Riot Nears 20% in Bitfarms, Close to Trigger ‘Poison Pill’

Riot Platforms has escalated its takeover efforts against rival bitcoin miner Bitfarms by increasing its stake to 19.9%, edging close to the 20% threshold that would activate Bitfarms’ poison pill defense.

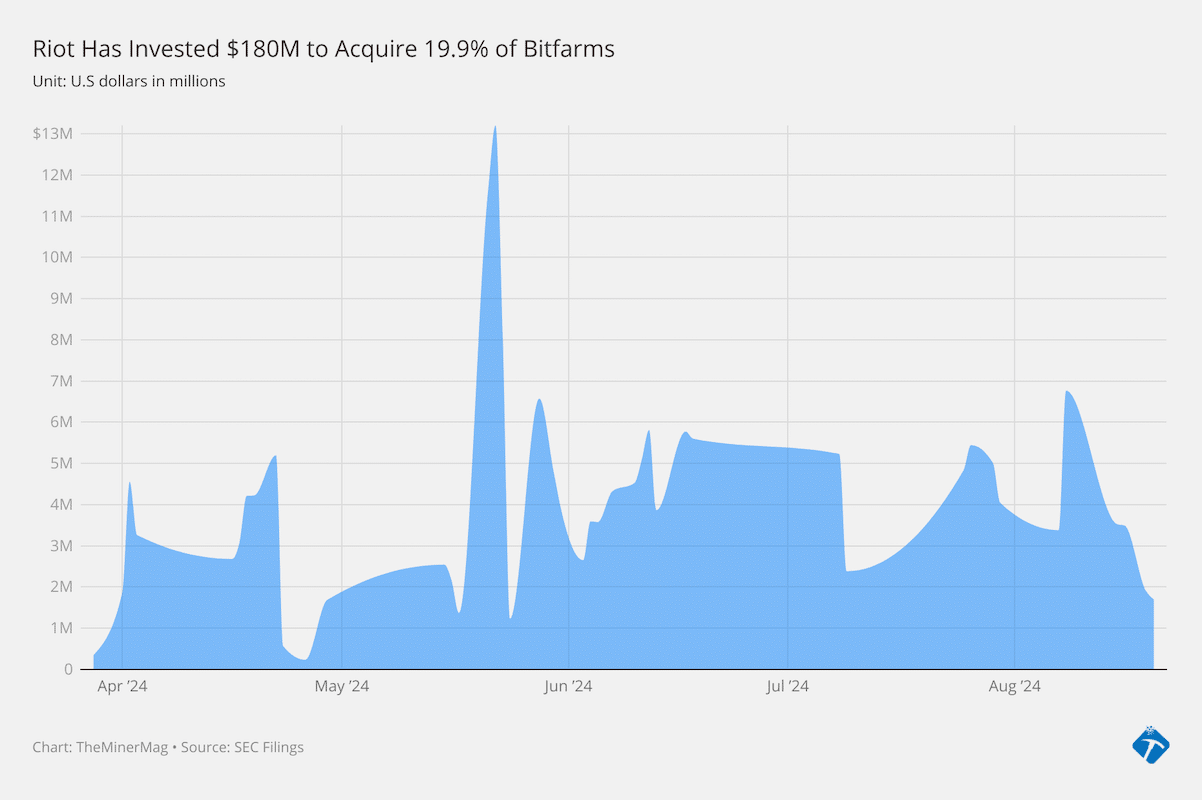

According to Riot’s filing on Wednesday, the company invested an additional $10 million since August 15 to acquire 4.5 million more shares of Bitfarms, bringing its total holdings to 19.9% as of August 20.

Bitfarms adopted a second shareholder rights plan – known as a “poison pill” strategy – granting shareholders one right per share, exercisable if any entity acquires 20% or more of Bitfarms’ shares without a “Permitted Bid.”

This move came after the Ontario Capital Markets Tribunal sided with Riot in terminating Bitfarms’ initial poison pill strategy, which had a triggering threshold of 15%.

Since April, Riot has invested $180 million to accumulate 80.8 million shares of Bitfarms at an average cost of $2.23 per share. Bitfarms has scheduled a special shareholders meeting for Oct. 29 to vote on the takeover bid.

Riot’s aggressive acquisition comes during a period of heightened consolidation and competition in the bitcoin mining industry, following the recent halving event.

Meanwhile, Bitfarms announced on Wednesday an all-stock merger with Stronghold Digital to expand its U.S. bitcoin mining and energy capacities, though its stock price dipped by 5.5% to $2.24 after the news.