Bitcoin Hashprice Hits All-Time Low Amid July 4th Sell-Off

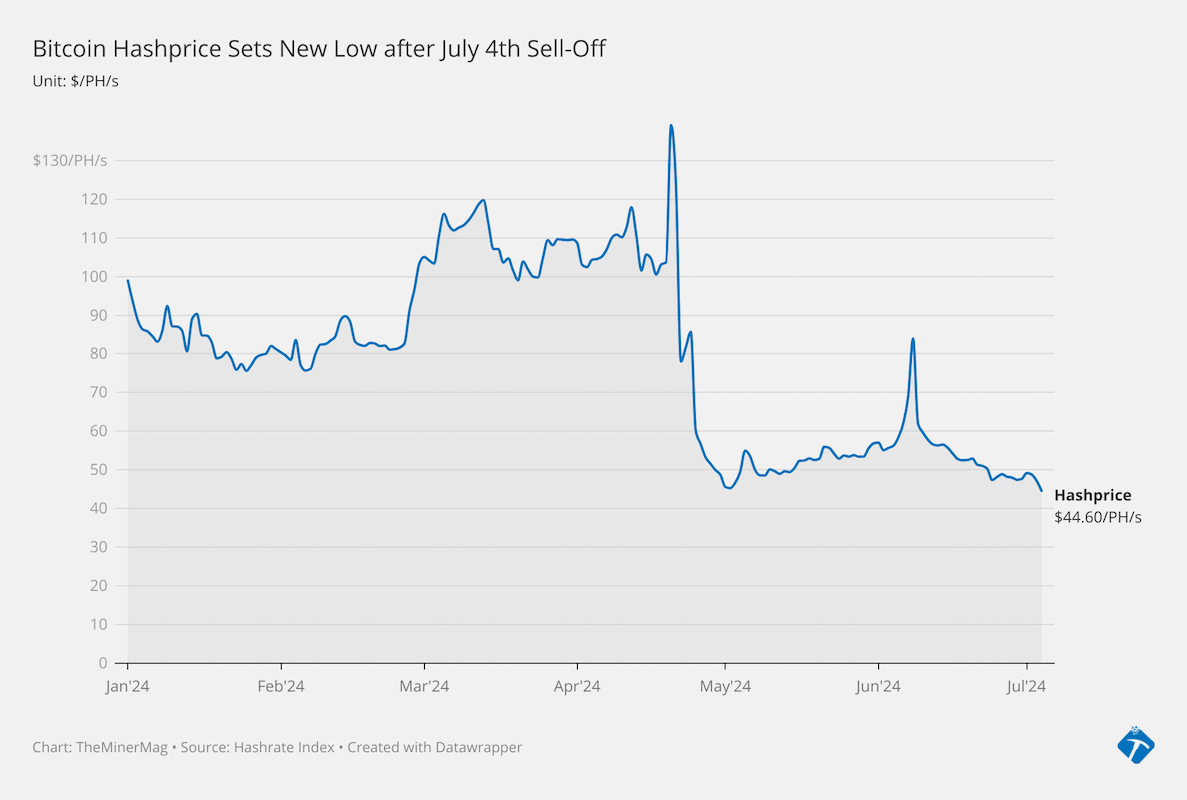

Bitcoin’s hashprice, the dollar value of daily mining revenue per unit of hashing power, has dropped below $45/PH/s, setting a new record low following a broader bitcoin and crypto market sell-off.

Data from Luxor’s Hashrate Index shows that bitcoin’s hashprice reached $44.6/PH/s on Thursday, lower than the previous record of $44.75/PH/s seen on May 1. With a moderate easing in bitcoin’s network hashrate and mining difficulty since early May, the market sell-off on Thursday further pushed down the hashprice.

Bitcoin’s price fell from $59,000 early Thursday, continuing its slump to as low as $57,000 around 6:00 a.m. EDT. At the time of publishing, it was trading at $57,800.

The market turbulence appeared to be sparked by the German government‘s on-chain transactions to crypto exchanges, coupled with sell pressure from concerns over Mt. Gox’s creditor payout.

Bitcoin’s average hashrate has been declining over the past two weeks as unprofitable operators unplugged from the network due to the bearish hashprice.

Meanwhile, large-scale, publicly traded mining companies have been installing more mining machines to grow their production post-halving, taking advantage of the capitulation of less competitive operators.

With the overall hashrate decline, bitcoin’s mining difficulty is expected to decrease by about five percent on Friday. This adjustment is poised to give the hashprice a boost, though it remains to be seen how soon or whether the market will bounce back.