Miner Weekly: Bitcoin’s Record Low Hashprice Pushes Miners to the Brink

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

It hasn’t been a great week for bitcoin mining operations. Just a few days after an all-time high difficulty adjustment last Wednesday, bitcoin’s price tanked by $10,000 within 24 hours. This sent bitcoin’s hashprice—a metric that represents the daily mining revenue in dollars per a set unit of hashrate—to a record low, falling below $36/PH/s.

Even though bitcoin’s market price has bounced back after dropping below $50,000, the hashprice is still hovering around $40/PH/s. This is 10% lower than the previous all-time low recorded in early July. With bitcoin’s seven-day moving average hashrate declining since last week, we won’t see a new difficulty adjustment until next week (hopefully it will be an ease!)

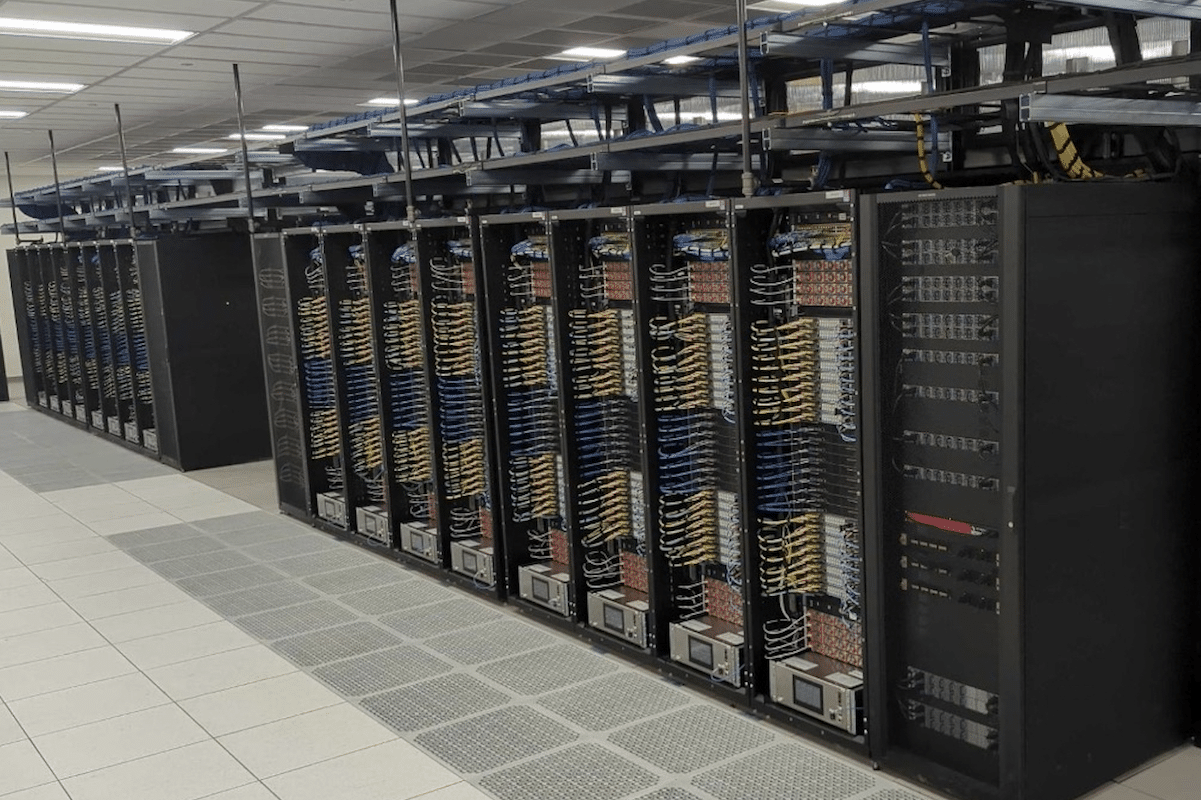

The current hashprice makes it a challenging environment in bitcoin mining, especially for those without competitive power costs. A relevant example is the 4.1 EH/s of Antminer S19XPs that Bitmain has hosted at Core Scientific since late last year. The hosting rate was $0.0745/kWh, suggesting a daily hashcost of $39/PHs—that’s just about the current hashprice breakeven point of $40/PH/s.

Even proprietary mining operations of publicly traded companies are unlikely to generate net profits with the current record-low hashprice, before accounting for depreciation and tax. Over the past week, Marathon, Core Scientific, and Riot—three of the four largest public operators by hashrate—have published their financial numbers for Q2, the first quarter following bitcoin’s halving. The chart below from TheMinerMag outlines the estimated breakdown of their total hashcosts in Q2, including fleet, corporate, and financial hashcost. That helps project their all-in mining costs in July (over $60k per bitcoin!) based on last month’s daily production benchmark.

The chart above outlines the estimated breakdown of their total hashcosts in Q2, including fleet, corporate, and financial hashcost. That helps project their all-in mining costs in July ($60k+ per BTC!) based on last month’s daily production benchmark.

With that being said, for Marathon and Riot, it is likely business as usual despite the recent hashprice correction, as they are opting to hodl all their mined bitcoin anyway.

Year-to-date, Marathon and Riot combined have raised over $1.5 billion in cash via stock offerings, according to TheMinerMag’s data. It seems that they can afford such a hashprice correction, but they still have large pending capital expenditures. For instance, the two pure-play mining companies also spent over $1 billion in the first half of 2024 on power, plant, and equipment.

