Bitcoin Miner Riot Increases Stake in Bitfarms to 15.9%

Texas-headquartered bitcoin mining giant Riot has increased its stake in Bitfarms to 15.9% as part of its ongoing hostile takeover bid.

Riot filed an SC 13D/A on Tuesday, indicating that it is holding 71.56 million outstanding shares of the Canadian rival following additional market purchases over the past week.

Riot’s latest purchases, amounting to $19.3 million worth of Bitfarms shares, were made after the Ontario Capital Markets Tribunal sided with Riot’s application on July 25 to terminate Bitfarms’ initial shareholder rights plan strategy, known as a “poison pill.”

Under the initial rights plan, Bitfarms would dilute its outstanding shares if a single entity accumulated over 15% of the company’s stakes. Before the Tribunal’s ruling, Riot was holding 14.26% of Bitfarms.

After Riot’s Tribunal win, Bitfarms adopted a new “poison pill” but revised the threshold to trigger equity dilution from 15% to 20%.

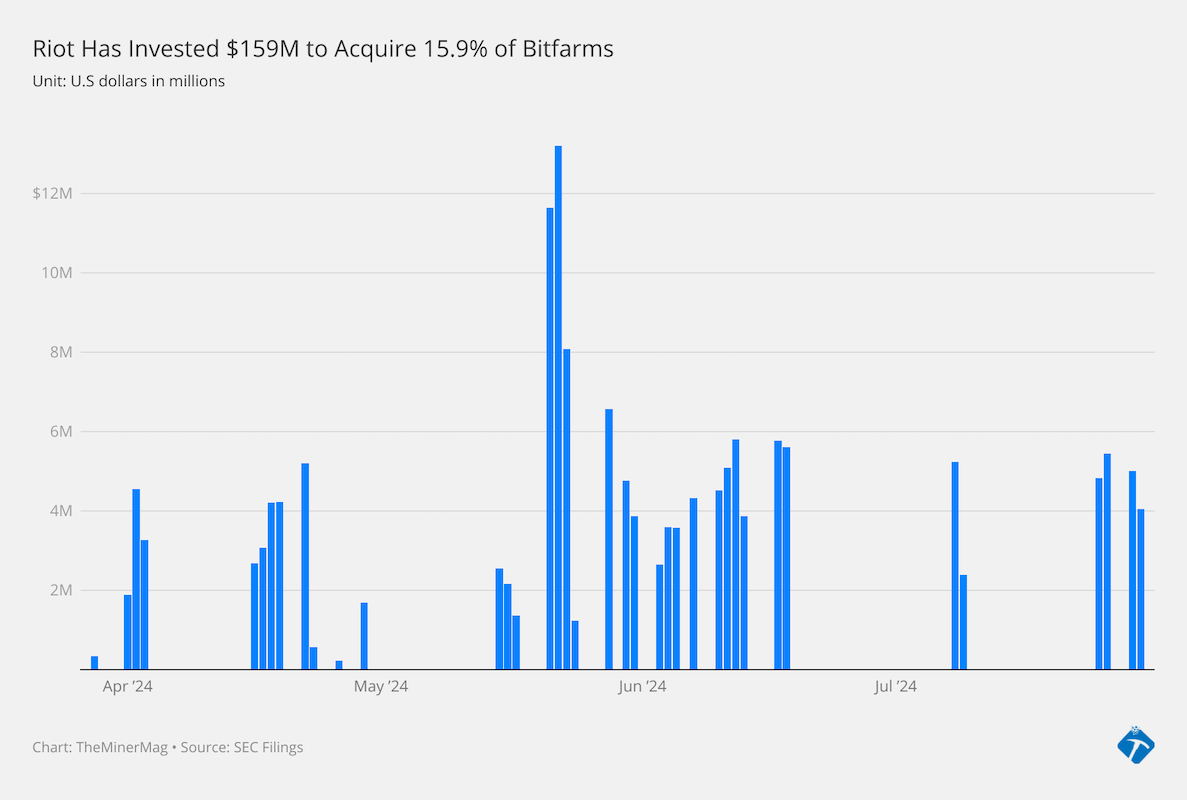

As of July 31, Riot has invested $159.16 million in accumulating 71 million shares of Bitfarms at an average cost of $2.22 per share. Bitfarms’ stock price closed at $2.52 on Tuesday.