Rhodium Seeks Court Order for Bitcoin Mining Sales in Chapter 11

The Texas court overseeing Rhodium’s Chapter 11 case is scheduled for a Monday hearing on the insolvent bitcoin mining operator’s motion to sell the assets at its Temple site.

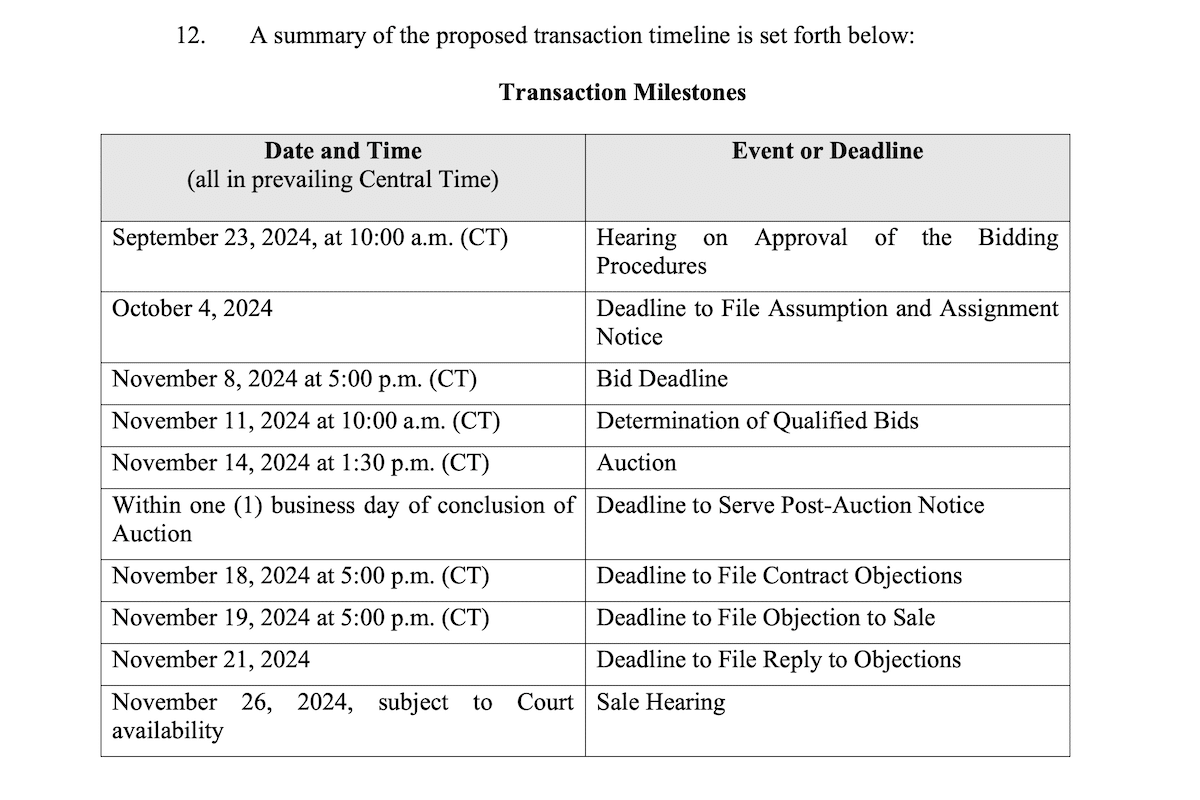

Rhodium filed an emergency motion last Tuesday, seeking the court’s approval of its proposed sale and auction plan for its proprietary bitcoin mining site in Texas. A hearing for the proposal is scheduled for 9:00 a.m. Central Time on Sep. 23. If the sale proceeds as planned, it could be finalized by November.

As previously reported, Rhodium filed for Chapter 11 bankruptcy protection late last month after facing financial distress, failing to repay loan principals due in July. As of December 31, 2022, Rhodium had 1.1 EH/s of energized mining capacity at its proprietary Temple site, which had a capacity of approximately 50 megawatts.

In its emergency motion last week, Rhodium claimed it had received a “preliminary letter of intent for a $105 million cash acquisition” of its Temple site mining infrastructure prior to filing for Chapter 11.

Rhodium stated that its proposed bidding procedures aim to continue soliciting potential buyers, expanding outreach to those interested in acquiring either the entire Temple site or just a subset of its assets, including bitcoin mining infrastructure, leases, power agreements, and colocation agreements.

Following the Chapter 11 filing, Galaxy Digital offered Rhodium a $30 million cash or bitcoin debtor-in-possession loan, a move suggesting Galaxy’s potential interest in acquiring distressed assets to expand its bitcoin mining capacity. Galaxy Digital’s mining segment became a vertically integrated operation after acquiring the Helio site in Texas from Argo Blockchain in 2022.