CleanSpark Orders 7.8 EH/s of S21XP Bitcoin Miners for $167M

CleanSpark, the second-largest public bitcoin mining firm by realized hashrate, has announced an expansion of its mining capabilities with a preorder of 7.8 EH/s for $167.7 million.

In its 10-Q filing on Friday, the company reported that it entered into a purchase agreement with Bitmain on August 7, securing 26,000 units of S21XP immersion-cooled bitcoin miners at a rate of $21.5/TH/s. The delivery is scheduled to arrive in two batches of 13,000 units each, planned for October and November 2024.

The purchase agreement also includes a call option allowing CleanSpark to acquire up to 50,000 additional S21XP immersion-cooled miners, totaling 15 EH/s, at the same price of $21.5/TH/s.

This option is exercisable until July 26, 2025. If fully exercised, it would involve an additional expenditure of $322.5 million. CleanSpark said it would pay a nonrefundable fee of $32.25 million to secure this option, representing 10% of the total potential purchase price.

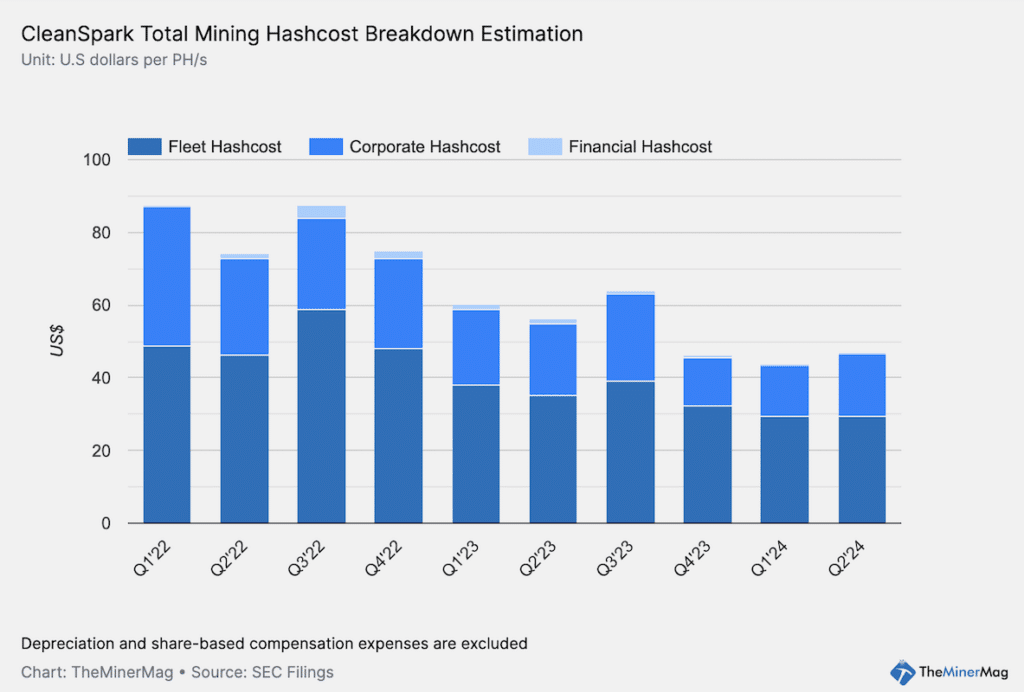

Despite efforts to increase fleet efficiency, CleanSpark’s Q2 financial report indicated that its fleet hashcost remained unchanged from Q1, primarily due to increased power costs. The company’s energy cost across its proprietary sites and hosting partner rose from $0.0476/kWh in Q1 to $0.0494/kWh in Q2.

CleanSpark raised approximately $150 million in Q2 and another $215 million since July through equity financing as it opted not to sell any of its mined bitcoin during this period. In June, CleanSpark entered into a contract to purchase a corporate aircraft for $10.8 million.