Hut 8 Converts $38M Bitcoin Mining Debt into Equity

Bitcoin mining and data center operator Hut 8 has converted an outstanding loan of $38 million into common stocks, thereby extinguishing its debt to crypto investment bank Anchorage Digital.

In an announcement on Tuesday, Hut 8 said that Anchorage Digital converted the loan into Hut 8 common stock at $16.395 per share, which represented a 51% premium over the 20-day average price of Hut 8’s stock prior to the conversion. Hut 8’s stock closed at $12.20 on September 30.

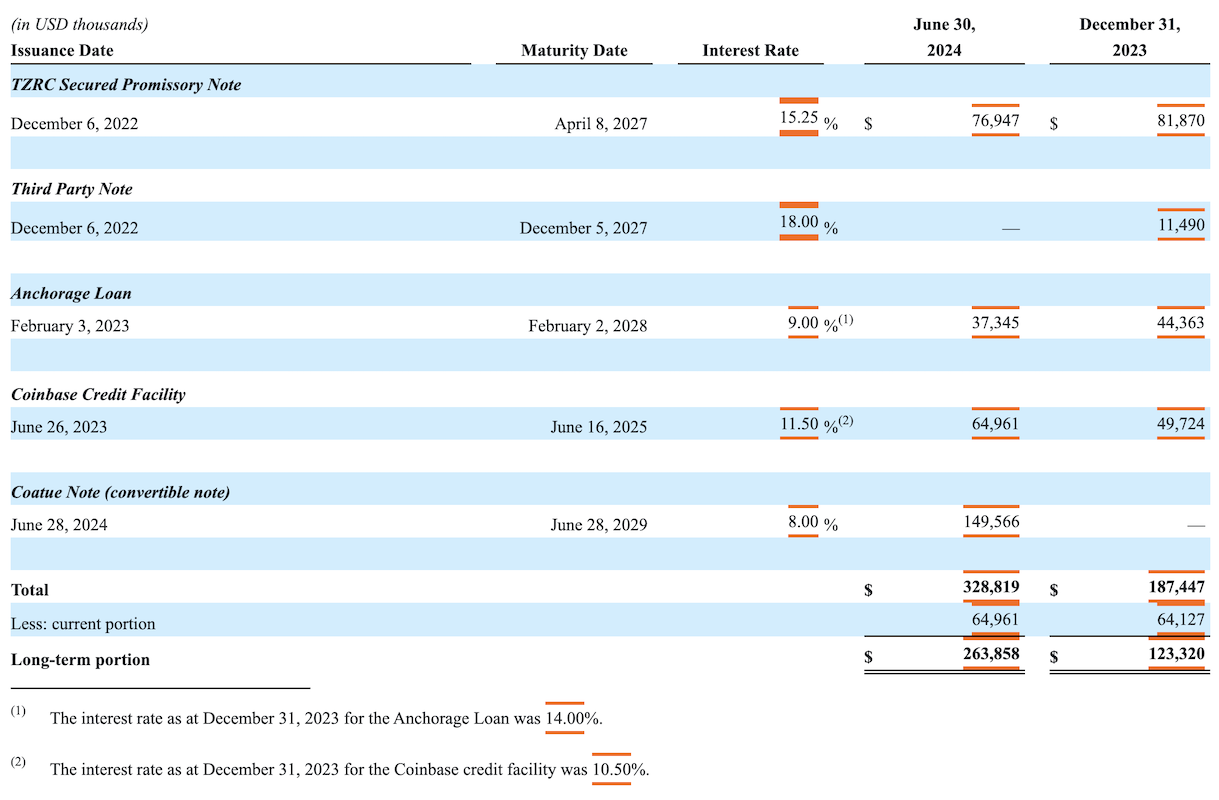

In February 2023, Hut 8 restructured an equipment financing loan with Anchorage Digital, using 21,000 bitcoin miners as collateral. The loan was set to mature in five years with an annual interest rate of 14% as of December 31, 2023, and 9% as of June 30, 2024. The outstanding balance as of June 30 was $37.3 million.

The debt-to-equity conversion comes as Hut 8 expands its business beyond bitcoin mining and managed services into high-performance computing and AI hosting.

“With a strengthened balance sheet and decreased leverage, we believe we are even better positioned to advance discussions with prospective counterparties and to execute on the development of next-generation mining and AI data centers,” said Asher Genoot, CEO of Hut 8.

Following the payoff of the Anchorage debt, Hut 8 still carries approximately $290 million in current and long-term debt. According to its Q2 filing, Hut 8 had loans and notes payable totaling $328.8 million as of June 30. This included $150 million worth of convertible notes raised in June to fund Hut 8’s data center expansion aimed at the AI sector.