Bitcoin Miner CleanSpark Seeks to Double Authorized Shares

Bitcoin mining giant CleanSpark is seeking to double its authorized shares for issuance paving the way to expand its capital-raising potential.

The company filed a proposal on Friday, calling for a special shareholder meeting to approve a doubling of its authorized shares for issuance, from 300 million to 600 million units.

This move, if approved, could allow CleanSpark to sell more stocks, generating proceeds to cover its operating and capital expenditures.

CleanSpark’s filing reveals that the company has issued 250 million common shares, 1.75 million Series A preferred shares, and 1 million Series X preferred shares. Each common share carries one vote, while Series A shares hold 45 votes each.

The newly issued Series X shares, part of a share subscription agreement on Friday with independent board director Thomas Wood, offer 1,000 votes per share solely for the proposal to increase authorized shares.

However, the 1,000 votes per share of Series X preferred stock are not cast directly based on the holder’s discretion, but are “mirrored” in proportion to the votes cast “FOR” and “AGAINST” the share increase proposal by the holders of common stocks and Series A preferred stocks.

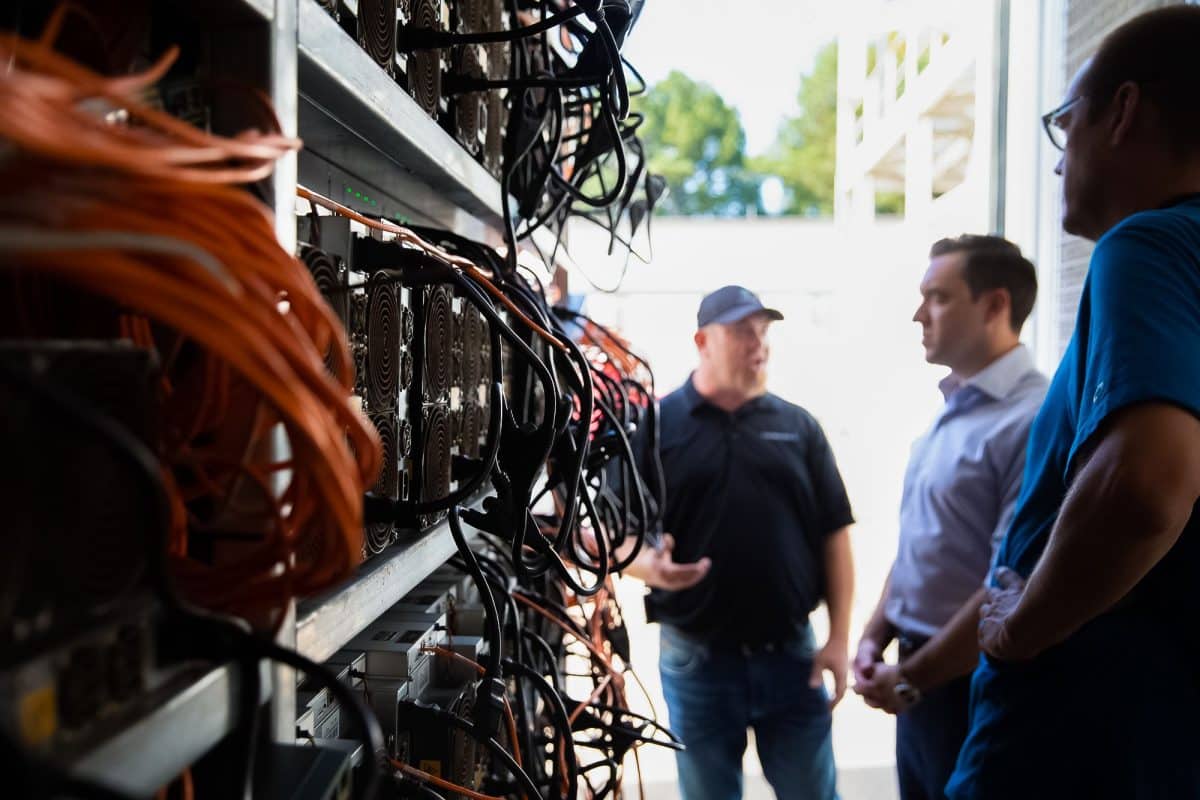

CleanSpark is one of the pure-play bitcoin mining companies that have embraced a full “hodl” strategy since January 2024.

This strategy, focused on holding onto mined bitcoin rather than selling, has been fueled by extensive equity financing efforts. During the first half of 2024, CleanSpark, alongside other pure-play mining “hodlers” Marathon and Riot, raised $810 million, $668 million, and $505 million, respectively, through stock offerings.