Bitcoin Mining Difficulty Sets New Record Above 90 Trillion

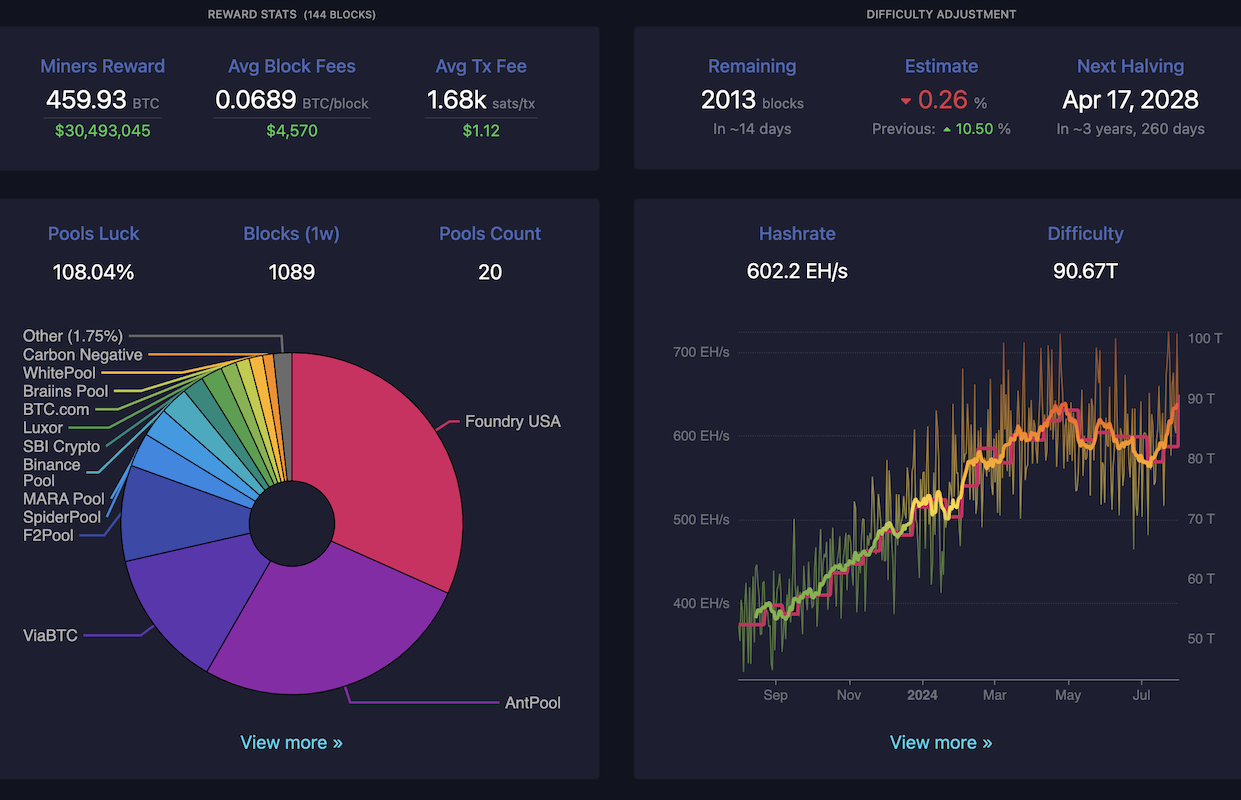

The level of competition in bitcoin mining has surged past 90 trillion for the first time, setting a new record after more than three months.

Bitcoin’s mining difficulty increased by 10%, reaching 90.67 trillion on Wednesday following two weeks of surging hashrate that accelerated the network’s average block interval to 9 minutes and 3 seconds.

Right after the fourth bitcoin halving in April, the network’s mining difficulty set a new record but had declined since then as the plunging hashprice forced unprofitable operators to unplug from the network.

Bitcoin’s seven-day moving average hashrate dropped from a high of 650 EH/s post-halving to 556 EH/s late last month after bitcoin’s hashprice bottomed at a record low below $45/PH/s.

Although bitcoin’s price rebound earlier this month elevated the hashprice to $52/PH/s, the new difficulty record is poised to pull the daily mining revenue back to $46/PH/s. This low level of hashprice will again put pressure on inefficient operations, catalyzing their capitulation.

However, large-scale publicly listed operations appear to be the main force behind bitcoin’s hashrate increase over the past month and are likely to continue ramping up capacities. Companies like Bitfarms, CleanSpark, Riot, Cipher Mining, Marathon, and Terawulf expanded their energized hashrate by over 15 EH/s in June.

Bitcoin network data shows that Marathon’s MARA Pool mined 198 blocks in July and is set to reach 200 blocks in the remaining days. This will make July the second most productive month for the firm by block production market share since December 2023.