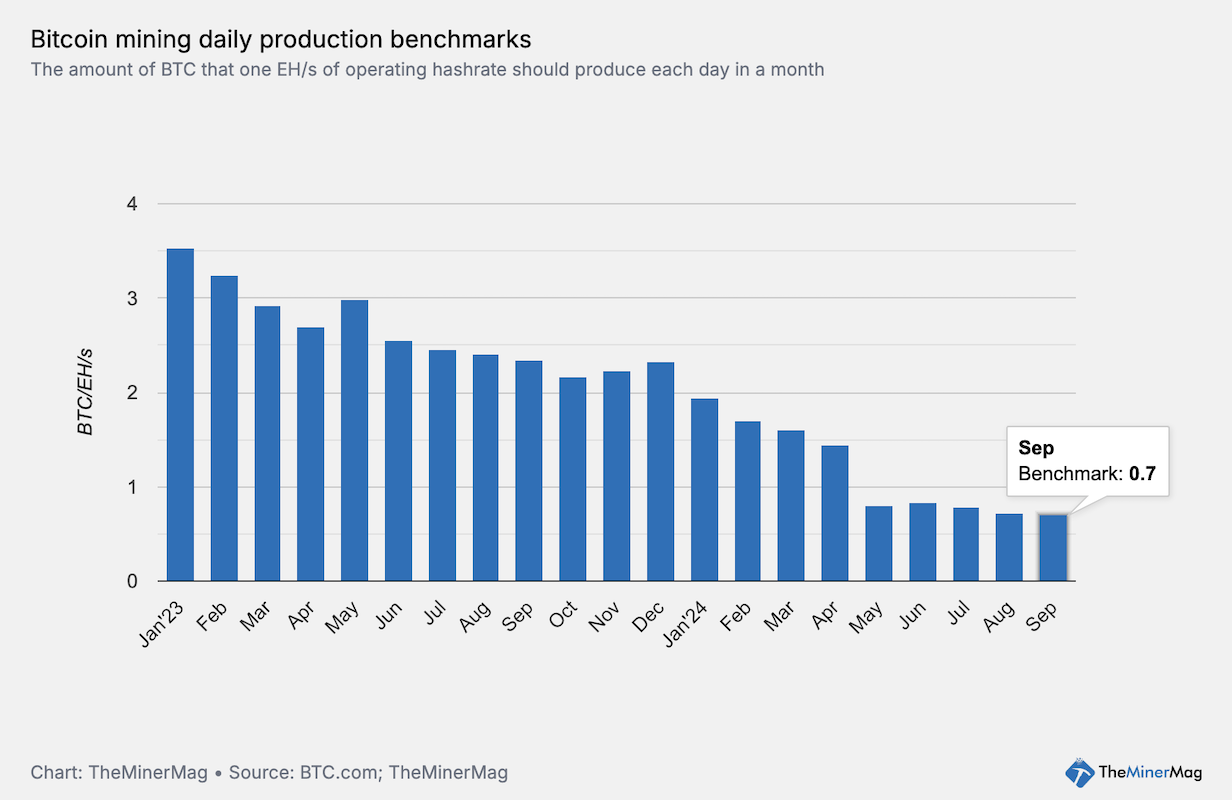

Meanwhile, public mining companies continue to race to expand their bitcoin compute power (aka hashrate), often at their own expense and that of others (because the more everybody mines the more difficult it becomes for everyone to mine) as bitcoin’s daily production benchmark keeps dropping, setting an all-time low of 0.68 BTC/EH/s in September.

If the market in October doesn’t perform well, the worst is yet to come for bitcoin’s hashprice. So far, “Uptober” doesn’t seem to be living up to its name.

Regulation News

- This New York Town Passes Bitcoin Mining Regulations – TheMinerMag

- Arkansas Judge, Prosecutor Accused of Targeted Crypto-Miner Crackdown – Law.com

Hardware and Infrastructure News

- MARA Pool Realizes 32.7 EH/s in Bitcoin Hashrate As Uptime Improves – TheMinerMag

- CleanSpark restores 200MW in the wake of Hurricane Helene – The Block

- Compass Mining Energizes 2,400 Bitcoin Miners in Nebraska – TheMinerMag

Corporate News

- Swan Bitcoin sues former employees, alleges theft of bitcoin mining business – Blockspace.Media

- Russia’s Crypto Mining Tycoon Builds Fortune From Putin’s U-Turn – Bloomberg

- Here’s What Swan Bitcoin Redacted in Mining Lawsuit Involving Tether – TheMinerMag

- Judge axes class action claiming Iris Energy misled investors during IPO – Cointelegraph

- Bitfarms Settles Dispute with Former CEO Geoffrey Morphy – TheMinerMag

- MARA Purchased 192 Bitcoin in September While Retaining Mined BTC – TheMinerMag

Financial News

- Canaan Raises $50M in Third Tranche of Preferred Stock Offering – TheMinerMag

- Hut 8 Converts $38M Bitcoin Mining Debt into Equity – TheMinerMag

Feature

- Swan Bitcoin’s Lawsuit, Bitdeer’s New ASIC, Riot and Bitfarms’ Settlement – The Mining Pod