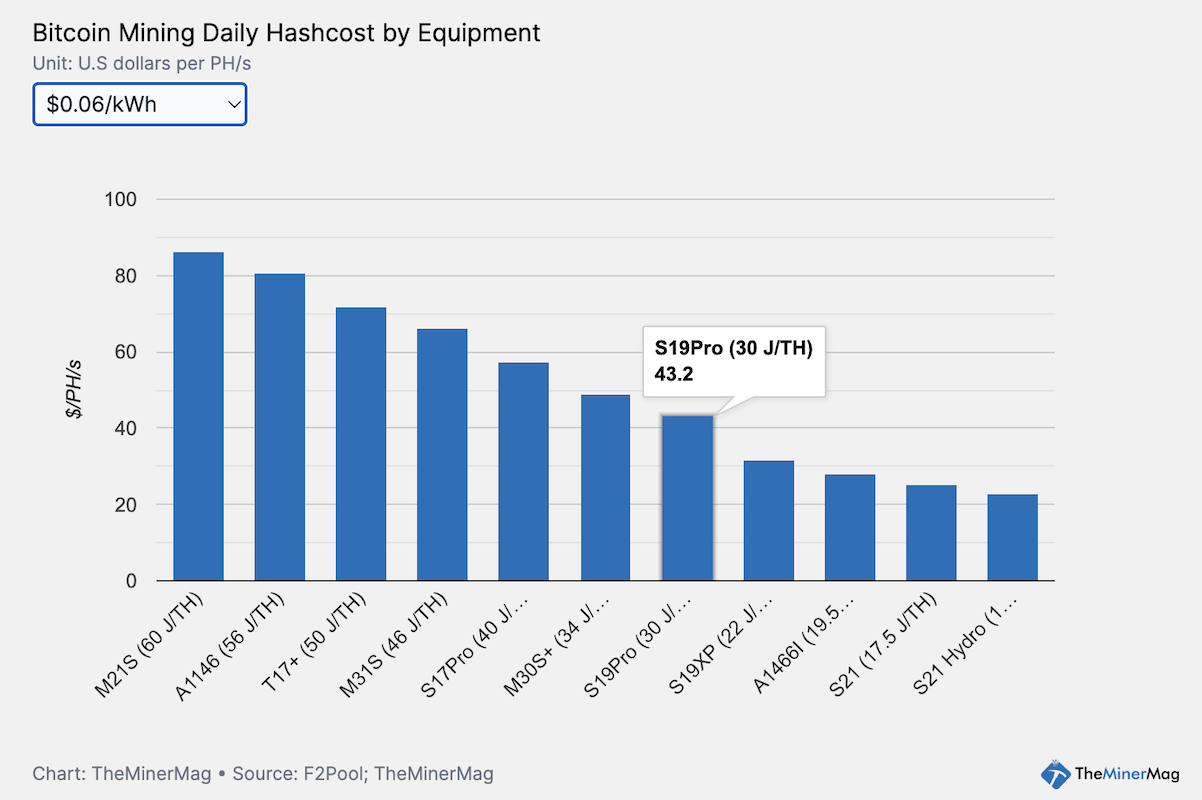

S19 Pro Miners at Risk as Bitcoin Hashprice Hits New Low

Bitcoin’s hashprice has continued to decline, even with a negative difficulty adjustment on Friday, rendering a wide range of mining equipment unprofitable at an average energy rate of $70/MWh.

Bitcoin’s mining revenue per unit of hashing power set a record low on Thursday, which was surpassed early Friday UTC as the hashprice plunged to $43.28/PH/s following yet another broader market sell-off.

Although the hashprice saw a moderate increase as the mining difficulty decreased by 5% on Friday, it still remained under $45/PH/s. If this bearish hashprice level persists, the network may experience another wave of hashrate capitulation in the coming weeks.

As shown in the chart above, Bitmain’s Antminer S19 Pro, the dominant model since the 2020 halving cycle, incurs a daily hashcost of $43.2/PH/s at an energy rate of $60/MWh, or $46.8/PH/s at $65/MWh.

This means bitcoin’s hashprice has entered a zone where operators of S19 Pros could be on the brink of running at a gross loss unless their power costs are well below $60/MWh.

Meanwhile, for operators with higher energy or hosting costs, even more efficient models like the Antminer S19 XP could be at risk.

As previously reported, Bitmain entered into an agreement with Core Scientific to host 4.1 EH/s of S19 XPs at Core’s facility for a hosting fee of $74.5/MWh. At such an energy rate, an S19 XP’s hashcost – or breakeven hashprice – would be about $39.3/PH/s.

Visit TheMinerMag’s data dashboard for more analysis.