Bitcoin Mining Stocks Shed $3.5b in Market Cap Amid 17% Plunge

The market capitalization of a dozen major US-listed bitcoin mining companies is experiencing a significant decline amid a broader slump in the US equity market on Monday.

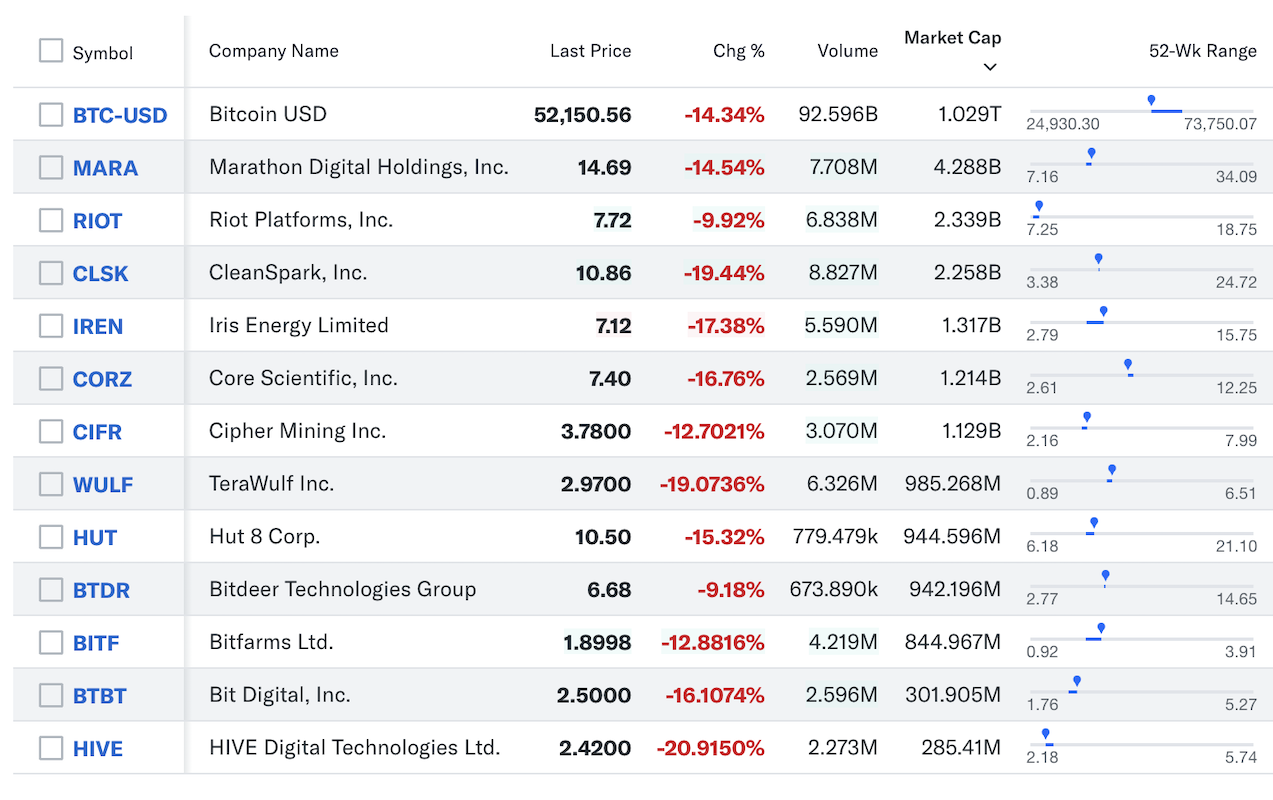

As of July 31, the combined market cap of Bitdeer, Bit Digital, Bitfarms, Cipher, CleanSpark, Core Scientific, HIVE, Hut 8, Iris Energy, Marathon, Riot, and Terawulf stood at $23.5 billion.

However, by Friday, this figure had already dropped by over 10% to $20.3 billion, reflecting a substantial decrease in market value.

On Monday, the situation worsened as these stocks opened with an average plunge of over 15%, following a decline in bitcoin’s market value, which also sent bitcoin’s hashprice to new record lows. Their combined market cap plunged by 17% to $16.8 billion as of publishing on Monday and shed 28.5% since the beginning of August,

The decline in mining stocks’ value follows a period of broader market volatility, which has seen equity prices fall across various sectors.

Per the Wall Street Journal, a global market selloff intensified on Monday with Japan’s Nikkei 255 dropping by over 12%. Tech shares on the Nasdaq are also down significantly with Nvidia, Apple, and Tesla losing 9%, 5%, and 6% as of writing, respectively.