In the case of Core Scientific, it adopts a 100% bitcoin liquidation strategy. Even with a relatively lower projected all-in mining cost, selling mined bitcoin isn’t generating much net profit but helps Core to pay financial expenses (the $260 million debt elimination in early July came just in time). On the other hand, Core is doubling down on the HPC/AI potential with 382MW of hosting capacity for CoreWeave, as mentioned in our weekly list of curated news below.

Hardware and Infrastructure News

- CleanSpark Acquires 75MW Cheyenne Bitcoin Mining Sites – TheMinerMag

- Bitcoin Hashprice Hits Record Low of $38/PH/s Amid Market Slump and Difficulty Spike – TheMinerMag

- Core Scientific Expands CoreWeave HPC Hosting to 382MW – TheMinerMag

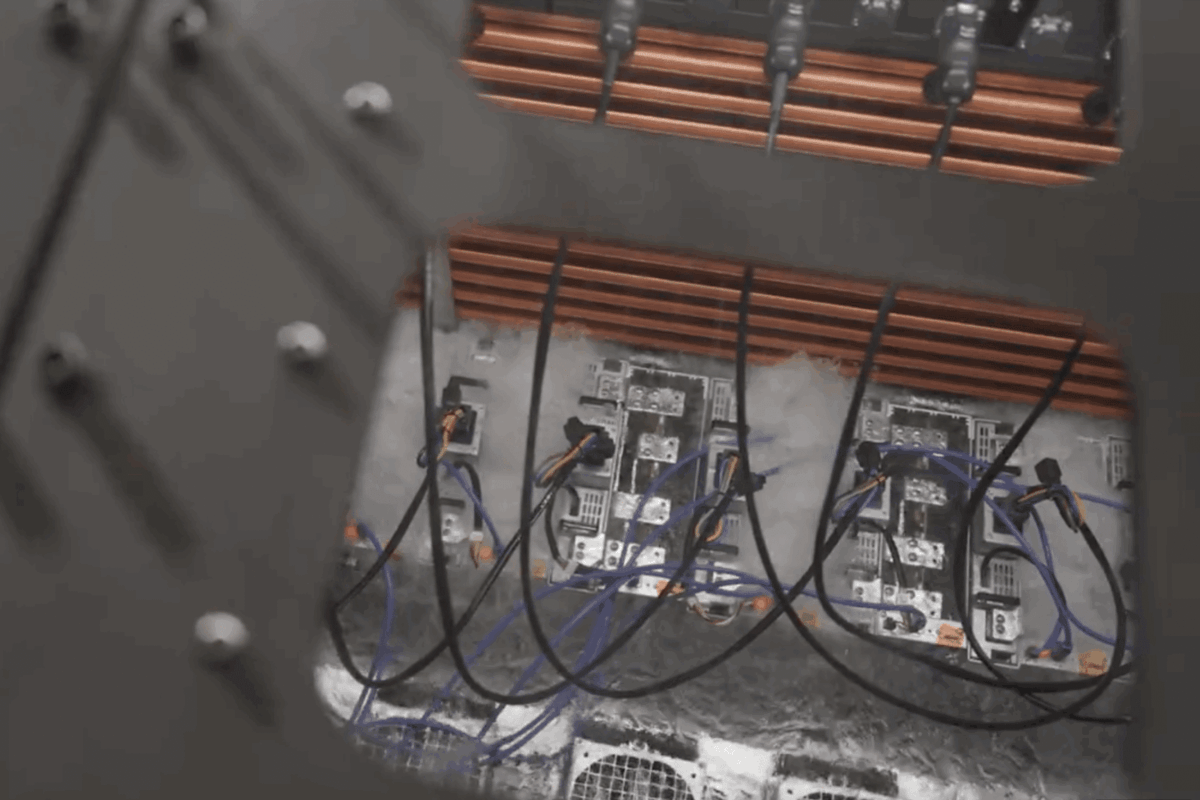

- Marathon Shifts 1.6 EH/s Bitcoin Hashrate to Immersion Amid Noise Complaints – TheMinerMag

- Iris Energy Saw July Electricity Spike to $61k per Bitcoin – TheMinerMag

- Bitcoin Mining Giants Deposit $150M to Bitmain Rivals Since Q2 – TheMinerMag

Corporate News

- Cathedra Bitcoin Resumes Trading on TSXV on Aug 6 – Link

- Talen Energy offers up nuclear-powered crypto mining campus stake, sources say – Reuters

- Bitcoin miner Hut 8 hires former Citigroup exec as new CFO – The Block

- Bitcoin Miner Rhodium in Distress Amid Loan Defaults – TheMinerMag

Financial News

- Bitcoin Mining Stocks Shed $3.5b in Market Cap Amid 17% Plunge – TheMinerMag

- Digihost Announces US$4 Million Private Placement – Link

Feature

- 10% Difficulty Adjustment, Riot’s Hostile Takeover, Cantor’s $2B Loan Book, and MARA’s $100M HODL – The Mining Pod

- Bitcoin Mining Difficulty Peaks as BTC Price Falls – Decrypt

- Trump’s bitcoin strategy was shared behind closed doors with CEOs who raised $25 million. Here’s what he told them – CNBC

- Decentralizing Bitcoin Mining With Bitcoin Mechanic – The Mining Pod

- Bitcoin’s hashprice hit a record low. That’s a big problem for miners – DLNews