Miner Weekly: $820M M&A Deals for 1.2 Gigawatts of Power

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

It is not often that we witness Bitcoin’s hashrate breaking new records despite Bitcoin’s hashprice—the daily mining profitability per unit of hashing power—remaining stubbornly low at $40/PH/s.

Over the past weekend, major mining pools reported a total bitcoin hashrate exceeding 700 EH/s, resulting in yet another all-time high in mining difficulty this Wednesday.

While large-scale mining operations have continued to deploy newly arrived bitcoin miners, intensifying the network competition, there has also been a slew of mergers and acquisitions in the industry.

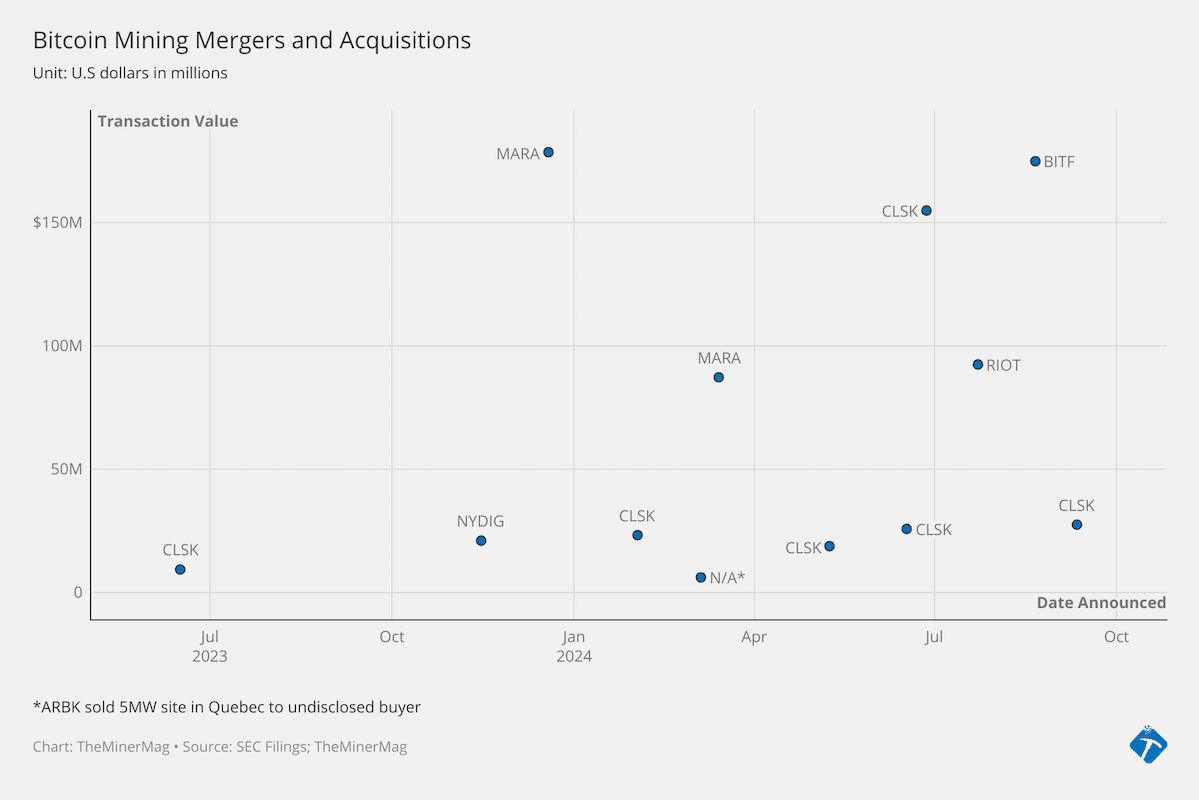

The graph above maps out the buyers in major M&A deals related to mining infrastructure over the past year. Although the data is based on announced transactions, it provides a glimpse into the broader picture. Notably, M&A activity has surged this year in anticipation of the halving.

The dozen transactions above since June 2023 had a total value of $820 million for approximately 1.2 gigawatts of immediately available power capacities, excluding the expansion potential of the deals. About $400 million were cash payments while the rest was mostly paid in stocks. In Greenidge’s case, it sold a South Carolina site to NYDIG to extinguish $21 million in loans payable.

While the sellers included a mix of public and private operators, the buyers are mostly the major names in the industry with CleanSpark being the most active in pursuing immediate access to mining infrastructure. The company expanded its operations from Georgia to Mississippi, Wyoming, and Tennessee.

As mega mining farms consolidate infrastructure, Bitcoin’s hashrate is poised to continue its upward trajectory in the coming quarters. Mining machine manufacturer Bitmain is expected to ship a substantial volume of its Antminer S21 Pro and S21XP models from September through year-end, based on previously announced purchase orders.

At present, real-time mining pool data indicates that bitcoin’s hashrate has declined to 677 EH/s, and the average block production interval—since the last difficulty adjustment two days ago—has extended to nearly 12 minutes. However, it remains too early to determine whether we’ll witness a significant easing of difficulty.

Regulation News

- Norway takes the register to keep out crypto miners – Datacenter Dynamics

Hardware and Infrastructure News

- Antpool, F2Pool to Support Fractal Bitcoin Merge Mining – TheMinerMag

- Tokyo Grid Operator Mines Bitcoin to Save Renewable Surplus – TheMinerMag

- Bitcoin Seven-Day Hashrate Nears 700 EH/s, Setting New Records – TheMinerMag

- Compass Reaches 5 EH/s After Energizing 3k Bitcoin Miners – TheMinerMag

- Bitcoin Mining Difficulty Sets New High after Record Hashrate – TheMinerMag

- CleanSpark Acquires 85MW Bitcoin Mining Sites for $27.5M – TheMinerMag

Corporate News

- Iris Energy Boosts Bitcoin Production by 10% in August Despite Rising Difficulty – TheMinerMag

- Marathon Puts AI on Horizon with New Board Directors – TheMinerMag

- Bitcoin Miner Ionic Faces Challenge From Disgruntled Shareholders – Decrypt

- Bitfarms Hints at HPC Expansion with Team Changes – TheMinerMag

Financial News

- Bitcoin Mining Host Applied Digital Raises $160M With Backing from NVIDIA – TheMinerMag

Feature

- Galaxy’s $30m Offer to Rhodium, Bitmain’s ASIC Surplus, Bitcoin Mining (in Space!), and…Tokenized Nicotine? – The Mining Pod

- Inside the Texas Bitcoin Mine Reportedly Making Residents Sick – NBC

- Blockstream’s ASIC Mining Note With Adam Back – The Mining Pod

- The World’s Biggest Bitcoin Mine Is Rattling This Texas Oil Town – Wired