Bitcoin Miner Rhodium in Distress Amid Loan Defaults

Texas-headquartered bitcoin mining firm Rhodium Enterprises is said to be in distress, having failed to repay loans due by the end of July, according to an investor familiar with the situation.

Rhodium Enterprises raised $78 million through debt financing in March 2021 to develop two liquid-cooled mining projects: Project Encore (25MW) and Project 2.0 (35MW). These loans were set to mature on July 30, 2024.

Emails from investors to Rhodium’s management over the past year, seen by TheMinerMag, indicate that the company’s executives had already signaled in August 2023 that they would not be able to repay the combined loan payable of $54 million due by July 2024.

Rhodium made two debt restructuring proposals prior to the July deadline, but some stakeholders did not agree with the plans, the investor told TheMinerMag. Consequently, Rhodium defaulted on the repayment for those investors and has not made any revised restructuring proposal since then.

Investor communications obtained by TheMinerMag reveal how disappointed lenders and shareholders believe Rhodium’s executive team mismanaged the company during the bear market, despite its competitive power costs, leading to its current financial distress. Rhodium has not responded to TheMinerMag’s request for comment.

Sub-$10k per BTC

Rhodium was one of the U.S. mining operations aiming to go public during the 2021 bull market. Having mined 2,847 BTC in 2021, it ranked as the fifth-largest bitcoin producer among public peers, following Core Scientific, Marathon, Riot, and Bitfarms. It increased bitcoin production to 3,576 BTC in 2022.

Rhodium planned a $100 million initial public offering (IPO) slated to begin trading on January 20, 2022, with an implied valuation of up to $1.7 billion. However, it halted the plan at the last minute.

The reason for the management’s decision to decline the public raise was unclear at the time, especially as its competitor Core Scientific completed a reverse merger and began trading as planned on the same day.

Rhodium formally withdrew the IPO prospectus in October 2022 after entering into a reverse merger proposal with a special-purpose acquisition company (SPAC) called SilverSun. However, the merger proposal was terminated by SilverSun in November 2023.

According to prospectuses filed by Rhodium, its direct cost of bitcoin production was $6,638 and $8,693 per BTC in 2021 and 2022, respectively, indicating its access to low power costs. The company stated in one filing that its average power cost in 2022 was $0.022/kWh.

Rhodium’s all-in mining cost, including other cash-based corporate and interest expenses, was estimated to total $10,783 and $20,614 per BTC in 2021 and 2022, respectively.

As of December 31, 2022, Rhodium had cash equivalents of $20 million and a working capital of -$2.5 million. The company has made no public disclosure of its books since then and is said to have denied some investors’ requests to view its more recent financial records.

Riot Dispute

Although Rhodium had a relatively low direct cost of bitcoin production in 2021 and 2022, this was dependent on its partnership with Riot’s hosting subsidiary, Whinstone.

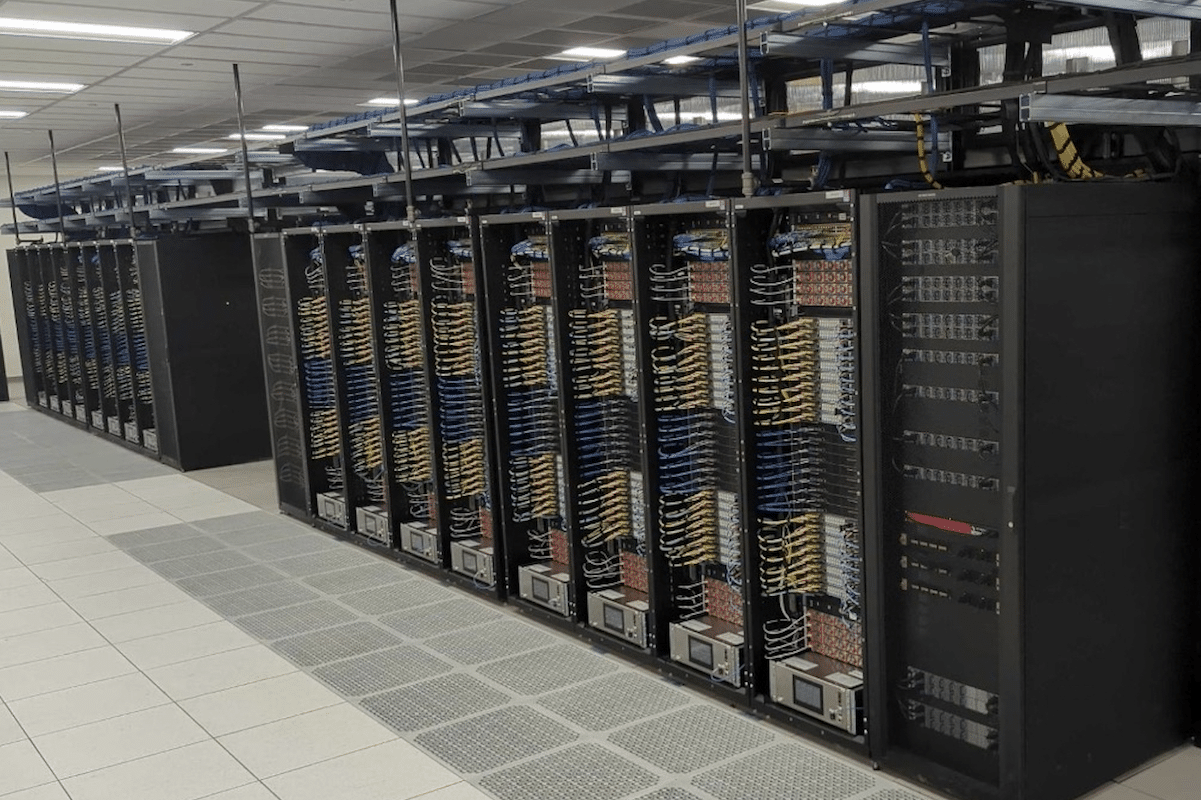

According to Rhodium’s latest filing, it had 47,100 miners, including the WhatsMiner M30 series, as of December 31, 2022. Of these, 2.7 EH/s were colocated at Riot’s Rockdale site, and 1.1 EH/s were energized at its proprietary Temple site, which had about 50MW.

Investors suggested that Rhodium sell the Temple site to increase the company’s liquidity in 2023. However, Rhodium’s management was said to have not pursued this option. The firm did not respond to TheMinerMag’s inquiry about whether it is considering selling the Temple site.

Meanwhile, the relationship between Whinstone and Rhodium began to deteriorate at the start of 2023, primarily over entitlement to certain power credits. In May 2023, Whinstone filed a petition against Rhodium, accusing them of breach of contract and failure to pay specific service fees, leading to the termination of their hosting relationship.

Whinstone is seeking over $26 million in recovery, while Rhodium has filed contingent counterclaims for breach of contract and is seeking arbitration for unpaid energy sale credits and lost profits.

In December 2023, Rhodium submitted an arbitration demand to the American Arbitration Association (AAA) for damages and specific performance of unspecified contracts. In June 2024, Rhodium amended its demand to include additional claims, now seeking at least $67 million in damages. The company appears to be relying on these contingent counterclaims to repay its lenders.