Miner Weekly: Quitters and Winners in Post-Halving Bitcoin Mining Race

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitcoin’s average monthly hashrate continued its decline in June, dropping to 580 EH/s from 599 EH/s in May and 625 EH/s in April—a telling sign of the extent of capitulation among unprofitable operators in the two months following bitcoin’s halving.

The continuous decline of hashrate in June led to the increase of bitcoin’s daily production benchmark from 0.8 BTC/EH/s in May to 0.83 BTC/EH/s. This means if a company’s operating hashrate remained unchanged at 1 EH/s, it would be able to mine 24.84 BTC in June, which was 0.7% higher than the 24.66 BTC it could mine in May—despite June being one day shorter.

What’s interesting is comparing that benchmark with the bitcoin production of major public mining companies, who appear to be taking advantage of the overall decline in network competition.

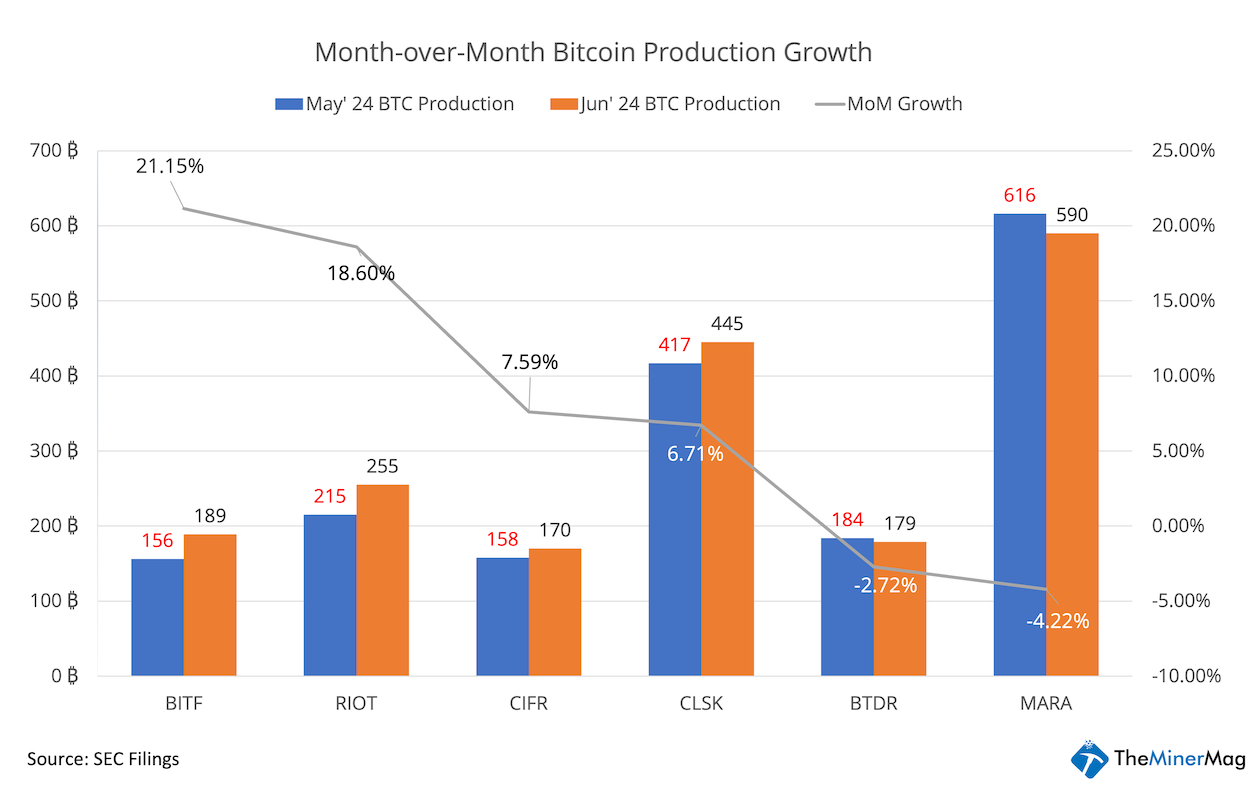

So far, Bitdeer, Bitfarms, CleanSpark, Cipher, Marathon, and Riot have released June production updates. Four reported notable growth of proprietary bitcoin production on a month-over-month basis, as the chart above shows. While Marathon and Bitdeer had a decline in bitcoin production, they ramped up energized proprietary hashrate, especially Marathon reaching the 30 EH/s level.

If we ignore the fluctuation of monthly mining rewards and average network hashrate, Bitfarms, CleanSpark, Cipher and Riot alone have increased their realized hashrate by 4.18 EH/s in June. They racked up more mining machines at a time when smaller and unprofitable operators had to unplug machines due to bitcoin’s low hashprice levels.

As a result, the amount of hashrate unplugged from the network could be much bigger than the average hashrate decline—big enough to offset the hashrate growth of large mining operations.

In other words, a hashrate consolidation is happening behind the scenes as large-scale operators secure larger portions of mining rewards, utilizing the billions of dollars in cash raised through stock offerings to finance the expansion of their fleets and infrastructure.

With that being said, bitcoin’s mining difficulty is expected to ease about 5% sometime on Friday due to the overall hashrate decline.

Regulation News

- Man Arrested with Nearly $600K Worth of Stolen Bitcoin Miners – KTLA Los Angeles

Hardware and Infrastructure News

- Bitdeer to Scale up Bitcoin Mining Power in Ohio – TheMinerMag

- Northern Data Purchases NVIDIA H200 GPUs Targeting Q4 Delivery – TheMinerMag

- Bitfarms Ramps up Bitcoin Production After Fleet Upgrades – TheMinerMag

- Crusoe Pivots to Building Data Centers, Plans 100MW Facility – DatacenterDynamics

- CleanSpark Hits 20 EH/s as Bitcoin Hashrate War Intensifies – TheMinerMag

- Marathon Reports 30 EH/s in ‘Energized’ Bitcoin Hashrate – TheMinerMag

Corporate News

- Bitfarms Adds Board Director in Response to Riot Stand-Off – TheMinerMag

- Northern Data Weighs AI Unit US IPO at Up to $16 Billion Value – Bloomberg

- Alameda-Backed Miner Genesis Digital Assets Weighing US IPO – Bloomberg

Financial News

- Argo Extends Galaxy Loan after Slashing $7M Debt in Q2 – TheMinerMag

- Iris Energy Raised $413M After Bitcoin Halving – TheMinerMag

Feature

- Non-Standard Bitcoin With Portland Hodl – The Mining Pod

- Mining Pool Centralization With CheckSum – The Mining Pod