Hut 8 Secures $150M from CoreWeave Investor for AI Push

U.S. bitcoin mining, hosting, and fleet management firm Hut 8 has secured an investment of $150 million from New York-based hedge fund manager Coatue Management.

Hut 8 said in a statement on Monday that it has entered into a definite agreement with a fund managed by Coatue, which will invest $150 million through a convertible note expected to close by July 11.

According to the statement, the note will carry an interest at 8% with an initial term of five years. The interest will be payable in cash or in-kind at Hut 8’s option and the note will be a senior unsecured debt.

Coatue will have the option to convert the note into common stocks of Hut 8 and the initial conversion price is $16.395, Hut 8 said in the release. The company’s stock closed at $12.35 on Friday.

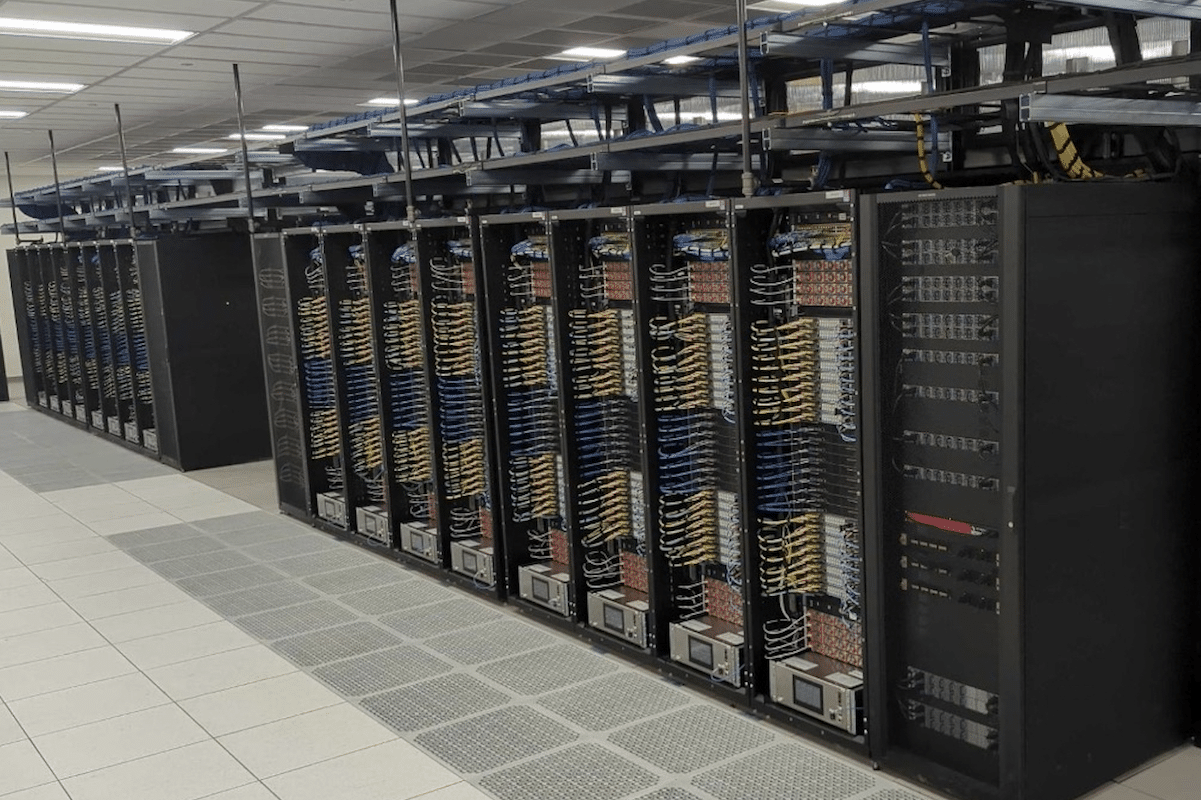

The debt financing comes as Hut 8 eyes a further expansion of its HPC business into providing more AI computing hosting capacities. Its HPC business began in 2022 after acquiring the cloud and colocation data center business from TeraGo.

“We are committed to supporting innovators advancing AI and believe that compute capacity is crucial to unlocking significant growth across the ecosystem,” Coatue’s founder and portfolio manager Philippe Laffont said in the release.

According to Coatue’s website, it is also an investor of CoreWeave, which recently signed a 200-megawatt AI hosting capacity at Core Scientific’s facilities. Following the AI expansion deal, Core Scientific’s stock price rose sharply to outperform bitcoin and all other major mining stocks.