‘Phoenix’ Mines 90% of Bitcoin Cash Blocks Over Two Days

It’s rare to witness 90% of the blocks on a proof-of-work network being mined by a single entity, whether it’s a pool or a mining operator, over a span of two days.

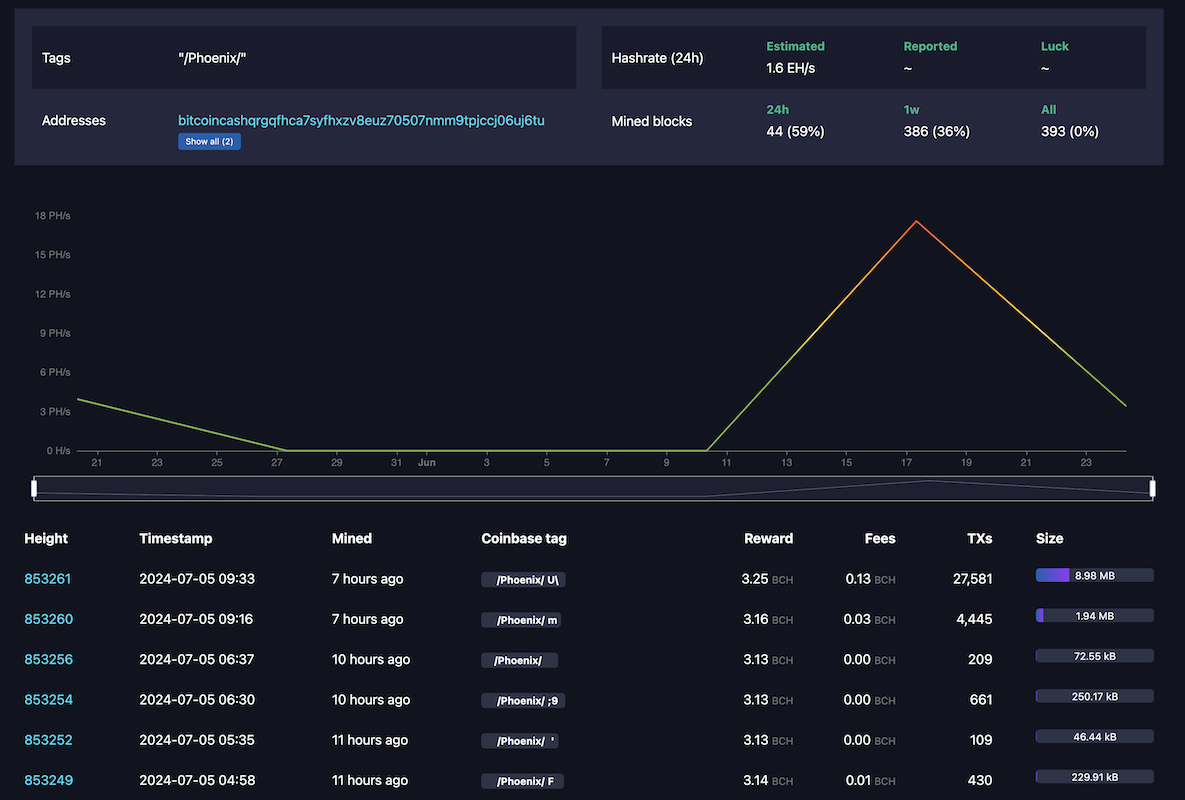

Blockchain explorers of the Bitcoin Cash network show that 317 out of the 351 blocks (90%) mined on July 3 and July 4 bore a “Phoenix” tag with the same coinbase payout address, although that ratio has dropped to 29% on Friday so far.

Bitcoin Cash, a hard fork of the Bitcoin network from 2017, also uses the SHA-256 algorithm and targets a block production interval of every 10 minutes.

The fact that 351 blocks were produced in two days, much higher than the usual average of 288 blocks, suggests the hashrate spike brought by the “Phoenix” miner, which received a total of 992.52 BCH over the two days, worth approximately $300,000.

It is not immediately clear who is behind the “Phoenix” tag or as to the strategy of such a move. Although bitcoin’s hashprice is currently at an all-time low of around $44/PH/s, it is still higher than the hashprice of Bitcoin Cash, which is about $30/PH/s.

Phoenix Group, an Abu Dhabi-listed bitcoin mining company, has rolled out a mining pool service dubbed Phoenix Pool that targets both bitcoin and bitcoin cash networks.

The company has not responded to TheMinerMag’s request for comment on whether its Phoenix Pool is associated with the “Phoenix” coinbase tag.