Bitfarms Ramps up Bitcoin Production After Fleet Upgrades

Canadian bitcoin mining firm Bitfarms, currently engaged in a hostile takeover battle with its U.S. rival Riot, has significantly ramped up bitcoin production after upgrading its mining fleet.

In a production update on Monday, Bitfarms reported mining 189 BTC in June, reflecting a 21% increase from the previous month. The bitcoin production implies a realized hashrate of 7.61 EH/s, marking a 20% increase compared to May.

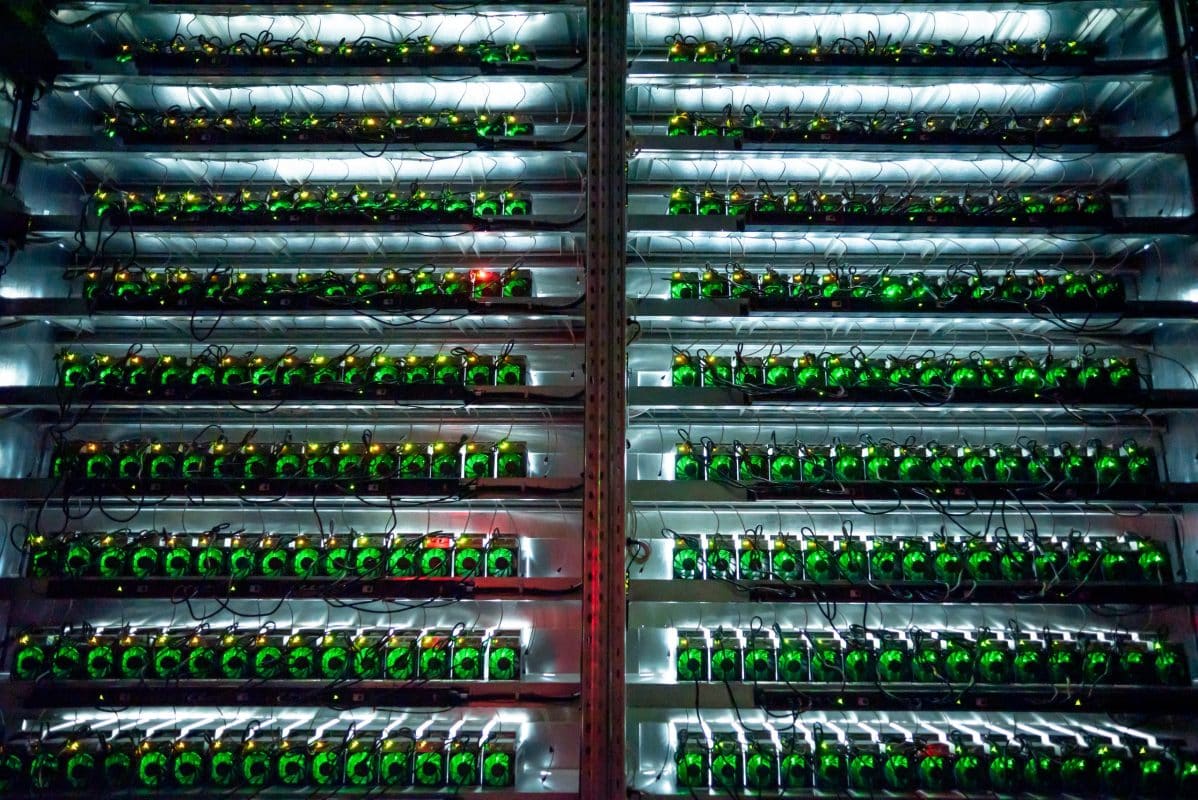

Ben Gagnon, Bitfarms’ chief mining officer, stated that the company installed over 39,000 new bitcoin miners and decommissioned 39,000 older units in the first half of the year.

“We ended June with 11.4 EH/s installed, 10.4 EH/s operational, and an efficiency of 25 J/TH,” Gagnon said, adding that Bitfarms has completed upgrades at all its Quebec facilities. The firm had an operational hashrate of 7.5 EH/s at the end of May.

Bitfarms’ increased hashrate is part of the ongoing competition among public bitcoin mining companies, which have preordered over $1 billion worth of the latest generation equipment since Q4, ahead of the next halving event.

In addition, Bitfarms announced that its 70-megawatt substation in Paso Pe, Paraguay, was energized in June. However, a shipping delay for miners to Paraguay has postponed the installation of an additional 600 PH/s until July.

To fund its operational expenses, Bitfarms sold 71% of its mined bitcoin in June, ending the month with 905 BTC on its balance sheet, valued at approximately $57 million.

As previously reported, Bitfarms signed a lease in June to expand its hashrate footprint to the U.S. in Pennsylvania with an immediately power capacity of 12 MW. The company recently appointed a new independent director in its effort to deter Riot’s takeover bid.