Iris Energy Expands 10.5 EH/s Bitcoin Hashrate with S21XP

Iris Energy has doubled down on its bitcoin mining hashrate capacity by purchasing an additional 10.5 EH/s from Bitmain for $226 million.

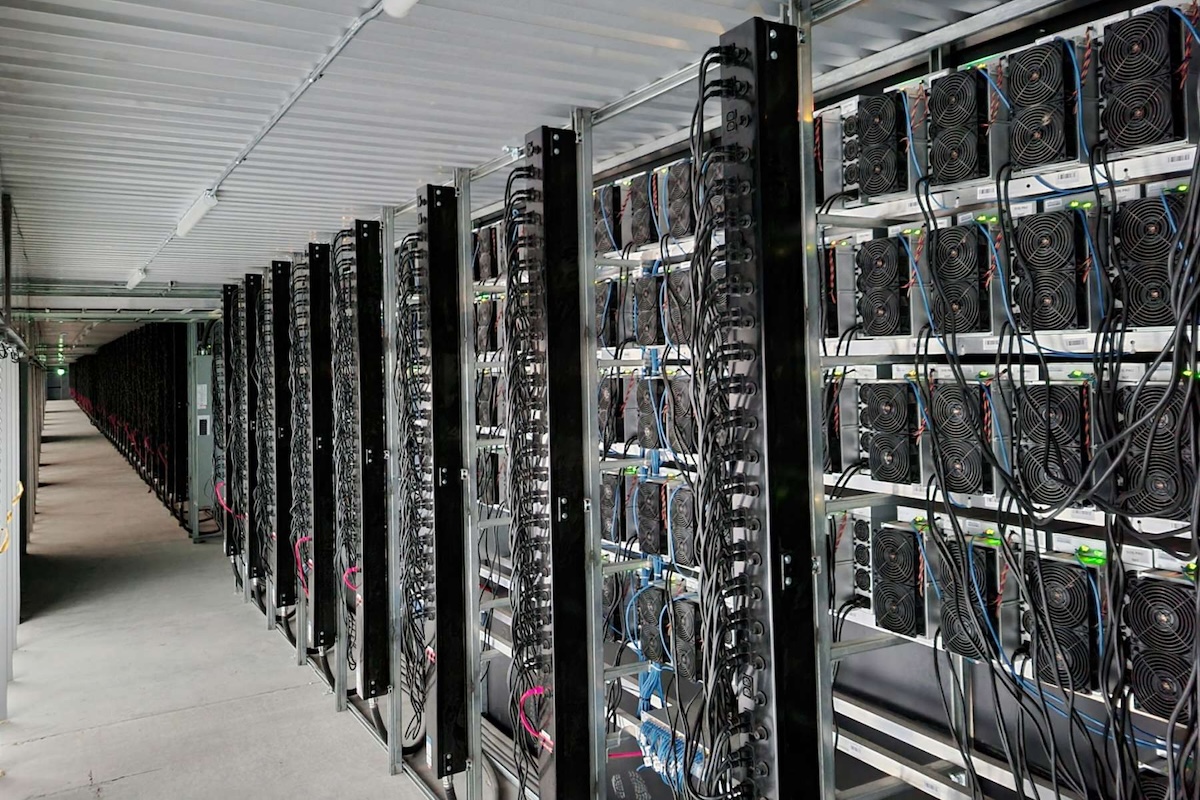

In its fiscal year 2024 report, released on Wednesday, the company announced a new purchase agreement with Bitmain dated Aug. 16, for 39,000 S21XP Antminers at a price of $21.5/TH/s. The equipment, totaling 10.5 EH/s, is expected to be delivered in October and November.

Previously, Iris Energy ordered approximately 5.3 EH/s of Bitmain’s T21 and S21 Antminers between October 2023 and January 2024, with most units delivered by July. The company also pre-ordered 12 EH/s of S21 Pro Antminers for $226 million in May, which were shipped in July and August.

In its earnings release, Iris Energy reported that its installed hashrate had increased to 15 EH/s as of August 28, up from 10.5 EH/s on August 2. With the newly purchased S21XP Antminers, the company expects to reach a hashrate of 30 EH/s by the end of 2024.

However, according to its July production update, Iris Energy’s realized hashrate and bitcoin production was affected by the performance of the T21 Antminers due to “a batch production issue.” Bitmain was said to be replacing all the defective units.

Additionally, Iris Energy reported increased electricity costs in July due to higher energy hedge pricing during the summer in Texas and “much lower than expected energy market volatility.” This resulted in lower-than-expected energy trading profits. In response, the company closed out its existing hedging contracts for August and September 2024 at a cost of $7.2 million.

Based on the earnings report, Iris Energy’s total hashcost was estimated at $57.5/PH/s, with $22.2/PH/s attributed to its corporate hashcost, which was among the highest compared to its public mining peers.